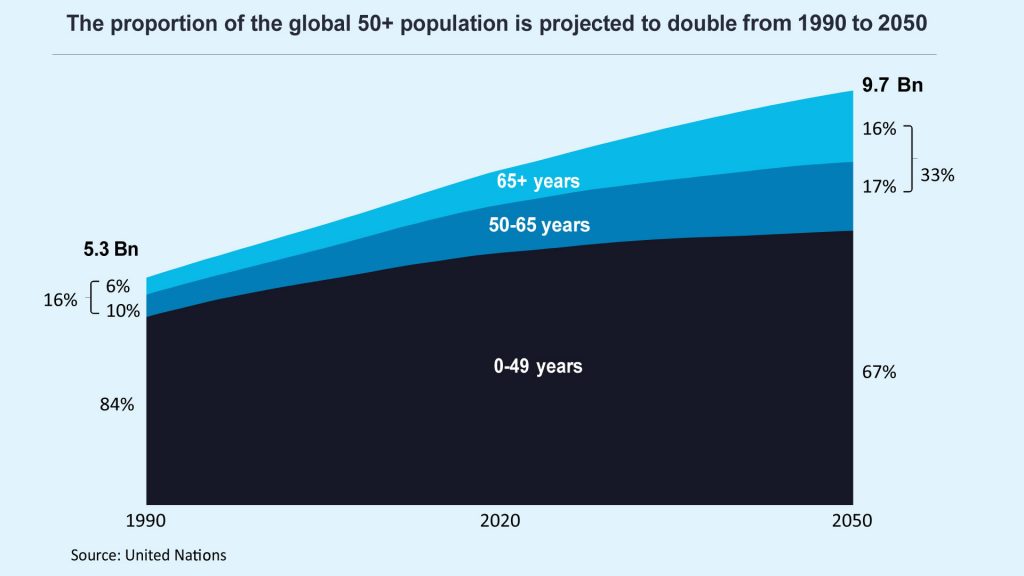

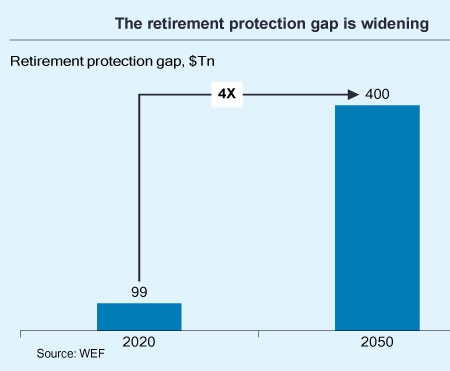

The World Life Insurance Report 2023 by Capgemini says the proportion of the global 50+ population is projected to double from 1990 to 2050, mainly because of increasing longevity and falling birth rates. The socio-economic impacts of this demographic shift will be severe for individuals and societies worldwide, it warns, adding the combination of declining governmental support and increasing healthcare costs would force individuals to shoulder more of the financial responsibility for aging well. The report maintains that the retirement protection gap is projected to quadruple by 2050 to US$400 trillion in markets with the largest and most established pension systems.

“Yet consumers face barriers to adopting life insurance, including product complexity and limited awareness, and this contributes to insurers’ struggles with slow growth and limited relevance,” says the report, adding: “Moreover, the industry’s financial situation is in flux as history’s largest inter-generational wealth transfer could cause a massive outflow of nearly 40% of life insurers’ assets under management (AUM) by 2040.”

The report avers that strengthening relationships with aging policyholders and their beneficiaries is a strategic necessity.

INSURERS GET A CHANCE

Life insurance companies have a clear and compelling opportunity to spark growth by developing comprehensive aging-well solutions that support customers’ desire to live long, healthy and happy lives, points out the report. It recommends insurance companies to engage earlier and more effectively with future beneficiaries. That opportunity starts with the affluent and mass affluent segments, which hold a whopping 39% of global wealth and account for 20% of the aging population.

Life insurance companies have a clear and compelling opportunity to spark growth by developing comprehensive aging-well solutions that support customers’ desire to live long, healthy and happy lives, points out the report. It recommends insurance companies to engage earlier and more effectively with future beneficiaries. That opportunity starts with the affluent and mass affluent segments, which hold a whopping 39% of global wealth and account for 20% of the aging population.

The report argues for shifting the goal from today’s product-centric approach, where offerings are determined mainly by what is technically feasible, to a more customer-centric model, based on broader value propositions and more personalized experiences.

DEPENDENCY RATIO TO GO UP

The ratio of the dependent population (aged 65 and above) to the working-age population (aged 15-64) is called the dependency ratio. This is predicted to rise from 15% today to 26% by 2050. Though older individuals require more public resources than other age groups, the governmental support capacity is strained.

The report also says the ongoing macroeconomic volatility will accelerate the shifting of the financial burden of retirement from governments to individuals and will widen the retirement protection gap, ie the difference between desired retirement income and actual income from pensions, savings and social security.

The World Economic Forum (WEF) predicts it will expand 4X, from US$99 trillion in 2022 to US$400 trillion by 2050, in markets with the largest established pension systems. These markets include Australia, Canada, China, India, Japan, Netherlands, UK and USA. The retirement protection gap is a serious concern as more consumers seek to maintain physical and financial health and quality of life for longer. Capgemini’s 2023 Voice of the Customer survey, including 6775 policyholders from 20 global markets, found that 60% of individuals aged 65 or older have not sought professional financial advice to prepare for retirement or to transfer their wealth.

Read more:

Noise, A Flaw in Human Judgement

Vivriti: Sustainability Assessment Model Boosts ESG

RevFin App DNA – Psychometrics, Biometrics & Gamification