iSTOX, the digital securities platform, has accredited investors from 24 countries, including India:

iSTOX is a private capital exchange backed by the Singapore Exchange (SGX), Temasek subsidiary Heliconia Capital, Japan Investment Corporation (JIC) and the Development Bank of Japan (DBJ). Using blockchain and smart contract technology, the exchange overcomes manual processes in the traditional private capital space. The company’s Chief Operating Officer Darius Liu discusses business and technology perspectives.

iSTOX is a private capital exchange backed by the Singapore Exchange (SGX), Temasek subsidiary Heliconia Capital, Japan Investment Corporation (JIC) and the Development Bank of Japan (DBJ). Using blockchain and smart contract technology, the exchange overcomes manual processes in the traditional private capital space. The company’s Chief Operating Officer Darius Liu discusses business and technology perspectives.

Mehul Dani: What has been the digital strategy of your company for investors in India and other countries?

Darius Liu: iSTOX is a digital securities platform on a mission to democratise the private capital markets. We do that by fractionalizing investments in the private markets such as hedge funds, wholesale bonds and private equity, so that individual accredited investors can participate in amounts in the order of $10,000-$20,000 instead of $1 million. Investing in these private market products helps individuals diversify their portfolio, because private market investments can have a relatively low correlation to the public markets. This added diversification can bring higher returns over the long term.

As a global platform regulated by the Monetary Authority of Singapore (MAS), we can onboard investors from any country in the world except the US. To date, we have accredited investors using iSTOX from 24 countries spanning Asia, Europe, the Americas, Australia and New Zealand. We do have quite a number of investors from India. Backed by the Singapore Exchange and Temasek-subsidiary Heliconia Capital, we received our full licence from the MAS in February 2020 – graduating from the MAS fintech regulatory sandbox in that month.

How has covid impacted your operations and how have you responded?

Almost immediately after we received our licence, we were confronted with the effects of covid, including lockdowns, the inability to hold meetings and events, and our staff having to work from home.

As a fintech company operating on a fully digital system from day one, we adapted quickly. We had already implemented digital signatures for all documents. All meetings could happen over Zoom. Our data systems are hosted by AWS Cloud Services. The transition was relatively seamless for us.

We did have to change the way we engaged with accredited investors, our customers. When a new investment product is issued, the issuer typically does roadshows to introduce the product to investors. In the pre-covid world, this would have involved at least some physical meetings, but in the face of covid we have implemented fully online roadshows. From what we have seen in the past year, investors have responded positively to the change.

What are the underlying technologies at iSTOX?

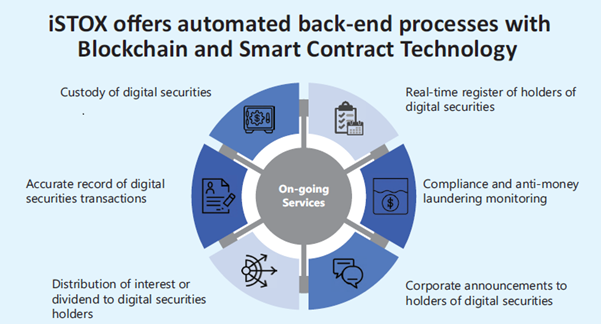

iSTOX is a digital securities platform. That means we facilitate the issuance, custody, and distribution of digital securities, using blockchain and smart contract technology to overcome manual processes you might see in a traditional issuance.

Today, when a bond, or a fund or equity is issued by a company in the traditional private markets, there is an army of staff working behind the scenes to make it happen – whether it is the custody or the ongoing actions related to the security, such as coupon payments in the case of a bond. In the case of private market instruments, these processes are often executed with a fair degree of manual effort, and as a result, issuers cannot serve a large number of investors because of cost and scalability considerations.

iSTOX solves this problem by issuing the securities directly as smart contracts, or tokens, onto a blockchain. The efficiency gains from tokenization means most processes can be automated, and as a result we can bring the benefits of private market investing to many more customers, including smaller investors. This is possible because our technology allows the digital securities issued on iSTOX to be fractionalized, that is, they are easily broken down into smaller units.

To give one example, we recently offered individual accredited investors Astrea VI private equity bonds by Azalea, which is a wholly-owned subsidiary of Temasek Holdings, for a minimum investment amount of just $20,000, instead of $200,000. That is a 10 times reduction. In this way, previously out-of-reach investments have become possible.

A second benefit of blockchain technology is instant settlement. After investors subscribe to any primary issuance, they can trade it on the iSTOX secondary exchange for as little as $1000. The power of blockchain means trades that match are settled instantly, and not in two or more working days which is typical at exchanges not running on the blockchain.

How have digital initiatives contributed to business growth? How much business approximately has been garnered and what is the expected growth? How have you brought partners such as distributors or agents into your digital strategy?

The digital channel is by far the primary channel for us, accounting for nearly all of our growth. As a fintech company, we do not have physical branches. When a customer hears about us – perhaps via word of mouth or digital marketing or in the news – and they want to sign up, they will register on our website, iSTOX.com. The entire KYC process is completed online, including the submission of documents. That is why we have been able to onboard investors from 24 countries, including from India. This strategy will continue in 2021, and our target is to triple our customer base compared with 2020.

Financial institutions are an important customer segment for us as well. Besides onboarding individual investors directly, we also work with external asset managers, family offices and brokers that each represent a group of investors. To better serve these institutions, we have designed a platform that allows them to view each individual client’s holdings as well as subscribe to or trade private market products on that client’s behalf. We add value to our institutional users by allowing them to offer different and new investment opportunities to their end clients, in addition to the instruments they already have access to. Working with both individual and institutional clients helps us scale the business more quickly and bring the benefits of the digital securities revolution to more people.

How strong is your company’s presence on social media? Can you describe your marketing and promotional efforts?

Social media is an important channel we use to communicate with and educate our customers. Most individual investors we engage have not spent much time trying to understand private market investments in the past – they did not have access to such investments anyway, so it was not relevant to them. But now that we are bringing them access to products like hedge funds and wholesale bonds for the first time, it is naturally also our task to do investor education on some of these products. We will use all channels available to us, including webinars, roadshows, email and, of course, social media. With accredited investors, we find that their social media habits may not entirely mirror that of the general social media user. For example, they tend to spend more time on LinkedIn than other social media users do, and they are also known to actively seek out information about investing and the financial markets, which is an encouraging sign.

In our marketing efforts, we also place a great emphasis on delivering top quality content and information that will be useful to investors, and we shun a purely advertising approach. Time is very valuable to our clients, and even in the few minutes that they are engaging with an article we have written, we want them to feel that they have learned something useful, and that the article wasn’t simply a sales pitch.

In the post-covid scenario, what are your targets and plans for tech–led business growth?

Our platform is currently available on desktop. We are nearly done building a new mobile app, which will launch in the first half of the year. That means being able to subscribe to private market products as well as trade them in the secondary market on the go, from anywhere. This is something our customers were requesting, so we devoted resources to making it happen.

We are also launching more products on our platform in 2021. To date, most investment opportunities open to our clients have been funds and bonds. This year, we will enable customers to buy direct equity in unicorns. Imagine, as an individual investor, being able to buy shares in pre-IPO unicorns like BYJU’S or Grab or Stripe or SpaceX. This was only available to ultra-high net worth individuals in the past – because, again, the minimum would have been $1 million or more. But with technology, we can fractionalize that to $20,000 units. We are working hard to launch this. We first had to make enhancements to our tech infrastructure to prepare for the new product. That is now done. What remains is for us to find the right deal that would be both valuable and exciting for investors on our platform.