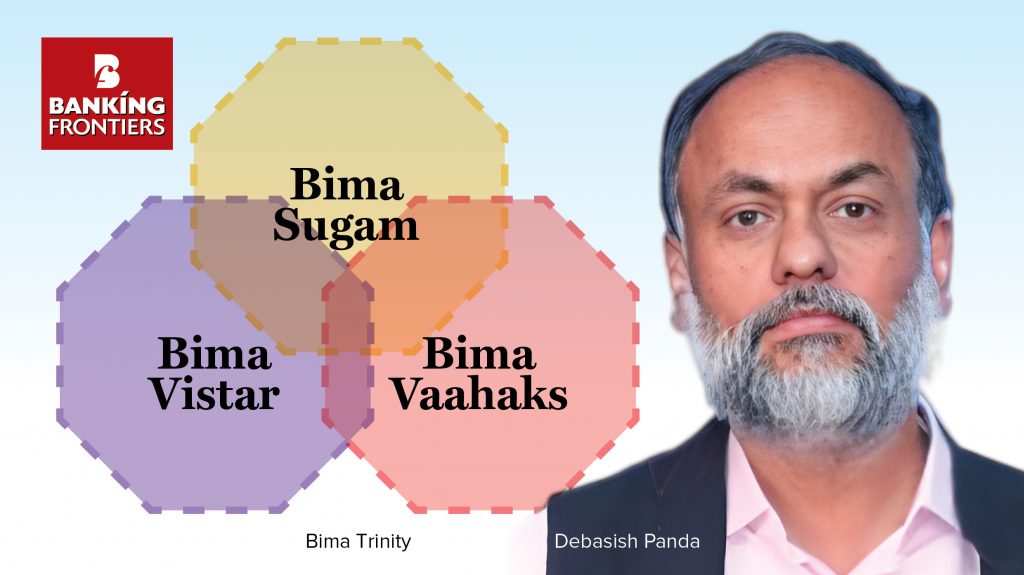

The Insurance Regulatory and Development Authority of India is bringing in a major change in the insurance sector through the proposed ‘Bima Trinity’:

India’s insurance regulator the Insurance Regulatory and Development Authority of India (IRDAI) is set to launch a unique all-in-one insurance product – Bima Vistaar soon. It will offer a single insurance policy providing life, health and property cover at very affordable premium. And Bima Vistaar will complement 2 other initiatives – Bima Sugam, a one-stop digital platform, and Bima Vahak, a women-oriented distribution channel, to increase insurance penetration, especially in the semi-urban and rural areas.

IRDAI expects to launch this Bima Trinity in the first quarter of FY2025. Its Life and General Insurance Councils are now in the final stages of reviewing the product.

A CRUCIAL TOOL

The most important aspect is that Bima Vistaar will be a crucial tool in retirement planning as it eliminates the need to purchase separate policies for life, health and property coverage. According to IRDAI, the product design and other key aspects of Bima Vistaar have almost been completed and it is a question of completing a technology platform to launch the product.

IRDAI explained that using this combination, it wants to extend insurance cover to all in the country by 2047. Also, the aim is to bridge the existing gaps in product design, pricing and distribution. It has stressed that while Bima Vistaar will be a simple product with no ambiguity in terms of its benefits and exclusions, Bima Vahak will be the insurance intermediaries who will sell and renew insurance policies and make claim requests completely online. And this process will be done through the Bima Sugam platform.

WOMEN AGENTS

IRDAI has already issued guidelines to operationalize Bima Vahaks, which will be done along with the rollout of Bima Vistaar. It is expected that women ‘Vahaks’ will have an advantage in convincing women members of rural households of the need for affordable social security and take cover through Bima Vistaar.

The regulator also expects that Bima Sugam will evoke great interest among insurers not just from the country but abroad also. Initially, it is proposed to have several small platforms to launch Bima Vistaar and Bima Vahak and then integrate these into a large, single platform, based on the latest technologies, including AI and ML. The platform will also be a very efficient last-mile connectivity for insurance coverage in the country.

DIGITIZING MARKETPLACE

The platform is intended to digitize the insurance marketplace – from buying policies, to renewals, to claim settlement, and for agent and policy portability. It will assist customers with all insurance related queries and will be a window to view all policies and renewal details.

IRDAI Chairman Debasish Panda has said it is necessary for the insurance sector to step out from metro cities and focus more on the villages, blocks and districts to make insurance for all by 2047. And he hopes that the Bima Trinity will be the most effective tool.

IRDAI expects that Bima Vahaks will sell both life and general insurance policies in rural areas at gram panchayat level. Anyone can become a corporate Bima Vahak or an individual Bima Vahak to distribute insurance policies in rural areas. Corporate Bima Vahaks can appoint individual Bima Vahaks as sub-distributors. All Bima Vahaks can sell insurance policies, do KYC and facilitate claim servicing. They will be using handheld electronic communication devices.

Individual Bima Vahaks can tie up with one life insurer, one non-life insurer, one standalone health insurer and one agriculture insurer.

IRDAI has also said the Bima Vahaks shall be deployed in each gram panchayat before 31 December 2024 and lead insurers of each state and/or union territory will coordinate the deployment of resources to ensure maximum coverage of gram panchayats.

The IRDAI Chairman has also said the regulator wants to make health insurance claims completely cashless across the country.

The Bima Trinity is the result of the initiative by IRDAI in late 2022 in setting up a committee to explore and recommend on how to bring about synergies in the working and operations of insurance companies.

RESPONSE FROM INSURERS

The insurance companies have given positive response to the proposal. They feel the consultative approach that is possible through Bima Vistaar is an encouraging aspect and Bima Sugam will bring in a great level of transparency in the insurance market.

—————————————————————

Read more:

Engagement customization is the philosophy: Sanjiv Bajaj

Imbibing Intelligent Technology