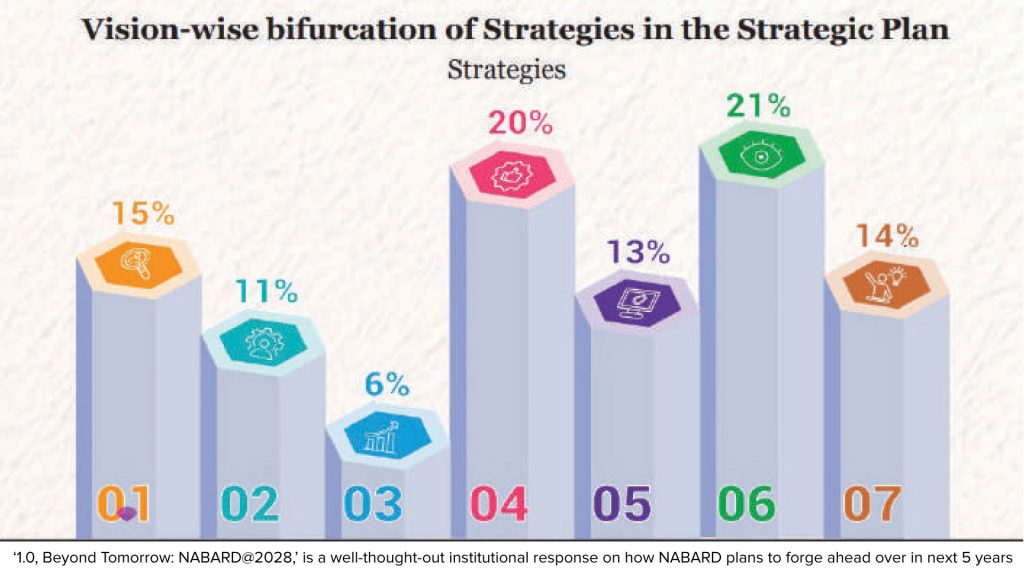

Creates a roadmap built on 7 comprehensive visions, 86 strategies and 386 milestones:

NABARD, India’s apex development bank, has ended the 2023 fiscal on a strong and introspective note, drawing out its first strategic plan document christened ‘1.0, Beyond Tomorrow: NABARD@2028,’ a well-thought-out institutional response on how it plans to forge ahead over in next 5 years.

Pragati: People, Planet, Profit

Considering the fact that NABARD has to focus equally on finance as well as development, ‘Pragati 1.0’ charts a middle path, seeking a fine balance between both the functions, while remaining rooted in pursuit of the triple bottom-line encompassing People, Planet and Profits.

Pragati 1.0’s roadmap is built on 7 comprehensive visions, 86 strategies and 386 milestones. With Pragati 1.0, NABARD not only decides ‘WHAT to do?’ but also ‘HOW it gets it done?’ and ‘WHO will do it?’, while remaining moored to the WHY of its institutional being.

NABARD is playing a pivotal role in mitigating/adapting to the impact of climate change by funding environmental-friendly projects, while also being the nodal agency for the Green Climate Fund (GCF). Given that the threat is especially severe in places where people’s livelihoods depend more on natural resources, NABARD would further strengthen its climate adaptation measures for safeguarding rural livelihoods and ensuring sustainable development. Further, to direct financial flows to support investment in clean and green technologies in rural areas, green financing products are being envisaged in the medium term.

In the medium term, to become self-sustainable, NABARD would pursue alternate financing sources like impact bonds, partnering with global agencies to finance development initiatives, attracting green investments, policy advocacy with the government to issue green bonds with tax credit to investors, etc

Resilience of Rural Credit

While NABARD had taken the initiative of bringing StCBs and DCCBs on CBS platform, the PACS have so far been largely left out of the ambit of technology adoption. As the implementing agency for the project on ‘Computerization of 63,000 functional PACS’, NABARD will take the initiative of digitizing cooperatives by bringing in all the core and non-core activities of the PACS on a computerized platform. It includes automation of membership, deposits, lending, trading, procurement, warehousing, public distribution, HR management, accounting and comprehensive MIS to be generated for reporting to higher tier structures and NABARD, and for audit, reporting and compliance, legal requirements, etc. NABARD has an onerous task in facilitating formation of 2 lakh PACS and dairy societies in uncovered villages in the next 5 years along with other stakeholders.

NABARD shall play an anchor role in turning around the RRBs by providing centralized services in technology adoption, capacity building, product innovation, etc.

NABARD’s supervisory activities are designed to protect the interests of the depositors, ensure stability and growth of the financial system and assure compliance to regulatory guidelines. NABARD has devised manuals / guidance notes and templates on stress testing tools for credit, market and liquidity risks as part of the enhanced CAMELSC approach.

An innovative project, ‘SuperSoft – Digitalization of Inspection Process’, under implementation by the bank, envisages digitalization of the entire inspection process right from budgeting until the closure of compliance to inspection observations and carry-over of the pending observations to the next inspection cycle in a seamless manner.

Re-imagine, Leverage Digital

The physical and digital environment is essential for the bank to function and grow faster and better. It involves a robust infrastructure for the bank to operate at ease and in a non-disruptive manner. NABARD needs to be a data driven organization. To this end, many projects have been formulated over the next 5 years to ensure that operations are digitalized, while also taking care of cyber security and information security aspects.

The Digital Strategy Map proposed over 5 years includes features such as Artificial Intelligence (AI) & Machine Learning (ML), zero trust, subsidiary development, Blockchain, containerization, software factory, setting up of dedicated Cyber Security Operations Center (CSOC) and Network Operations Center (NOC), cloud readiness and migration to the cloud, etc. In order to align its initiatives with the all-pervasive priorities of GoI, NABARD is establishing a central data repository in the form of a data warehouse, which will eventually act as an eco-system enabler for evidence-based policy making and setting the developmental agenda for rural India.

Best in Class Phigital Infra

NABARD has chalked out its strategies:

1 Creating a robust and modern information management system

2 Broad-basing data flow to enterprise dashboard

3 Using analytics for digital monitoring

4 Using technology and data analytics in promoting evidence-based decision making

5 Accelerating Digital Drive – Building sustainable ICT infrastructure, adapting to emerging technologies through implementation of NextGen applications with focus on resilience, reliability, security and Upgradation of existing applications/ infrastructure to enhance accessibility, usability and inclusion 6 Making PLPs stakeholder-friendly 7 Leveraging digital initiatives 8 Reinforcing asset management and safety of goods and people 9 Improving facilities through IT in management of bank’s premises and security operations 10 energy conservation 11 Strengthening legal certainty of operations.

Read more: