Dr Joseph George Head of Information Systems & Technology, National Bank of Fujairah PJSC. (The views expressed are the author’s own and not of the insitution he is associated with.)

Once upon a time there was a boy called Finto, who was very talented with artistic capabilities and possessed a benevolent mind. His poor parents ran a tea shop in the town. Finto spent most of his time scribbling and painting on whatever surfaces he found.

One day he came across a big colorful balloon and he started painting on it, the elegance of which soon attracted public attention. He decided to inflate the balloon and fly it from the roof of his parents’ tea shop to make the art more conspicuous, thus attracting more customers to the shop. As the balloon started expanding, so did the charm of the art which drew in public accolades. The tea shop soon became crowded with people who came to witness the magnificence of the art. Finto’s caring mother was watching all his hard work in making the balloon more beautiful, to attract customers. But she also noticed that while the balloon was gorgeous and attractive, her son was getting tired as he had to keep blowing air into the balloon to keep it afloat as tiny holes caused by the pointed brush drained the air off the balloon. On the other hand she also noticed her beloved husband struggling to serve the customers as the crowd grew beyond his expectations.

The situation worsened to a stage that it affected the credibility of the shop as they could not cope with the growing number of customers and serve them satisfactorily. Finto’s objective to help his father serve the customers after attracting them to the shop through his innovative approach did not work out as he had to labor hard to keep the balloon intact. But despite of his all his hard work, minor holes on the balloon started to take a toll on the beauty of his art as air oozed out through them, thus shrinking the balloon. Shrinking balloon along with the tea shop’s inability to serve the customers, started turning people away.

SHRINKING BALLOON

The above narration is not different from what is being done in retail banking digital transformation journey. Before one gets into the same in an aggressive manner, we need to understand the common ‘missing links’ and ‘crack and creeps’ in our transformation journey. These days, customer expectation is convenience and customized products and services. We need to see if our solutions are aligned with the customer expectations and are consistent. As the adage says, ‘a stitch in time saves nine’, ability to identify and cater to customized needs and service will lead to long term relationship and retention. Only a mother understands the need of her child in depth. Likewise, the provision of convenience and customized solutions can be achieved through the ‘ACE Mother-Care model’ while embarking on retail digital transformation journey.

WHAT IS THE MODEL?

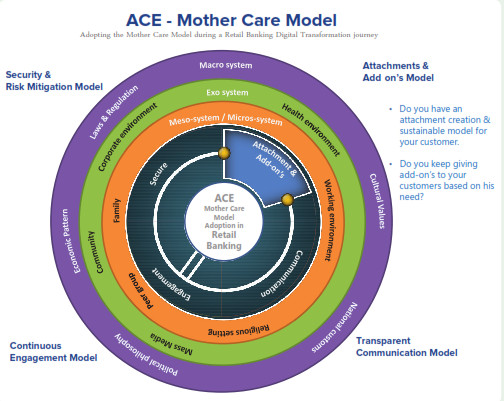

ACE Mother Care Model is based on the principle of Bronfenbrenner’s Ecological Model of Child Development. As a child is growing, he is attached to his family, classroom, friends’ group, religious settings, community, influence of media, healthcare environment, school system, community, cultural values, national customs, economic patterns, political philosophy’s and so on. For a child to grow in a balanced manner, the attaching chord for him is his mother. The mother has to hit a balance of all influence factors to shape her child a better citizen and affectionate to his parents and community.

The above model is adopted to define ACE Mother Care Model to further define various attaching frame work during retail banking digital transformation journey.

While defining our retail digital transformation, we need to understand our retail customer environment like family, work environment, peer group, religious settings, community, influence of media, healthcare environment, school system, community, cultural values, national customs, economic patterns, political philosophy’s and so on. By knowing these factors, we have to define an Attachment Model framework based on our customer segments.

In retail banking, customers are expecting convenience, customized products and services. Retail banking core is all about CASA, loans and cards, but the important factor is, while creating the ‘Attachment Model’ connected to a clear ‘Engagement Model’, we should ensure that the ‘addons’ to retail banking core stand out, providing an excellent customer experience while meeting their expectations.

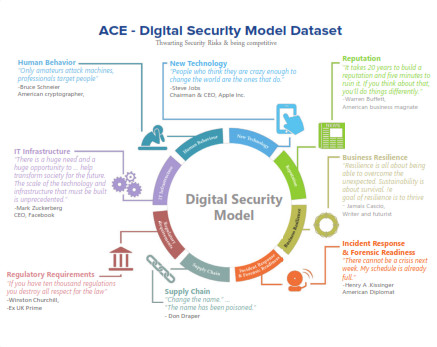

As we ensure the Attachment Model sustains long-term relationship with a well-connected Engagement Model through Addons, we need to ensure that the ‘Communication Model’ is chorded to the ‘Security Model’. The first three models (Attachment, Engagement and Communication) are the core of retail and is to be defined by retail experts in an analytical manner. The Security Model has to be defined by IT in consideration of customer experience on digital transformation journey.

By defining the above model, the core retail banking group can act like a mother to take care of their customers’ need by knowing them in depth, resulting in a better customer experience and retention.

– Dr Joseph George is head of Information Systems & Technology, National Bank of Fujairah PJSC. These are his personal views.