S. Muralidharan, GM, Payments at FIS India

Your personal assets such as car, phone, house and even valuables are locked when not in use. What about your credit or debit card? Wouldn’t it have been wonderful if there was a feature to lock the cards access when not required? This extra layer of security puts an additional shield to the CHIP and PIN based security feature today. With the recent surge in criminal activity targeting payment cards, banks across the globe are beginning to recognize the need for a solution which can protect their customers from any unexpected fraud losses. Early fraud identification and prevention is the most important aspect in such situations.As per a recent study, nearly 88% of fraud victims across the global markets do not receive real time fraud alerts, despite around 85% of the card users owning a mobile device. Very smartly, scammers clone the SIM card first and then change the mobile number on the bank’s database, routing away all the notifications that the user would receive otherwise. Every day, we read about the rising number of card frauds that happen in India. Once a card is compromised, a user blocks his card – which becomes a reactive method to prevent further transactions. But what if there was a proactive method to temporarily block the card when not in use.

SecurLOCK, a newly launched product from FIS, addresses this need of the market by allowing cardholders to set rules on their cards on how they wish to use their cards. The app adds many features on the card as part of customer self-service. The most important security feature is if the user does not wish to use his card, the card can be locked through the smart phone app linked to the card. Before resuming transactions, the card can be unlocked, enabling card transactions. With its ability to provide real time transaction alert and controls, this product protects its user from fraudulent transactions. It is a secure way to provide the cardholders with the flexibility to determine where, when and how they want to use their payment cards.

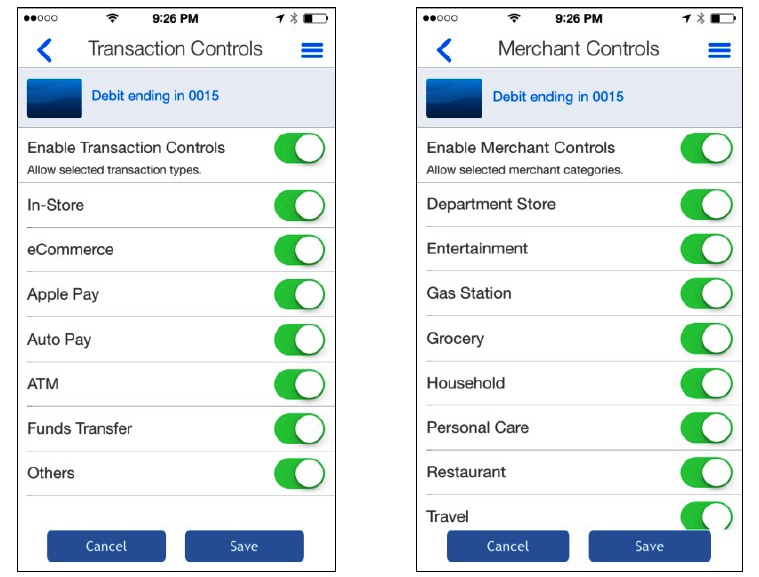

The solution can be embedded as part of any bank’s mobile application. This puts the control of the card with the customer who can control the complete card activities. Other functionalities that can be managed are setting merchant categories such as online shopping only or setting transactions type such as ATM transactions or setting transaction limits such as a few thousand rupees. These limits can be set on a loved one’s card to manage finances as well and reduce risk. All this is done without any need to call and speak to a support representative.

The user can also set features such as the location that he wants to transact. Without this feature, If the user is in a particular location and the fraud happens in a completely different location, he first needs to convince the authorities that he had not really travelled to that particular place. In case the transaction happens when the security feature is enabled, the transaction may get declined. The user will have to remove the lock and then do the transaction again. Other features such as checking balances, viewing transaction history, ATM locator and low balance alerts are also available as fully loaded features within the SecurLOCK APP. Real time transaction alerts are tied to the app rather than the phone – so in case the phone number is changed by the scammers, the alerts will still be sent to the app. In the worst case scenario, when the user loses the card, rather than struggling to reach across to the call center, the user simply changes the status to card lost, which disables the card permanently.

SecurLOCK Equip mConsole used in conjunction with SecurLOCK Equip mobile card control app allows financial institutions to provide the cardholders with the required support, analytics and usage information of the cards transactions. mConsole helps in tracking or monitoring of suspicious activity, card track usage, identifying trends by date, location and merchant type. It has a simplified view and real time transaction alerts with self service functions that provides cardholders with far superior experience which is an important component in ensuring overall customer satisfaction.

Customer surveys show that as a result of proactive control and instant engagement provided by SecurLOCK, they have made those cards top-of-wallet. For financial institutions, higher card usage increases direct interchange revenue and also indirect interest revenue from funding the incremental card spend. This becomes a differentiating factor and becomes a winning value proposition to customers in this vastly crowded market space.