Edited, shortened and simplified version of the speech by M. Rajeshwar Rao, Deputy Governor, Reserve Bank of India on February 09, 2024 at the 6th edition of the NBFC Summit organized by Confederation of Indian Industry at Mumbai:

Globally, the NBFC sector shrunk by 3% during 2022, but grew by 10% in India. As of March 2023, NBFCs credit to GDP ratio stood at 12.6% and the sector has grown to become 18.7% of banking sector assets as on March 2023 as compared to 13% a decade ago. Consequently, it imperative that the regulations of the NBFC sector keep pace with the changing landscape and move from a light touch regulatory approach to a more calibrated and nuanced approach to safeguard financial stability.

The NBFC sector has become stronger and resilient post introduction of the SBR framework introduced in October 2022. As on September 30, 2023, NBFCs in the base, middle and upper layers constituted 6%, 71% and 23% of the total assets of NBFCs, respectively. The latest edition of the Financial Stability Report (FSR) 4 compares important figures from Sept 2022 to Sept 2023 (see Fig 1).

RBI conducted stress tests which show that the overall sector will be able to withstand future shocks. It shared figures for baseline scenario, medium shock and severe shock. CRAR would be at 22%, 21.3% and 21% respectively. For liquidity risk, the number of NBFCs which would face negative cumulative mismatch in liquidity over the next one year in the baseline, medium and high-risk scenarios would be 6, 17 and 34 respectively. Overall, the NBFC sector remains healthy, stable and resilient to future shocks.

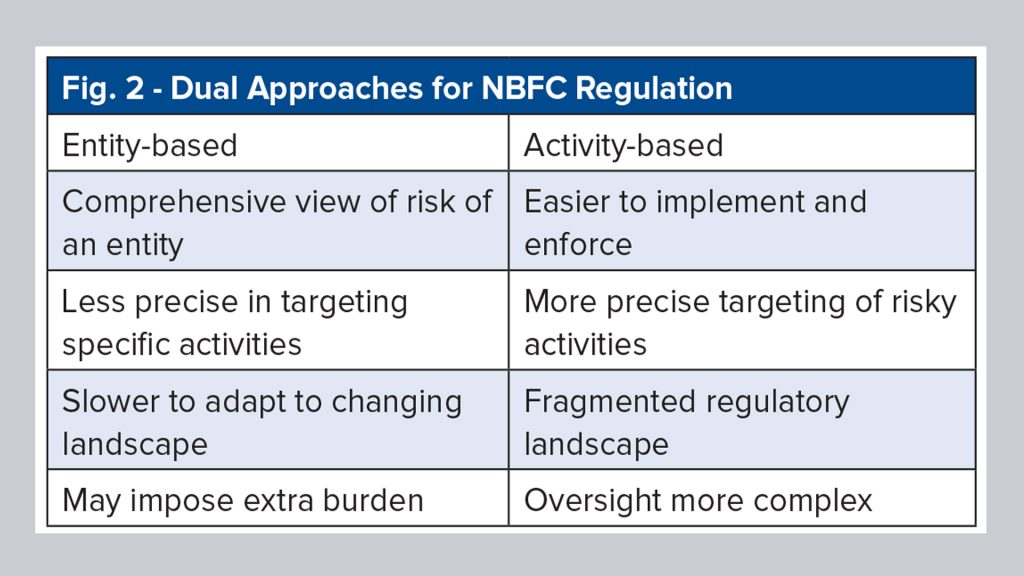

Balancing Regulatory Approaches

Peer to Peer Lending Platforms: P2Ps do not undertake any credit risk on themselves and merely act as a meeting place for lenders and the borrowers. Hence prudential regulations for them have been kept very light at basic entry level requirements. On the other hand, the P2P lenders trust the platforms for getting to know the borrowers, and avail additional services such as KYC authentication, credit scoring, legal formalities, recovery assistance, etc. For this reason, conduct norms for these platforms have been kept at par with other regulated financial entities.

Microfinance Sector: Microfinance loans constitute a very small share in overall credit and therefore create lesser stability concerns. However, they affect a large number of borrowers who belong to the vulnerable category. To maximize customer protection, an entity-agnostic and activity-based comprehensive regulatory framework for microfinance loans has been put in place for microfinance loans provided by all regulated entities.

Infrastructure Debt Fund: The regulatory guidelines for the activity of infrastructure financing recently have been harmonized with other categories of NBFCs engaged in infrastructure financing. Accordingly, RBI has withdrawn the requirement of a sponsor and has aligned their regulatory capital requirement and exposure norms with NBFC-IFCs and NBFC-ICCs in the middle layer.

Regulating Upper Layer NBFCs

Significant differences continue to exist between the regulations applicable to banks and NBFCs. Minimum initial capital requirement for a universal bank is Rs10 billion vis-à-vis Rs100 million for an NBFC. Also, the scrutiny for a banking license applicant is far more rigorous than the scrutiny for an NBFC license applicant. During the last 5 years, RBI has provided certificate of registration to 447 NBFCs, zero universal banks and only 2 small finance banks (SFBs).

Further, banks cannot engage in any activities other than those which are specifically provided under the Banking Regulation Act, 1949. Whereas there is no such provision under RBI Act governing NBFCs’ regulations. Also, banks are required to deploy minimum 40% of the adjusted net bank credit towards priority sector lending and this requirement is even higher for SFBs at 75%. NBFCs have no such requirements.

There are almost no regulatory restrictions for operations of NBFCs. Commercial banks on the other hand, are subjected to detailed branch authorization policy. In a nutshell, the regulations for NBFCs (especially in the upper layer) are much more calibrated and are certainly not on par with the regulations applicable to banks.

Should NBFCs be allowed to accept deposits?

There have been intermittent demands that NBFCs should be allowed to accept public deposits. Acceptance of deposit, in whatever manner and form, necessitates existence of a macro financial safety net including deposit insurance and central bank liquidity backstop. These safety nets come with increased regulatory rigour and intense supervisory oversight. The NBFCs have evolved as niche companies serving specific economic function and it is uncharacteristic for them to demand becoming like a bank.

Accordingly, RBI has not issued any certificate of registration to new NBFCs for acceptance of public deposits since 1997. Over the last decade, the number of deposit-taking NBFCs has dropped dramatically from 241 to 26.

Concerns & Expectations

NBFCs are large net borrowers of funds from the financial system, with the highest exposure to banks. Several NBFCs maintain borrowing relationships with multiple banks. Banks also subscribe to their debentures and commercial papers. Such concentrated linkages coupled with high leverage may create contagion risks in the financial system. Concentration of funding sources for NBFCs is also not a prudent strategy as they may face sudden drying up of such funding during stress events. Therefore, it may be prudent for NBFCs to broad-base their funding sources and reduce over-dependence on bank credit.

In pursuance of high growth, there seems to be tendency among the NBFCs to get the customers on board with oversimplified underwriting processes. While the ease and convenience for a borrower is very important, this should not come at the cost of underwriting standards. Besides improving the ease of lending, NBFCs should equally focus on maintaining the quality of their loan portfolio.

Of late, some of the business practices of NBFC-P2Ps do not appear to be in line with the regulatory guidelines. Instead of educating the lenders about the inherent risks in the lending activity, NBFC-P2Ps have been observed to underplay the risks through various means such as promising high/ assured returns, structuring the transactions, providing anytime fund recall facilities, etc. Any breach of licensing conditions and regulatory guidelines is non-acceptable.

Rule-based prescriptions on pricing of loans were replaced with a principle-based framework with enhanced disclosures and transparency requirements. Lenders were quick to pass on the increased costs to borrowers but reluctant to pass on the benefits. Some of the MFIs have increased their margins disproportionately in the new regime. Irresponsible practices would compel us to act.

Some of the NBFCs, have concentrated exposure to segments such as consumer loans, vehicle loans, etc. If any of these segment faces economic stress, there can be significant impact on the financial of those NBFCs and, in turn, on their lenders including banks. Entities should consider these risks and we expect that Boards are having a pulse on such issues.

With NBFCs delivering their services through digital medium and in partnerships with fintechs, the sector’s exposure towards technology related risks, including cybersecurity threats and operational disruptions, as well as their reliance on third party partnerships has increased significantly. RBI expects the entities to put in place suitable risk mitigation measures, commensurate with their business and risk profile, even if it means going beyond the regulatory minimum requirements.

Concluding Thoughts

RBI has recently come out with a draft omnibus framework for Self-Regulatory Organizations (SROs). The SROs are expected to play an important role in improving the compliance culture as well as promote ethical business practices, customer protection, better governance standards, sound risk management measures and contribute positively to the orderly development of the financial sector, including NBFCs.

Strengthened regulation and enhanced oversight of the NBFC sector is the best testimony of the importance of the NBFC sector, in not only the financial system but overall economy. It’s time that NBFC sector comes out of its own shadow as well as that of the banking sector. I am sure that NBFCs will play a significant role in achieving the dream of a $5 trillion economy going forward.

Read more:

Quontic Bank: Bitcoin by way of interest payment