Ujjivan Small Finance Bank has joined hands with Haqdarshak, a social and financial inclusion enterprise, to empower the nano and MSME entrepreneurs in India. Together, they have developed a unique financial literacy program to bridge the knowledge divide among nano and MSME entrepreneurs. Through this program, the bank aims to reach around 15,000 individuals within the next 3 years.

Ujjivan Small Finance Bank has joined hands with Haqdarshak, a social and financial inclusion enterprise, to empower the nano and MSME entrepreneurs in India. Together, they have developed a unique financial literacy program to bridge the knowledge divide among nano and MSME entrepreneurs. Through this program, the bank aims to reach around 15,000 individuals within the next 3 years.

The partnership aims to equip the target audience with knowledge and tools to make informed financial decisions and minimize risks. The collaboration will provide access to government and welfare programs using Haqdarshak’s technology-enabled model addressing last-mile connectivity. Haqdarshak’s HQ App is designed to help citizens explore and apply for government and private welfare programs with trained community agents known as Haqdarshaks.

India’s MSME sector contributes approximately 30% of the country’s GDP and employs approximately 11 million people; therefore, empowering them is crucial. This partnership also aligns with RBI’s broader goal of fostering a financially inclusive and resilient society.

Many entrepreneurs in this industry need assistance with financial management, risk mitigation, and maximizing financial resources. A comprehensive financial literacy program will be conducted to recognize this need for participants identified by Ujjivan SFB. The program will include in-person training on the exclusively developed content, hands-on exposure to the HQ app for scheme identification, and continuous skill development. The engagement will be through interactive elements and visuals, with monitoring through real-time data on applications, categories of programs, and benefits channelled.

Haqdarshak CEO Aniket Doegar, said: “This is a huge partnership and a chance for us to generate a large-scale impact with Ujjivan SFB. The partnership will be an important step in India’s effort to foster entrepreneurship. We are happy for the opportunity, which will allow us to amplify our impact by 10x. This program will empower grassroots entrepreneurs and aligns with our vision of providing social security and financial inclusion to 100 million citizens by 2030.”

Ittira Davis, MD & CEO, Ujjivan Small Finance Bank, said that the bank’s commitment to its customers extends beyond providing banking and financial services. “By offering financial knowledge and resources to nano and MSME entrepreneurs, we can assist them in navigating the complexities of business and personal finance more effectively. Haqdarshak’s expertise and technology platform of will be instrumental in reaching and assisting MSMEs nationwide.”

Incorporated in 2016 in India, Haqdarshak Empowerment Solutions is a for-profit, private limited company that empowers citizens and MSMEs by providing easy access to relevant welfare schemes information and last-mile support for application to these schemes through its technology platform and field. It has an assisted-tech model wherein this app is used by field agents to improve the entitlement uptake in the community while earning a livelihood in this process.

Ujjivan Small Finance Bank began operations in February 2017 and currently serves 7.6+ million customers through its 686 branches and 20,000+ employees spread 25 states and union territories in India. The gross loan book stands at Rs253 billion with a deposit base of Rs267 billion as of June 30, 2023.

Outline of training content

Overview of the sector

a. Introduction to the MSME Sector

b. What is an MSME?

c. Classification of MSMEs based on activity and size of the enterprise

Financing For MSME

a. Types of formal loans

b. Types of costs incurred by the business

c. Importance of a CIBIL check

d. Components of a project report

How to prepare for business loans

a. Prerequisites for securing a business loan

b. Your business loan bank proposal

MSME documents & schemes

a. Udyam Registration for MSME

b. FSSAI Registration for MSME

c. Registration under Shops & Commercial Establishment Act

d. GST Registration

Read more:

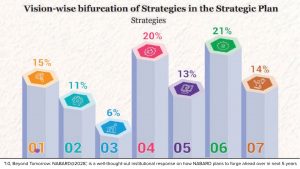

NABARD envisions a strategic plan

Inspired by Vivekananda’s Life and Principles