Mayank Sharma, EVP – Unsecured Loans & Business Liabilities at Unity Small Finance Bank, shares the story of the foray into unsecured lending:

Unity Small Finance Bank was launched on 1st November 2021. Among other businesses, was the unsecured lending business, for which Mayank Sharma was given the charge. Right away, the bank started hiring people and appointing partners. The pilot for this business was launched in Delhi with direct sales team (DST) and direct selling agency (DSA). The pilot went on for one year. At the end, the numbers were small, but the results were encouraging.

Mayank dives deeper: “We could get much higher productivity from our relationship managers and sales team members, and the portfolio also performed very well in spite of one lockdown in between. That gave us the confidence that we can launch this product at full scale and it will be really beneficial for the bank.”

EXPANSION

After the pilot, the bank decided to expand the business beyond Delhi to 9 other cities – Lucknow and Jaipur in north, Mumbai, Pune and Ahmedabad in west, Bengaluru, Chennai and Hyderabad in south and Kolkata in east. It set up one specialized branch in each city. Mayank shares the progress: “In 6 months, we reached approximately Rs500 million business per month. In one year, we crossed Rs1 billion a month in lending. As of December 2023, our portfolio sized is around Rs13-14 billion and I am confident that in another 6 months will cross Rs20 billion.”

Now the bank has stopped the DST model. Mayank says that 99% of all DSAs in the market are working with Unity Bank and several corporate channels have also signed up. Also, all biggies like Star Power, Andromeda, etc, are partners. Mayank is now exploring the banking partnerships model.

CUSTOMER STRATEGY

The bank has chosen to focus on MSME customers and self-employed segments. Majority of them are registered under Udyam. 70% of the borrowers are traders, 20% are manufacturers and 10% are service providers in areas like software services, consultancy services, etc.

Mayank’s background had a key role in the initial choice of customer segments. He has been in financing since the last 20 years, most of which was on the unsecured side where he developed a fair understanding. His experience taught him that it is easy to get manufacturers in the book but they demand very low rate of interest because of their scale and their investments.

Since the bank was coming from an NBFC (Centrum) background, its cost of funds was a little higher than other banks. “We are still not competing with the big banks. Although our rate of interest is competitive, our NIM is healthy, which is reflected in our half-yearly results,” says Mayank.

To maintain this NIM, Mayank chose to focus on traders because the community is trustworthy, make timely payments, and are less rate sensitive, except in a few markets like Rajasthan and Gujarat. This targeting strategy worked for the bank and helped build the book. This portfolio is performing very well and the bank is now expanding this portfolio. In next financial year it will be launching at least 10 new locations and this could even go up to 20.

CREDIT RATING

What is typically the credit rating for Unity bank’s target customers? Mayank reveals that Unity Bank normally does not look at credit ratings because the customers are small and the average ticket size would be approx. Rs2 million. “So we don’t ask for credit rating from these customers. But yes, we will take a look at their CIBIL scores and most of the customers have a score of 750+. That is probably why this portfolio is working well for us,” he reveals with a smile.

Apart from that, the bank’s underwriting team is also well experienced. Most of the underwriters have been in the business for long and have done unsecured loans in their past organizations.

Mayank adds a softer side: “We have hired people and kept them in the same location. For example, if somebody belongs to Mumbai, we have kept him in Mumbai only because he belongs to that place, has local connection, knows local people, and understands the business and the risks of this geography. Checking references is also very easy for them.”

DYNAMIC SECTOR FOCUS

The bank is open to all sectors, except a few which are there in its negative list. Given the fast-changing scenario, every month, it chooses which areas and which sectors to speed up and slow down. In covid days, pharma and FMCG were doing so well for all financers. But in recent months, pharma and FMCG traders are not paying EMI in time, in comparison with other sectors. So, the bank has decided to go slow in these sectors. Earlier it was slow on cloth merchants, cloth traders and garment manufacturers, but now it has decided to go aggressive in that segment. So, every day is permutation, combination and assessment.

BUSINESS TRENDS

There are certain businesses like steel, which are cyclical. Sometimes one can predict in this. But covid has disturbed everything and all matrices have been disturbed. Mayank shares: “At this point of time, honestly, I would say that nobody can predict anything and people have hardly any clue. Certain trends will once again establish themselves, but it will take a few more years to be able to predict these.”

There are certain trends that are based on, for example, festivals or elections. And then there are unpredictable things like geopolitical uncertainty. Vehicles traders, garment trades and jewellery showrooms, and to some extent FMCG traders have also very well in this festival season. “From the impact of election perspective, our customers are not that big. Most of them are in the Rs500-2000 million turnover range. These companies do not face much business fluctuation due to political events,” clarified Mayank.

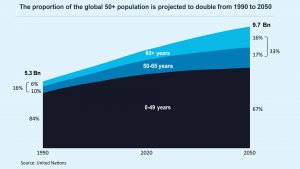

While demand is good, Mayank is not seeing any supply-side challenges. He believes we are in the beginning of an upcycle and demand will pick up further. In last few years, the people at the bottom of pyramid were affected badly, but some sections are recovering and coming out of it because of government policies and various changes in the market. He cautiously forecasts: “We are just at the beginning of another big boom cycle. And I see things improving in another 12-24 months unless there are external unpredicted events.”

TICKET SIZE

Unity Bank lends to various businesses including microfinance, where ticket sizes are very small. There the funding range is Rs30,000 to Rs3 lakh. From Rs3 lakhs, the bank shifts gear to secured funding, which goes up to max Rs5 million. Another business is supply chain finance, where the portfolio turns very fast, typically in 2-3 months. The bank doesn’t have any size restriction as of now, but it wants to focus on granular loans. It wants to have many customers and it wants a granular portfolio.

SECTORS & GEOGRAPHIES

In manufacturing, Delhi & NCR play a vast roll because there are many industrial areas like Ghaziabad, Faridabad, Noida & Gurugram which are hubs for manufacturing. Among manufacturers, Unity Bank has borrowers who make goods for OEMs and there are others who make daily use items. In the service sector, the bank has a good presence from Hyderabad, Chennai and Bengaluru, mainly from the software service providers. In East, UP and Rajasthan, customers are mostly traders.

Mayank and his team at Unity Bank have achieved handsome results with their strategies in their initial journey. It will be interesting to see how they evolve their strategies and how they innovate as they drive into the future with their aspirations.

RECRUITMENT & TRAINING

80% of the 50 people that the bank recruited came from NBFCs and 20% from banks. Unity Bank did not hire anyone from elsewhere as they wanted subject matter experts. “After another 1-2 years we will start hiring freshers. We have freshers in other departments, but not in this department,” adds Mayank.

The first thing that Mayank trains his team is negotiation skills. He explains: “If they are not smart enough to negotiate, they never get the kind of NIM we are looking for and they will never be able to generate sufficient income. They have to give higher productivity and higher price. After that, we introduce them to our technology – how we process the files, how we underwrite them, how we disburse the money, how we collect it, and what will be his/her role and responsibility in this entire journey.”

Even the sales person is made familiar for the entire process from onboarding of customers till collections and till closing of the loan. Explains Mayank: “We make everybody aware of the challenges, limitations and advantages and benefits of other functions. There are certain trainings which are mandated by RBI, like KYC, POS, etc. We give them all these mandatory trainings.”

FINANCIAL PROGRESS

In its financial results for the half year ending 30th September, 2023 (6 Months), Unity Small Finance Bank reported a healthy growth with Net Income rising 115% YoY to D5.15 bn driven by new products and geo expansion. The Pre-provisioning operating profit rose to D1.37 bn, rising 103% over the corresponding period last year. Net Interest Margin (NIM) stands at 11%, which is amongst the highest in the industry. Net Advances showed a strong growth of 89% YoY reaching D59.47 bn, distributed between Business Banking (60%), Inclusive Banking (32%) and SME & Venture Debt (4%). Deposit base grew 147% YoY and stood at D39.18 bn. 75% of these deposits came from new to bank customers. Net NPA was 0.4%, PCR was 99% and Capital Adequacy Ratio (CRAR) was 37%.

Read more:

Utkarsh Bank to create an AI Chatbot that will support compliance