As businesses see the need for digitization, what is trending is the concept called hyperautomation:

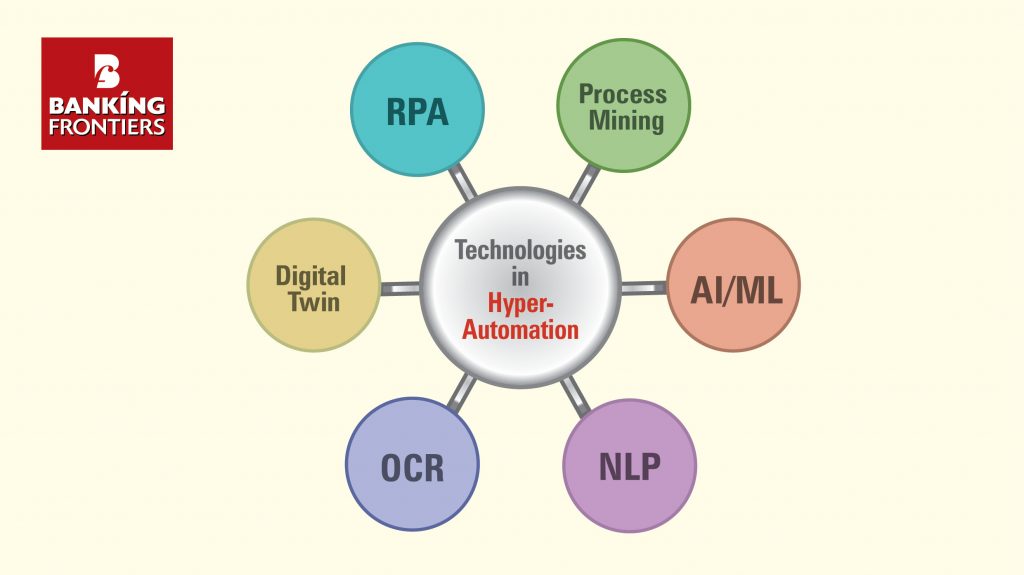

Hyperautomation or Digital Process Automation is the buzzword coined by Gartner in 2019 to explain how enterprises, especially those in the financial services sector, could strengthen their business operations using a unique integration of high-end technologies. Gartner had predicted that hyperautomation will be a key technology trend in the next 10 years. The concept goes far beyond automation and digitization and it is described as the process of automating business operations using the combined strengths of technologies like RPA, AI and ML, Big Data, Cobots and Chatbots.

What stands out is that hyperautomation makes it possible to identify the processes that can be automated and then create bots to carry out these processes. It eliminates human intervention in low-value processes and provides data that can be easily converted into business intelligence at a level that was hitherto not available. The beauty is that it is not based on any one single traditional technology but is the integration of various technologies mentioned above.

A NECESSITY NOW

Gartner has also said that hyperautomation will not just be an option, but it will be a necessity for an organization’s survival. A survey had revealed that 85% of participants plan to either increase or maintain their hyperautomation investments over the next 12 months, with over 56% managing 4 or more hyperautomation initiatives simultaneously.

Information processing agency Bloomberg has said the global hyperautomation market is anticipated to reach US$118.66 billion by 2030. The growth, it said, is supported by rapid digitization, increased demand for automation in banking processes, lower operational costs and improved efficiency.

Interestingly, one of the major factors that influenced the adoption of hyperautomation has been the pandemic. As businesses started operating in a more distributed manner, hyperautomation has been able to take care of the painful, repetitive processes and outdated infrastructure. When implemented in the correct context, it can automate all the processes and tasks that are either manually or semi-automatically being done now.

While modern-day organizations are already taking the process-driven approach, hyperautomation is a tool for data-driven decision-making that can result in better operational and other efficiencies. For, it brings together digital operating systems, workflows, RPA and AI on an integrated platform to deliver high value processes through intelligent decisions.

CRUCIAL FOR FI

In the world of banking and finance it is becoming a crucial factor, especially in achieving cost-efficiency and in ensuring high levels of customer satisfaction. In short, it converts data into a high-performing and precise BPM tool so that customers are empowered with insights for smarter decision-making, even as online banking channels become accessible.

JPMorgan Chase has a new platform based on hyperautomation. Called COIN, or Contract Intelligence, it makes use of ML tools in the tedious task of parsing complex loan agreements, thereby ensuring speed and accuracy without any human intervention.

Similarly, Goldman Sachs used hyperautomation to strengthen its compliance framework. It deployed AI to sift through tonnes of communication data and identified patterns indicative of regulatory breaches. This helped the bank to improve its risk management practice and create a secure financial environment.

Bank of America is another global bank which has made use of hyperautomation to create Erica, a Personal Banking Assistant. Erica offers banking support from checking balances to managing payments, all through intuitive conversation.

PNC Bank and Citibank have invested in HighRadius, a B2B payments and receivables software company, and created a platform using AI to automate tasks that normally require human intervention – optimizing cash flow from credit, collections, deductions, billing and payment processing.

Another global bank ABN Amro has built an hyperautomation system using the TIBCO Connected Intelligence platform. It is being used to move from on-premises deployments to cloud deployments through Microsoft Azure. The bank could consolidate 40 different development teams creating a clearer organizational structure and eliminating shadow IT, inconsistent governance and duplicated efforts. Now, each of the individual business lines has a digital hub team that determines the best course of action based on business value and then works with the hyperautomation team to achieve that result.

COMBINING TECHNOLOGIES

Research firm Forrester has highlighted the role of hyperautomation in business processes and envisaged that it will at one point combine multiple technologies to reduce manual workloads. It has also predicted that several advanced technologies like NLP, Computer Vision and low-code/no-code platforms would be integrated to develop highly intelligent and flexible automation solutions.

Financial services sector analysts visualize that hyperautomation can not just automate simple tasks like data entry and reconciliation, but it can handle complex processes like risk management and compliance and at the same time cut down costs and save time and simultaneously increase efficiency.

Hyperautomation can speed up processes like account opening, balance inquiries, and loan applications, thereby freeing staff to handle complex customer interactions and prioritized tasks. It is also capable of analyzing large amounts of data to detect suspicious behavior patterns, thereby preventing fraudulent transactions. Human talent being used in this process can be redirected to tasks that need manual intervention. It is also capable of doing more accurate analyses, which can be of immense use in workflows.

There are also applications in loan processing, where processing time can be reduced and customer experience can be enhanced, and in compliance where checks and monitoring can be fully automated.

TOP SERVICE PROVIDERS

Some of the leading technology companies operating in the hyper-automation domain include Tata Consultancy Services, SS&C Blue Prism, UiPath, Automation Anywhere, Automation Edge, Appian, OneGlobe and Catalytic.

RPA IS CORE

Gartner, in ideating the concept, had envisaged that RPA, enriched by AI and ML, would be the core of this technology. It has said by combining these technologies, power and flexibility can be added in places where they were not possible previously. So, tasks that previously could not be automated now can be, so that human capabilities can be focused on tasks with a greater value, such as decision making, interpreting data and using critical thinking.

Gartner has also envisaged that hyperautomation platforms are varied and can be implemented on top of the technologies that enterprises already use. The main platform will be RPA, and there will be other intelligent BPM suites, or iBPMS, integration platforms as a service, or iPaaS, and information engines. It is also feasible to create a digital twin of an organization – DTO, or Digital Twin Organization – which is a virtual representation of a product or work flow that can simulate how processes interact and show where value is created in real time.

Cathy Tornbohm, Distinguished Research VP at Gartner, has said “The shift towards hyperautomation will be a key factor enabling enterprises to achieve operational excellence, and subsequently cost savings, in a digital-first world.”

Why is hyperautomation important for the banking and financial services industry?

It is explained that there are several challenges that this sector faces that make adopting hyperautomation necessary. The main ones are spelt out as:

1. Banks today face competitive threat from tech behemoths like Google, Apple and Amazon, which have the prowess to take on traditional financial institutions through the use of analyzed data at their disposal.

2. Many countries have liberal regulations, which help fintechs to float financial services enterprises at reduced costs and ensure better customer experience.

So, banks and financial services institutions are in a race to automate business operations and workflow and hyper-intelligent automation are keys for survival. It is inevitable to replace legacy systems with end-to-end hyper-intelligent automation. It is also an effective mode in fast-tracking digital transformation processes continually.

IMPLEMENTATION CHALLENGES

Experts say there are several potential risks or challenges that banking institutions face while implementing hyperautomation. These are listed as:

- Resistance to change: Employees may hesitate to adopt new technologies, which can slow the adoption process.

- Security concerns: Automating sensitive processes can increase the risk of cyber-attacks and data breaches.

- Compliance issues: Banks must ensure that automated processes comply with regulatory requirements and standards.

- Integration challenges: Integrating new technologies with existing systems can be complex and time-consuming.

- Dependency on technology: Over-reliance on automation can be problematic if systems fail or require maintenance.

Some of the perceived benefits that experts see in financial services institutions adopting hyperautomation are enhanced operational efficiency (by automating routine tasks and accelerating processes); improved customer experience (by providing personalized, 24×7 services to customers with the use of chatbots and virtual assistants); better regulatory compliance and risk management (through automation of compliance checks and monitoring for fraudulent activities); and cost savings and scalability (by automating labour-intensive tasks and reducing errors and reducing operational costs).

While hyperautomation can be an effective process for a better management of businesses in general, it cannot be a magic wand, warns experts. For example, it brings forth the risk of heightened data security and privacy concerns, cybersecurity vulnerabilities, the challenge of complex integration with existing systems, and operational disruptions due to technology dependencies. Possible mishandling of data and experiencing data breaches, ransomware attacks and other cyber threats can add legal consequences too.

Read more:

NBFC – No More a Bank’s Shadow