DBS Bank India is going phy-gital to expand its MSME business. It has engaged numerous tech partners to achieve its goals, reveals Sudarshan Chari, Executive Director & Head – SME Banking.

Manoj Agrawal: What is the size of the bank’s SME business in India in terms of value and number of customers? How have the numbers evolved over the last 3 years?

Sudarshan Chari: India is one of the largest MSME markets globally, and the significant contribution of MSMEs to the nation’s economic development cannot be understated. The share of the Gross Value Added (GVA) by MSMEs in the All-India GDP during the year 2021-22 stood at ~29%, as per data from the Ministry of Statistics & Programme Implementation. The sector is poised to achieve 10-12% CAGR of in the short to medium term.

DBS Bank India is committed to partnering with MSMEs on their growth journey. As of 2023, our SME loan book stands at around Rs64 billion, reflecting a CAGR of 40% over a 3-year period. We are optimistic about sustaining this growth in the coming years and aim to reach a milestone of USD 1.5 billion (Rs165 billion) for our SME loan book by December 2025.

What are the top 5 geographies for the bank’s SME business? What are the geographic expansion plans?

We have adopted a ‘phy-gital’ (physical + digital) model that seamlessly integrates our robust branch network with our digital capabilities. Out of our 530 branches, 250 are strategically located in India’s top 100 SME hubs and clusters, enabling us to serve 80-82% of the accessible SME market in the country. Among these, the top 5 SME markets are Maharashtra, Delhi NCR, Tamil Nadu, Andhra Pradesh & Telangana and Gujarat. 20% of our business originates from locations outside the top 10 markets.

We anticipate this figure to grow to approximately 30% over the next 2-3 years.

What new products has the bank developed or procured to serve SME customers? What are the latest activities that have been transformed from physical/manual to digital?

In the SME sector, traditional methods of evaluating a business’s creditworthiness are limited in scope and may not provide a clear picture of its financial soundness. To address this challenge and extend credit to sectors previously unable to access formal finance, we collaborated with a fintech solutions provider to develop a comprehensive, digital framework for GST-based lending.

The partner’s insights regarding GST were integrated into the customer’s credit lifecycle, enabling us to effectively evaluate their financial health. This evaluation was based on a comprehensive analysis of the entity’s GST data, encompassing aspects such as sales, purchases, and tax compliance. Our strategy allowed us to lend to SMEs without solely depending on financial statements. In just 6 months following its introduction, the GST lending initiative has shown remarkable results: approximately 25% of our total SME applications in the target segment are now for GST lending.

Additionally, we continue to design solutions that enhance operational efficiency for SMEs. Our aim is to make them simple, intuitive, and hassle-free, enabling our customers to ‘Live more, Bank less.’ We have also designed a solution for trade financing for corporate clients by harnessing data derived from their end-to-end procurement-to-payment (P2P) and order-to-cash (O2C) processes.

This transforms the entire process into an end-to-end digital experience and expands the solution to cater to different business cases, including logistics finance, inventory financing, pre-to-post shipment financing, merchant onboarding, collections, and foreign exchange. This approach proved significantly more efficient compared to traditional, cumbersome, and time-consuming credit assessment methods. By fully digitising the invoicing and trade credit process, we reached a broader audience that may not have otherwise had access to formal sources of finance.

Does DBS Bank partner with NBFCs for co-lending to SMEs?

We are evaluating co-lending partnerships that enable us to reach new geographies and customer segments. Through these collaborations, our ecosystem partners also benefit from the expertise, regional best practices, and extensive network that banks like ours bring to the table.

Apart from co-lending, we work closely with ecosystem players to create propositions that extend beyond the regular suite of offerings, enabling us to provide holistic financial support for MSMEs. For example, we have partnered with Godrej Capital’s business solution platform ‘Nirmaan,’ offering access to a comprehensive suite of value-added services, including a customised current account. Businesses registered with Nirmaan can enjoy exclusive benefits such as a 1-year waiver on Minimum Average Quarterly Balance non-maintenance fees, seamless integration with Tally ERP for connected banking, and competitive trade and FX pricing. Additionally, MSMEs on this platform can opt for a Business Debit Card powered by Visa, equipped with exclusive partner offers.

In 2023, we launched pre-shipment financing for SME suppliers through a partnership with Infor Nexus™. We have also partnered with IndiaFilings and created a co-branded portal that addresses various challenges new businesses face, from incorporation and GST registration to setting up financial management systems and accessing a broader ecosystem of investors and tech partners. We have 2 key partnerships on the Open Network for Digital Commerce (ONDC) front – GoFrugal Technologies and eSamudaay. With GoFrugal, we are helping SMEs quickly catalogue their products and expand their sales channels through omnichannel ERP solutions. Our collaboration with eSamudaay focuses on boosting local commerce in non-metro towns and cities, providing digital solutions and logistic support to smaller market players.

Which products and SME customer segments is the bank planning to expand into in the next 2-3 years?

We will continue to focus on solutions that go beyond traditional banking and help drive efficiency and synergies for SMEs. We offer a range of customized products and services, including lending for working capital, transition finance, and trade finance. We have also tailored our approach to specific industry verticals, including startups, retailers, educational institutions, renewable energy sectors, importers/exporters, and logistics, among others.

Additionally, as we progress towards a net-zero future, transitioning to low-carbon business models will become a central focus for SMEs. We empower SMEs to make this shift through our banking solutions. Our offerings encompass a suite of green financing options and bespoke solutions that can be tailored to suit business requirements. A recent example is our collaboration with H&M Group; we have developed a first-of-its-kind green loan program aimed at facilitating supply chain decarbonisation in the apparel sector. Through this program, SME suppliers can access financing from DBS and technical support from sustainability consultant Guidehouse to undertake factory upgrades that reduce their climate impact. Earlier this year, the collaborative finance tool completed the first successful transaction with Raj Wollen Industries.

We aim to grow our financing loan book by over 70% by the end of 2024, which currently stands at just over SGD 1 billion (Rs65 billion). At a group level, we had set a sustainable financing target of SGD 50 billion by 2023, which we surpassed, and we now stand at SGD 61 billion.

Furthermore, through the DBS Foundation, we champion businesses for impact that have a triple bottom line and drive positive environmental and social impact. We have instituted the Business for Impact Grant Award that recognises, rewards, and supports these businesses. Notable examples from India include Phool, Haqdarshak, S4S Technologies, and Ecozen Solutions.

Has the bank won any awards for SME banking in the recent past? If yes, please share the details.

DBS Bank has received several prestigious accolades for excellence in SME banking over the past few years. In 2023, we were honoured to be recognised as Singapore’s best bank for SMEs. In the preceding year, 2022, we received the title of the World’s Best Bank for SMEs in Asia and were also globally recognised with the same title by Euromoney. Additionally, our commitment to excellence in SME banking was further acknowledged in 2023 when we secured an award for ‘Best in Treasury and Working Capital for SMEs’ at the Treasurise Awards 2023 by The Asset.

Read more:

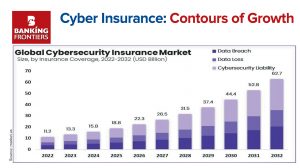

Cyber Insurance: Contours of Growth

Bima Trinity to transform insurance landscape in India