A panel discussion that looks at the most amazing transformational technology for NBFCs from multiple lenses such as alternate data, collections, disruption, regulation, payments ESG, etc:

- Moderator: Sushil Thakur, Director, Technology Consulting, Financial Services Advisory, EY India

- Poonam Vijay Thakkar, Mentor of Change, NITI Ayog

- Smitesh Shah, CTO, Ambit Finvest

- Samir Mohanty, COO & CTO, Avanse Financial Services

- Mandakini Kumari, Chief Product Officer, Vivriti Capital

- Mathew Panat, Chief Technology Officer, HDB Financial Services

Sushil Thakur: Financial services have been in the forefront of digital transformation. Do you see AI-ML technologies bringing a quantitative continuum to this growth or is there going to be a qualitative shift as we move along?

Poonam Thakkar: We are no more just India, we are digital India. We have the highest human resources in the world -1.4 billion people – and out of this, 1 billion people are under the age of 35, and average age is around 29 years. In the boardrooms we often discuss our investment in qualitative and quantitative with respect to research and deployment. The scale is possible only when AI-ML becomes a part of your business, because humanly there is only so much we can do. That acceptance has happened in the country in all businesses. The qualitative aspect from product and service and customers point of view is how to implement things that make life better such as chat bots, better learning of customer’s needs, better understanding of customer financials, and offering product or service when needed.

Sushil Thakur: Investment in fintech is expected to reach about $26 billion by 2026, at a CAGR of almost 24%. With such a huge AI driven disruption taking place, do you see the challengers and established players grow by competition or by collaboration?

Samir Mohanty: AI has come and created disruptions. But it has also enabled the large corporations to think internally. They have also reinvented their business model. They’ve started solving their unique business problems using AI and got results. They’ve bounced back with a lot of confidence and a lot of scale. The foundation is already there, and they’ve rediscovered themselves.

Many disruptors have come and will keep coming. Wherever there is an opportunity, large enterprises will always collaborate because what AI is doing today is actually expanding the collaborative ecosystem Today, reach and extensibility are rising by collaborating with the disruptors. So, I see 2 things that will happen – internal transformation and collaboration with disruptors.

There is a growing need for large corporations to change their mindset. To imbibe these kinds of technologies, you need to review your org structures. You need to re-prioritize the way you look at customer journeys.

Sushil Thakur: What kind of change would you suggest be made about innovation by established players? How can they leverage AI positively to ensure that they align with the overall strategic objectives of the organization?

Smitesh Shah: AI-ML is a buzzword. With ML, the largest use case has been in the financial services industry. The way we at Ambit have structured it is first to put up clear goal of what we want to achieve and how we are going to achieve it. You need to have a right pool of talent with you. You also need to ensure that you experiment, learn, reinvent and do change management. But there are challenges also. There are 3 critical things which need to be put in places – ethical, sustainability and security. At Ambit, we have clearly charted out what we want to achieve using AI-ML, which is that we want to do unsecured underwriting, but not linearly increase our team size. Today, we have put our scorecards in place. We started with expert judgment scorecards and then now we have moved to AI-ML based scorecards. There is a continuous self-learning which happens as the data gets enriched.

Sushil Thakur: According to a recent survey by Pew, 70% of business say AI is critical to their success, yet 41% of the technologists are concerned about the ethics of AI tools and 47% of business leaders are concerned about transparency. What are your comments on this?

Mathew Panat: It is a really interesting question. When the regulator gives us a license, we have a fiduciary responsibility for handling our customer’s data. Now-a-days, there are lots of buzzwords in the AI-ML space like supervised learning, unsupervised learning, etc. In a recent Senate hearing, Sam Altman submitted that companies like ChatGPT need supervision. There’s a reason for that? How is the AI-ML model built? When you have someone coaching the models, how do you ensure that the biases don’t come into that?

The regulator tells us that it’s just not enough to follow the letter, but to actually follow it in spirit. The intent of the letter is more important. The machine cannot get such human aspects. That does that mean we should throw away ML – there are merits in it. Now, the customer is also putting an AI engine on his side, and which breaks first would be an interesting to know.

You have ChatGPT and Bard with which you can do brilliant things, but you can use it for wrong purposes as well. So there have to be controls in place so that we don’t throw the baby with the bathwater.

Sushil Thakur: Coming to the ESG aspect of AI-ML, according to research, one LLM model may involve carbon emission equivalent to 550 cars emitting CO2 in a year. How do we address this?

Mandakini Kumari: It’s a great question. Initially we used to go with in-house infrastructure and dedicated data center. We can solve this with going on the cloud which will reduce the emission. The economy is growing and with it the number of cars, number of devices – so going on the cloud will help a lot. We see a lot of restrictions on the regulatory end, especially in the finance sector. We got some liberal laws now for a few cases where we can use the cloud and we are right now going towards cloud, which is giving the value addition from the ESG front. AI-ML and machine learning is more scalable on cloud.

Sushil Thakur: So how do you see AI being leveraged to serve to the MSME sector?

Poonam Thakkar: MSME are the base of our country and that sector has to grow. Look at the phenomenal numbers that MSME are posing today. India has 65 million MSMEs. The major factor is credit worthiness – that’s where everything starts. Products can be organized and created. Innovation can happen. The gate gatekeeper is credit worthiness. AI can play a fantastic role there, and add to it the layer of ML. Together, they can actually organize data which is not what is used by the corporations in a standard way. Today, you can understand credit worthiness of an MSME from their e-com transactions, their social media activity. etc. Cash on delivery is still a part of our system and not everything is linked to bank accounts. So alternate method of credit-worthiness using AI and ML can really be a game changer. With startup incubation centers, the government is actually taking a lot of deep steps to ensure that youngsters are getting into startups. So AI-ML can possibly play the biggest role We need a marriage of the traditional and emerging.

Poonam Thakkar: MSME are the base of our country and that sector has to grow. Look at the phenomenal numbers that MSME are posing today. India has 65 million MSMEs. The major factor is credit worthiness – that’s where everything starts. Products can be organized and created. Innovation can happen. The gate gatekeeper is credit worthiness. AI can play a fantastic role there, and add to it the layer of ML. Together, they can actually organize data which is not what is used by the corporations in a standard way. Today, you can understand credit worthiness of an MSME from their e-com transactions, their social media activity. etc. Cash on delivery is still a part of our system and not everything is linked to bank accounts. So alternate method of credit-worthiness using AI and ML can really be a game changer. With startup incubation centers, the government is actually taking a lot of deep steps to ensure that youngsters are getting into startups. So AI-ML can possibly play the biggest role We need a marriage of the traditional and emerging.

Sushil Thakur: With AI-ML, what do you see as the next wave of transformation in payments?

Samir Mohanty: Most of Avanse’s customers are lent to based on their future employability potential. When we find a student, there’s nothing in the bureau that we can analyze to make a lending decision. All our analytics is based on alternate data. To really underwrite a student, you can’t do based on parent’s bureau data – that becomes a LAP or personal loan. So the challenge before us is how to integrate a student using alternate data. One can go as deep as the unemployment rate in the US where students are going, the average per capita income trend, what he can earn on passing out, what he can earn at age of 40, etc.

We have 2 challenges. First is reaching out to the students when they are in a zone where we cannot connect. Second is we operate out of 17 branches, but we fund student out of 380 locations. This is where analytics led by AI & ML has solved the way. We started thinking about collections and where to go with the restrictions that we have. Our journey on AI-ML started with collections, not with customer acquisitions. Today, we don’t call the customers, we use all alternate algorithm to reach out to the customer. Our model which tells us which are set of customers who are very likely to bounce. Of our entire database to date, we can pinpoint 15% of the population which is creating 75% of the bounce. We reach some of them through contact center, some through the field, etc.

For us, payments have been enabled on all modes. We’ve created a platform which gives us single source of truth for all the collections. Moving ahead, I see this space evolving with what UPI is bringing in. The EMI management landscape is going to completely change for financial institutions and lending. I must acknowledge that the regulators are also enabling us to do most of these things.

Sushil Thakur: How do you see the emerging trends in collection and risk management defining the charter and the next course of action for the traditional way of doing the collection risk management?

Mathew Panat: HDB is fairly unique with a broad range of products including microfinance, consumer durables, commercial vehicles, construction equipment, etc. Obviously, that means the velocity and the volumes are also different and very unique to each of those offerings. So, the holy grail that we are trying to achieve is to take the customers that the banks would not lend to and ensure that it doesn’t get into the collections bucket because then it becomes an expensive proposition.

Even before we get into collections, what we want to do is that the credit appraisal process is so clean and watertight so that a very minuscule of them actually go into the 30+ bucket as we call it. And that’s the key to ensuring that the cost per transaction and the cost of credit is kept to the minimal possible.

In microfinance and consumer durables, loans do not go beyond one year. Whereas in construction equipment and loan against property, it’s one plus year and then goes up to 3-4 years. So where do we put in a machine-based credit decisioning engine in areas like consumer durables where the velocity and the volumes at which we take in loan applications, the sanction and disbursement has to be a fast process and human beings are not involved.

Whereas for construction equipment loan, it is it’s a relationship driven engagement. You get repeat business from that same customer who typically is doing something in a coal mine somewhere in Bihar, for example.

We’ve learned something interesting things along the way. We lend for JCB machine loans, and what we realized is these machines are supposed to be used in India, but they’re actually being exported to Africa. Now, no amount of AI-ML is going to help me with this. I’ll always be one step behind what the crooks are doing. So, we must have some level of human intelligence. In this case, we had to work with the customs department and tell them that if there is a machine that is hypothecated in India, before sending it abroad or allowing for export, they must take consent from the loan originator. These learnings go into the system and it becomes an automated process at the end of it.

Sushil Thakur: With so much of proliferation and so many NBFC options for the customer, what role will AM-ML play in terms of delivering excellent customer service?

Mandakini Kumari: We can categorize customers into 3 segments – those who are not tech savvy, those who are very tech savvy and those who are in between. The tech savvy generation would like to go for self-service and we have to provide technology to them, such as robo-advisors. For this category of customers, for saving, AI-ML should be built in such a way that it should read earning and expenses from bank statement, etc, and create a portfolio of investments. It is ideal for people who do not have a lot of time.

For the less tech savvy customers, Alipay has a mechanism to smile and make the payment without needing to swipe the card. We should build such products. We can have chatbot for EMI payments. We should create different product for different categories – segment by age group, asset class, etc. Collection is the key and hence 360-degree view of the customer with more and more data from the customer and his behavior can help build the product accordingly.

Sushil Thakur: There have been different schools of thought about the takeover of human work by AI-ML. What is your thought on this?

Smitesh Shah: I highlight 5 aspects – ethics, transparency, control, privacy and accountability. We must take all 5 five critical parameters into account. AI-ML uses a lot of data, but do we really have the right to use the data? We have to bring in accountability because today the AI-ML is black box. So ethics, transparency & control would be very critical to ensure that as we move along.

Sushil Thakur: To summarize, there is no one size fits all. There always has to be a balancing act. A regulator has been an enabler in adoption and rising to the next level. Thank you all very much.

Read more:

Ujjivan SFB & Haqdarshak: 3-year plan to educate 15,000

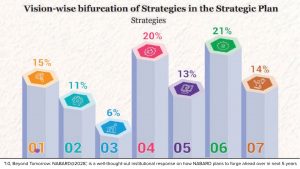

NABARD envisions a strategic plan