Abhijeet Bhattacharjee, CIO of Utkarsh Small Finance Bank, discusses the bank’s digital transformation journey:

Ravi Lalwani: What digital initiatives has Utkarsh SFB taken in 2023 and what benefits have they delivered?

Abhijeet Bhattacharjee: In the last 7 years the bank has seen significant growth across verticals and in the recent past became a listed entity. Our aspirations of being an inclusive finance bank may have started from the Hindi heartland, but today stands tall with more than 800 branches spread across 26 states and union territories.

With growth comes the need to scale up operations. It needs a strategic approach that requires investing and adopting the right tools in the dynamic technological changes. This, in addition, sets the pace of a cultural change in the organization as well as enables the employees to move towards upskilling to stay relevant in the organization they work at. Such a transformational thought process began at Utkarsh Small Finance Bank as we scaled up further. Our initial process was to create a blueprint for the next 5 years that consists of the new product design, process revamp, and entire review of the technology stack for modernization requirements. The essence of the blueprint was to create efficacy, agility and scalability within the system and rethink key customer and business journeys.

Post the blueprint, we have entered the design phase where it has been detailed for actual customer journeys, process modernization, technology platform selection, and strategic implementation partner identification. We are now moving towards the implementation phase and key deliveries are seeing the light of the day.

During the last year, we introduced multiple initiatives to strengthen the digital infrastructure of the bank, ie, agile middleware platform for integrations, API gateway for open banking stack, modern website, digital lead management platform, e-signature, video-KYC, etc

Digital transformation is a cultural journey as well, hence we are continuously working towards a better adaption of these new initiatives.

What are the usage trends for your various digital channels?

On the acquisition side, we started the digital movement 2 years back, and currently, more than 80% of our liability acquisition is either in do-it-yourself (fully digital) or assisted mode (partial digital). To target tech-savvy depositors, we use a fintech-led aggregator platform for scaling up the acquisition as well as account opening through the website. On the micro banking side, almost the entire acquisition is via tab-based model that has led to huge efficiency and cost savings for the bank. Digital collection is one of our new offerings and we are witnessing it improving. From a customer service perspective, continuously look to scale up our services and we are taking significant measures by introducing additional transactions over channels.

During the recent Global Fintech Festival in Mumbai, the bank collaborated with NPCI to launch new products – UPI- ICCW and UPI Lite X, among others.

Share details about your technology partners and what services they provide.

The choice of a technology partner is the basis of current business needs and technology intervention. We work with large software service providers for industry-standard products. However, for niche skills such as cloud, data engineering, automation, user interface design, etc, we collaborate with smaller partners who can bring agility.

How are the capex and opex for IT spending changing? What are your expectations for the years ahead?

As we are working towards setting up to scale up our technology architecture, the capex spends have increased steadily over the past years. We expect the same to continue in the coming years, given we are in a growth phase.

Tell us about your AI plans. In which functions in the organization do you see AI making the surest impact?

Fraud detection (online/offline) is one of the common use cases in banking parlance. We are working on creating our model of basic transaction patterns and customer profiles. However, we believe there is huge potential in regulatory compliance preparation. We are working towards creating a chatbot type prototype of querying on the RBI circulars, for internal employees.

Read more:

Capgemini: Insurers must shun product centric approach

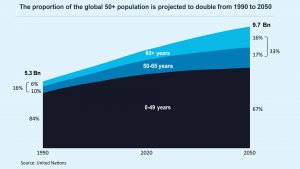

Longevity spells crisis for the aged

Noise, A Flaw in Human Judgement