The annual study ‘Top of the Pyramid’ by Kotak Wealth Management and Ernst & Young, give an insight into the varying perceptions of the ultra high networth households in India:

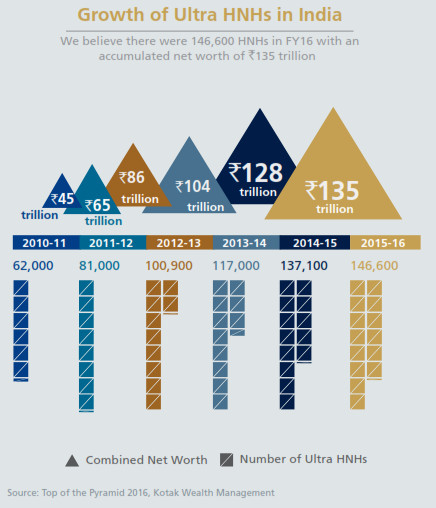

There are 146,600 ultra high networth households (UHNH) in India in FY 2016, against around 137,100 in the previous year, according to the annual ‘Top of the Pyramid’ report brought out by Kotak Wealth Management and Ernst & Young. While defining the growth as slower and moderate at 7% over one year and a 16% compounded growth over five years (corresponding growth rates last year were higher at 17% and 22%), the report finds that these UHNHs represent an accumulated net worth of Rs135 trillion, says the report and this represents a 5% growth on last year’s wealth and 18% compounded growth over the last five years.

The report projects the number of UHNHs to increase to 294,000 by FY2021 with a combined networth of Rs319 trillion driven by new UHNHs from emerging sectors and new avenues for investments that give higher returns. Smaller cities will also contribute to this growth in the number of ultra HNIs and their wealth, predicts the study.

The report defines a UHNH as one with a minimum networth of Rs250 million, mapped over 10 years.

“The business and investor-friendly approach of the government will help nurture and sustain a start-up ecosystem in the country and propel the growth of ultra HNHs,” says the report.

INVESTMENTS UP

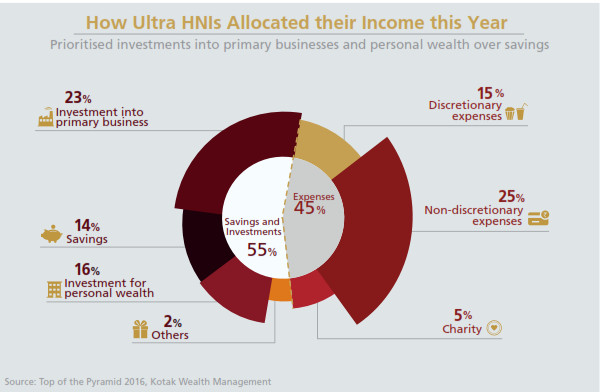

One significant finding is that in FY 2016, 59% of the UHNIs surveyed increased their investments into primary businesses and 43% saw a decrease in their overall savings, which they substituted with investments. “Non-discretionary expenses continued to dominate their income allocation, except in the case of entrepreneurs, for whom investments into businesses became a priority. For professionals, the proportion of savings reduced over last year, with a commensurate increase in their investments for personal wealth,” says the report.

It has been found that family-centered expenses – spending on jewelry, holidays, apparel, automobiles, home decor and events – continue to dominate for the UHNHs by contributing to 68% of overall spends, a slight increase over 67% last year. A higher proportion of UHNIs compared to last year are now considering these family-related expenses (except home decor) as non-discretionary.

IMPULSIVE BUYERS

The report found that 64% UHNIs are impulsive buyers when it comes to apparel and accessories. “Despite the allure of foreign destinations, many of them prefer to shop within India, as most major foreign luxury brands are now available locally. There has also been increasing awareness about art among the ultra HNIs, not only because they treasure the absolute pleasure of owning a beautiful and timeless creation, but also because owning art has started making sound business sense due to its manifold value appreciation. In this light, UHNIs are increasingly treating art and paintings as an integral component of their portfolios. Even so, for 68% of UHNIs, art and paintings are impulse purchases; only 32% engage in research before buying,” the study reveals.

The report also recalls that not too long ago, visiting a foreign location for shopping and other purchases was de riguer for these brand-conscious UHNIs because of the limited choice that shopping in India had to offer. “However, this is not strictly necessary anymore – the survey found that as many as 59% UHNIs now satisfy their apparel and accessory purchase needs in India itself. Dubai and Singapore have emerged as other popular destinations for apparel and accessory shopping, while Europe is the next most popular. What they really value is variety and exclusivity.”

WEARABLES

One other area of interest for the UHNHs is the ‘wearables’. These devices now form part of their daily lifestyle. It is also interesting to note that older UHNHs – between the ages of 36 and 50 years – were more eager to adopt wearable devices than the younger ones. There was close to 61% adoption among the 36 to 50-year age group compared to 55% adoption among UHNIs who are below 35 years of age.

“The quest for access to real-time information in an easy and convenient manner has led to as many as 57% of ultra HNIs becoming users of at least one high-end wearable device. What was once considered fiction has now become a reality; devices of the future are now exclusive and more accessible. Currently, popular wearable devices include smart watches, fitness bands, smart glasses, virtual reality headsets, and sleep headphones. As many as 68% of UHNIs have a smart watch – it seems to be one of their most popular wearable devices,” says the report.

COLLECTIBLES

Another area of passion for the UHNIs is collectibles. They do not leave any stone unturned to collect items that add to the grandeur of their living rooms, office spaces, or atriums, says the report quoting that 70% of UHNIs confessed that their passion for owning a collection of exotic and interesting items drove their purchases.

The study showed that 65% UHNIs prefer collecting electronic gadgets and about a third

have developed this interest over the last one year. Luxury cars account for 63% of ultra HNIs’

collections, followed by investments made in art and paintings.

GO GREEN

The study also covers the interest UHNIs have in adopting ‘green’ building practices to minimize the footprint of their homes on the ecology, while maximizing comfort. Beyond the latest luxury bathroom fittings, marble floor tiles, and technology time-savers, the wealthy are also investing in insulated roofs, automated sensor lights, water-conserving fixtures and fittings, rainwater-harvesting technology, and external solar lighting. They are also increasingly tying up with commercial and residential high-rises to install solar panels on rooftops, thus encouraging the

usage of alternate sources of energy. This has not only turned into a viable business model for ultra HNIs, but has also made the ‘go green’ lifestyle a coveted and fashionable one, finds the study.

SUCCESSION PLANNING

As regards succession planning, the study found that that 43% of UHNIs prepare for at least five years to put an efficient succession plan in place, while another 35% take anywhere between two to five years. “When it comes to a successor, over 90% of ultra HNIs choose from their children and high-performing family members, while less than 10% choose outsiders.”

However, the report indicates that this trend is likely to change in the future because of the increasing need for professional management from a good governance perspective. “Even today, most ultra HNIs (73%) prefer planning for succession with their close confidants; a few look for advice from external sources such as chartered accountants, consultants and wealth managers. People are also gradually relying on professional estate planners, trustees, and wealth advisors,” it says.

REAL ESTATE TOPS

In the investment patterns of UHNHs, there has been a realignment – with real estate (mainly commercial), debt, and alternate assets gaining ground at the cost of equities. As part of alternate assets, commodities attracted their interest – as much as 72% of UHNIs invest in commodities; of these, 40% have invested about 5-10% of their total assets in commodities, with gold and silver continuing to be the most preferred.

IMPACT INVESTING

One concept that has caught up with the UHNHs is impact investing. The study says through impact investing, UHNIs derive twin benefits – one, investing in ventures that provide good returns (albeit over a longer timeframe) and two, the satisfaction of having created enterprises that will make a lasting social difference, a feeling that is hard to put a price tag on.

“While the general interest for impact investments is high, professionals seem to have the highest inclination – 67% have an exposure to these investments. Key sectors attracting impact investment include financial services, clean energy and affordable housing. In addition to the existing Indian funds focusing on the segment, there is also a trend towards impact-investment-focused global funds setting up shop in India, which will give further impetus to this sector,” says the study.

It also says that most UHNIs that already have an exposure to impact investments end up increasing their exposure. Typical investments in this segment were below Rs50 lakh for financial services and clean energy, but up to Rs1 crore for affordable housing.