Welcome to the ever-changing world of Cyber Insurance – where the only constant is change itself! In the digital playground of bits and bytes, CEOs find themselves navigating a cyber insurance market that’s as dynamic as a cat chasing a laser pointer. Brace yourselves, because 2023 surprised everyone with softer conditions, but the cyber landscape remains as intricate as untangling a web of interconnected cyberattacks.

In the face of escalating cyber threats, cyber insurance empowers business leaders to embrace digital innovation with confidence, knowing they have a safety net in place should unforeseen threats arise. Ransomware and supply chain attacks are stealing the spotlight, causing underwriters to furrow their brows and ponder the fate of policy coverage tomorrow. Insurers like Beazley are throwing in a wildcard with the enigmatic risks of generative AI. It’s like the insurance world’s very own plot twist, with potential changes in future policy terms lurking in the shadows.

Market in Flux

Cyber insurance is experiencing explosive growth, fueled by a potent mix of threats and awareness. Escalating cybercrime forces organizations to shield their digital assets, while businesses wake up to the financial and reputational costs of attacks, driving demand for risk mitigation. Finally, stringent data regulations mandate robust cybersecurity measures, often including cyber insurance, making it a key player in the ever-evolving security landscape.

The Good News?

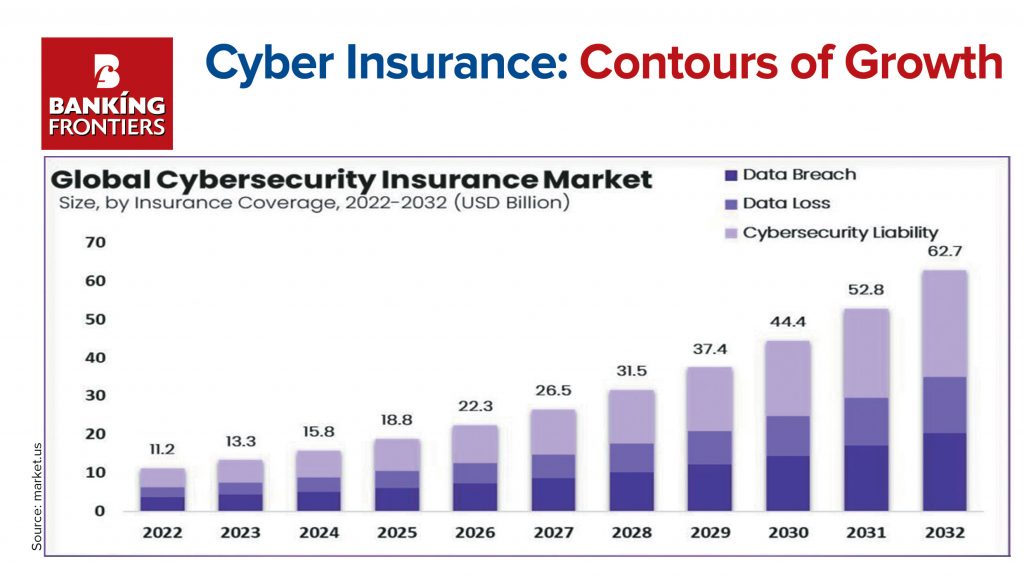

The winds of change are sweeping through the cybersecurity landscape, and the global cyber insurance market is at the forefront, experiencing a surge unlike any other. Here’s something to catch your attention:

- From $12.1 billion in 2023 to a projected $90.6 billion by 2033: That’s a staggering 22.3% CAGR, signifying a healthy market.

- Reaching $14.8 billion by the end of 2024: Just a year from now, we’re witnessing a near 23% growth, solidifying the upward trajectory.

These figures paint a clear picture: cyber insurance is no longer a niche product, but a rapidly growing essential in an increasingly digital and threat-laden world.

Fortresses in Digital Age

The cyber threat landscape is a battlefield, and the lines are constantly shifting. In 2022, cyberattacks soared 38%, and the pandemic triggered a staggering 600% surge in cybercrime. To counter this onslaught, a digital army of 50,000 cybersecurity organizations is standing guard globally, including industry giants like CrowdStrike, Palo Alto Networks, and MacAfee, alongside specialized firms like Mandiant and Mandiant Solutions, and regional players like CyberArk (Israel) and Quick Heal (India).

But this number isn’t just impressive – it’s essential. The cyber insurance market, projected to reach $32.3 billion by 2027, relies heavily on these organizations to assess risks, implement defences, and respond to incidents.

Here’s how they’re shaping the cyber insurance landscape:

Risk Assessment: Cybersecurity firms help businesses identify vulnerabilities and tailor insurance policies accordingly. Ponemon Institute’s 2023 Global Cost of Data Breach Report found that organizations with mature cybersecurity programs had 27% lower breach costs.

Incident Response: When breaches occur, these organizations are often the first responders, containing damage and minimizing losses. Statista reports that the average cost of a data breach in 2023 was $4.24 million, highlighting the importance of swift and effective response.

Security Awareness Training: By educating employees, these firms help organizations build a stronger human firewall against social engineering attacks, a prevalent tactic used by cybercriminals. The Cybersecurity & Infrastructure Security Agency (CISA) estimates that phishing attacks alone cost businesses billions of dollars annually.

Despite the growing army of defenders, vulnerabilities persist. 43% of cyberattacks target resource-strapped SMEs, as per the Global Cybersecurity Forum, highlighting the need for affordable solutions. Additionally, ISC2 predicts a staggering 4 million cybersecurity workforce gap by 2025, posing a significant challenge in finding qualified personnel to effectively address these evolving threats. This double whammy of resource limitations and skilled staff shortages emphasizes the crucial role of collaborative efforts, innovative solutions, and readily accessible talent development programs in strengthening our collective cyber resilience.

Despite these challenges, the expansion of cybersecurity organizations is a positive sign. By partnering with these specialists, businesses can build a more secure future, and the cyber insurance market can continue to evolve and adapt, offering valuable protection in an ever-evolving threat landscape.

Regional Variations

Cybersecurity has catapulted to the top of business concerns in 2024, making cyber insurance a critical shield against the evolving storm. Ransomware and supply chain attacks keep underwriters on edge, potentially impacting policy coverage. Insurers like Beazley are now wary of unforeseen risks posed by generative AI, which could influence future terms.

Regulatory frameworks play a crucial role in shaping the cyber insurance landscape. India, for example, expects a 27-30% market growth driven by data laws and digitization, spurred by the IRDA’s guidelines on ‘Product Structure for Cyber Insurance’. China, too, has issued a guideline to boost its cyber insurance sector.

However, regulations diverge across regions. Merck’s $1.4 billion settlement for the NotPetya attack sets a precedent, while the Insomniac Games breach highlights the ever-shifting nature of cyber threats, demanding proactive measures. Cowbell’s eLearning Academy reflects a commendable industry effort to enhance risk awareness and preparedness.

Cross-Country Perspectives

During Q3 2023, the cyber insurance market in the United Kingdom solidified its status as a buyer’s market, with intense competition among insurers. Furthermore, Insurance Business Australia recognized the top cyber insurance providers, underscoring the crucial role of these entities in helping clients combat emerging cyber risks. Thousands of brokers across Australia provided their professional views to determine the winners.

In India, the cyber insurance market is poised for robust growth, with expectations of a 27-30% increase in the coming years. IRDAI has issued guidelines aimed at facilitating the development of stand-alone cyber insurance products.

In China, projections indicate that segment premiums will rise to CNY 700 million by 2025, representing a 21% compound annual increase. China has also revealed guidelines to boost the healthy development of its burgeoning cybersecurity insurance sector. These regulatory moves highlight the global commitment to fortifying the cyber insurance landscape.

Cybercrime Shifts Gears

From India’s surge in attacks to a global focus on ransomware, the cybercrime landscape is evolving. Chester Wisniewski, a leading cybersecurity expert, paints a picture of 2024 threats: criminals are streamlining, prioritizing wealth accumulation through ransom and extortion. They’re masters of adaptation, exploiting zero-day vulnerabilities like the Citrix Bleed incident one moment, then seamlessly switching to credential theft the next.

Meanwhile, the U.S. demand for cybersecurity professionals’ soars, with Montana, Washington, and Florida leading the charge. This reflects growing awareness of the threat, but also a concerning trend: supply chain attacks are on the rise, targeting managed service providers and authentication systems. As organizations rely more on ‘as-a-service’ models and fortify defenses, experts predict an increase in attacks facilitated by malicious proxies and social engineering.

But there’s hope. Governments worldwide are expected to ramp up efforts against ransomware groups, recognizing their growing impact on critical sectors. The fight against cybercrime may be ever evolving, but vigilance, adaptation, and collaboration can still tip the scales in favour of online security.

Staying Ahead of the Curve

In conclusion, the 2024 cyber insurance landscape unveils a landscape filled with both promise and complexity for conglomerates. As articulated by Vaibhav Tare, Chief Information Security Officer at Fulcrum Digital, the metamorphosis of the cybersecurity landscape necessitates an agile approach. Essential to countering evolving risks is the adoption of AI-powered threat intelligence and predictive analytics. Priorities lie in the seamless transition to adaptive, intelligence-driven strategies and the establishment of robust cloud security measures.

In the face of evolving cyber threats, the role of cyber insurance takes on heightened significance, safeguarding the resilience and continuity of global organizations. Executives, armed with proactive information, can confidently navigate the cyber insurance arena, fortifying their organizations against the ever-expanding spectre of cyber threats. In this digital age, cybersecurity is not merely an option; it is an imperative.

Some Key Players

In the ever-evolving cyber insurance landscape, new faces are emerging alongside established players. While barriers to entry remain high, several companies are making their mark. CrowdStrike continues its meteoric rise, recently surpassing the $100 billion market cap milestone with its innovative endpoint protection solutions.

Check Point Software Technologies remains a stalwart defender, lauded by Gartner as a leader in the magic quadrant for endpoint protection platforms. Cisco Systems, a networking powerhouse, is expanding its cybersecurity offerings, recently acquiring cloud security leader Duo Security. CyberArk, the ‘guardian of privileged access,’ continues to solidify its position with its best-in-class identity and access management solutions. And Dell Technologies, a tech titan, is strategically building its cyber portfolio with acquisitions like Secureworks, aiming to become a one-stop shop for holistic security needs.

“In recent years, the cybersecurity landscape has dynamically evolved, necessitating a proactive and adaptive security approach. Acknowledging the industry-wide talent shortage, we address this gap through educational initiatives, academic collaborations, and skill development programs,” said Mignona Cote, Chief Security Officer, NetApp. These are just a few of the major players shaping the dynamic cyber insurance landscape, each bringing unique expertise and innovation to the fight against cyber threats.

Read more:

Bima Trinity to transform insurance landscape in India