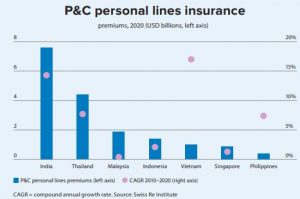

Swiss Re Institute carried out a survey on the prospects of digital personal Property and Casualty Insurance market in South and Southeast Asia and found it is poised for healthy growth:

The digital personal Property and Casualty (P&C) Insurance market in South and Southeast Asia is estimated to reach a cumulative $7.5 billion in premiums over the next 5 years. This projection has been made by the Swiss Re Institute following a survey undertaken across the region to understand attitudes towards buying personal lines insurance (home, personal accident, and employment) online.

The survey results indicate South and Southeast Asia has seen its number of digital consumers grow exponentially over the past few years; a trend accelerated by the covid pandemic. Low digital P&C personal lines market penetration estimated at 1-2% in the region shows strong growth potential, it says, adding, to capture this opportunity, understanding consumer preferences will be key to help P&C insurers expand their reach through digital distribution channels.

The study says: “Our findings show that across all markets, resistance towards buying insurance online stems from a lack of an individual or agent to help explain what is perceived to be complicated policy wording and to offer guidance through the claims process. Nevertheless, 40% of consumers would prefer to buy personal lines insurance online, with India topping the list of markets ready to embrace digitization.”

E-COMMERCE UNCERTAINTIES

The survey found more than 20% of all respondents indicated concerns of receiving fake or poor-quality goods purchased on digital marketplaces. Gadget risk is also a key concern, with 77% of respondents indicating having experienced damage to their devices in the past 3 years. The threat of cyberattack and identity theft is another issue with more than 20% of respondents viewing personal information and data loss as the most serious risk. As much as 30% of respondents would like protection from phishing or hacking attacks and from the illegal use of e-wallet transactions arising from loss or theft of a device. A further 21% of respondents said that they would like insurance to cover losses arising from identity theft involving the illegal use of personal information.

The study identifies unmet needs among customers, outlining the ways in which insurers can develop relevant digital solutions. “As consumers go digital and become more risk-conscious, insurers are presented with a unique opportunity to close the protection gap through developing simple, modular products, streamlining the digital onboarding process, and educating the consumers to enhance greater trust and familiarity with digital insurance offerings,” says the study.

E-COMMERCE HELPS INSURANCE

The study says India and countries in southeast Asia have been playing catch-up in the digital economy through fast mobile adoption and the covid pandemic has triggered a paradigm shift in consumer behaviour in these markets, with lockdowns pushing shoppers towards e-commerce platforms to access a broad array of goods and services. With a combined total population of nearly 2 billion people in India and southeast Asia, the stage is set for sustained high growth.

Swiss Re surveyed consumers in 6 countries – India, Singapore, Malaysia, Indonesia, Thailand, and Vietnam – to ascertain their attitudes to buying personal lines insurance online. The survey tested respondents’ perception of risk across a mix of five traditional and new product domains: home, employment, personal accident, online shopping, and gadget insurance. Across all markets, resistance towards buying insurance online stems from a lack of an individual or agent to help explain what is perceived to be complicated policy wording and to offer guidance through the claims process. Nevertheless, Swiss Re says the survey found that more than 40% of consumers across all the 6 markets would prefer to buy insurance online.

“India tops the list of markets ready to embrace e-commerce, with more than half of survey respondents saying they would prefer to purchase insurance online. Of the 6 markets, consumers in Singapore are least open to using online channels, with most still relying on local agents for advice. With respect to specific products, almost 35% of consumers across the 6 markets prefer digital channels for home and personal accident insurance products. In addition, close to 60% prefer to buy their travel insurance online,” says the study.

NEWER RISK PERCEPTIONS

It also says the move towards digital commerce in all its guises, and the perceived risks associated with buying goods and services online represent a developing opportunity for P&C insurers. More than 20% of all respondents to the survey said they were more likely to receive fake or poor-quality goods bought on digital marketplaces, and expressed interest in having insurance protection options for such eventualities.