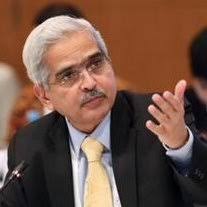

RBI governor Shaktikanta Das has announced the decision to reduce the fixed rate reverse repo rate under the liquidity adjustment facility (LAF) by 25 basis points from 4 to 3.75 % with immediate effect. The policy repo rate remains unchanged at 4.40 % and the marginal standing facility rate and the bank rate remain unchanged at 4.65 %.

RBI governor Shaktikanta Das has announced the decision to reduce the fixed rate reverse repo rate under the liquidity adjustment facility (LAF) by 25 basis points from 4 to 3.75 % with immediate effect. The policy repo rate remains unchanged at 4.40 % and the marginal standing facility rate and the bank rate remain unchanged at 4.65 %.

The RBI governor stated that India is among the handful of countries that are projected to cling on tenuously to positive growth (at 1.9 %). In fact, this is the highest growth rate among the G 20 economies. The World Trade Organization sees global merchandise trade contracting by as much as 13-32 % in 2020.

Turning to the status of banking operations since the nationwide lockdown was imposed by the central government on 25 March, the RBI has taken a number of steps to ensure normal business functioning by the entire banking sector. As a result, the payment infrastructure is running seamlessly. Banks have been required to put in place business continuity plans to operate from their disaster recovery (DR) sites and/or to identify alternate locations for critical operations so that there is no disruption in customer services. Das claimed: “RBI data shows that there was no downtime of internet or mobile banking. On an average, ATM operations stood at over 91 % of full capacity. The average availability of Business Correspondents (BCs) is over 80 %. Regional offices of the RBI have supplied fresh currency of Rs1.2 trillion from March1 till April 14, 2020 to currency chests across the country to meet increased demand for currency in the wake of the COVID-19 pandemic. Banks have risen to the occasion by refilling ATMs regularly, despite logistical challenges.”

In his statement of 27 March Das had indicated that together with the measures announced, the RBI’s liquidity injection was about 3.2 % of GDP since the February 2020 MPC meeting. Since then, surplus liquidity in the banking system has increased sharply in the wake of sustained government spending. Systemic liquidity surplus, as reflected in net absorptions under the LAF, averaged Rs4.36 trillion during the period March 27- April 14, 2020. As announced on March 27, the RBI undertook three auctions of targeted long term repo operations (TLTRO), injecting cumulatively Rs750.41 bn to ease liquidity constraints in the banking system and de-stress financial markets.

He said further: “Another TLTRO auction of Rs250 bn will be conducted today (April 17). In response to these auctions, financial conditions have eased considerably, as reflected in the spreads on money and bond market instruments. Moreover, activity in the corporate bond market has picked up appreciably, with several corporates making new issuances. There are also indications that redemption pressures faced by mutual funds have moderated.”

Against this backdrop and based on its continuing assessment of the macroeconomic situation and financial market conditions, RBI has proposed to take further measures to (i) maintain adequate liquidity in the system and its constituents in the face of COVID-19 related dislocations; (ii) facilitate and incentivise bank credit flows; (iii) ease financial stress; and (iv) enable the normal functioning of markets.

The RBI has undertaken measures to target liquidity provision to sectors and entities which are experiencing liquidity constraints and/or hindrances to market access. Long term repo operations (LTROs) to ensure adequate liquidity at the longer end of the yield curve, exemptions from the cash reserve ratio for the equivalent of incremental credit disbursed by banks as loans in certain select areas/segments and targeted LTROs or TLTROs fall in this class of sector-specific measures. It is, however, observed that the deployment of TLTRO funds so far has largely been to bonds issued by public sector entities and large corporates, especially in primary issuances. The disruptions caused by COVID-19 have, however, more severely impacted small and mid-sized corporates, including non-banking financial companies (NBFCs) and micro finance institutions (MFIs), in terms of access to liquidity.

The governor further said: “Accordingly, it has been decided to conduct targeted long-term repo operations (TLTRO 2.0) for an aggregate amount of Rs500 billion, to begin with, in tranches of appropriate sizes. The funds availed by banks under TLTRO 2.0 should be invested in investment grade bonds, commercial paper, and non-convertible debentures of NBFCs, with at least 50 % of the total amount availed going to small and midsized NBFCs and MFIs. The guidelines will spell out the details. These investments have to be made within one month of the availing of liquidity from the RBI. As in the case of TLTRO auctions conducted hitherto, investments made by banks under this facility will be classified as held to maturity (HTM) even in excess of 25 % of total investment permitted to be included in the HTM portfolio. Exposures under this facility will also not be reckoned under the large exposure framework. Notification for the first TLTRO 2.0 auction will be issued today.”

All India financial institutions (AIFIs) such as the National Bank for Agriculture and Rural Development (NABARD), the Small Industries Development Bank of India (SIDBI) and the National Housing Bank (NHB) play an important role in meeting the long-term funding requirements of agriculture and the rural sector, small industries, housing finance companies, NBFCs and MFIs. These All India Financial Institutions raise resources from the market through specified instruments allowed by the Reserve Bank, in addition to relying on their internal sources. Das added: “In view of the tightening of financial conditions in the wake of the COVID-19 pandemic, these institutions are facing difficulties in raising resources from the market. Accordingly, it has been decided to provide special refinance facilities for a total amount of Rs500 bn to NABARD, SIDBI and NHB to enable them to meet sectoral credit needs. This will comprise Rs250 bn to NABARD for refinancing regional rural banks (RRBs), cooperative banks and micro finance institutions (MFIs); Rs150 bn to SIDBI for on-lending/refinancing; and Rs100 bn to NHB for supporting housing finance companies (HFCs). Advances under this facility will be charged at the RBI’s policy repo rate at the time of availing.”

The surplus liquidity in the banking system has risen significantly in the wake of government spending and the various liquidity enhancing measures undertaken by the RBI. On April 15, the amount absorbed under reverse repo operations was Rs6.9 trillion. Das pointed out; “In order to encourage banks to deploy these surplus funds in investments and loans in productive sectors of the economy, it has been decided to reduce the fixed rate reverse repo rate under the liquidity adjustment facility (LAF) by 25 basis points from 4 to 3.75 % with immediate effect. The policy repo rate remains unchanged at 4.40 % and the marginal standing facility rate and the Bank Rate remain unchanged at 4.65 %.”

It has now been decided by RBI to increase the the ways and means advances (WMA) limit of states by 60 % over and above the level as on March 31, 2020 to provide greater comfort to the states for undertaking COVID-19 containment and mitigation efforts, and to plan their market borrowing programmes better. The increased limit will be available till September 30, 2020.

It has been decided that in respect of all accounts for which lending institutions decide to grant moratorium or deferment, and which were standard as on March 1, 2020, the 90-day NPA norm shall exclude the moratorium period, i.e., there would an asset classification standstill for all such accounts from March 1, 2020 to May 31, 2020. NBFCs, which are required to comply with Indian Accounting Standards (IndAS), may be guided by the guidelines duly approved by their boards and as per advisories of the Institute of Chartered Accountants of India (ICAI) in recognition of impairments. In other words, NBFCs have flexibility under the prescribed accounting standards to consider such relief to their borrowers. At the same time, we are cognizant of the risk build-up in banks’ balance sheets on account of firm-level stress and delays in recoveries. With the objective of ensuring that banks maintain sufficient buffers and remain adequately provisioned to meet future challenges, they will have to maintain higher provision of 10 % on all such accounts under the standstill, spread over two quarters, i.e., March, 2020 and June, 2020. These provisions can be adjusted later on against the provisioning requirements for actual slippages in such accounts.

Recognizing the challenges to resolution of stressed assets in the current volatile environment, it has been decided that the period for resolution plan shall be extended by 90 days. Details will be spelt out in the circular. Distribution of Dividend 20.It is imperative that banks conserve capital to retain their capacity to support the economy and absorb losses in an environment of heightened uncertainty. It has, therefore, been decided that in view of the COVID-19-related economic shock, scheduled commercial banks and cooperative banks shall not make any further dividend payouts from profits pertaining to the financial year ended March 31, 2020 until further instructions.

In order to ease the liquidity position at the level of individual institutions, the LCR requirement for Scheduled Commercial Banks is being brought down from 100 % to 80 % with immediate effect. The requirement shall be gradually restored back in two phases – 90 % by October 1, 2020 and 100 % by April 1, 2021.

In terms of the extant guidelines for banks, the date for commencement for commercial operations (DCCO) in respect of loans to commercial real estate projects delayed for reasons beyond the control of promoters can be extended by an additional one year, over and above the one-year extension permitted in normal course, without treating the same as restructuring. It has now been decided to extend a similar treatment to loans given by NBFCs to commercial real estate. This will provide relief to NBFCs as well as the real estate sector.

The RBI will monitor the evolving situation continuously and use all its instruments to address the daunting challenges posed by the pandemic. Mr Das expressed his deepest appreciation to doctors, healthcare and medical staff, police and law enforcement agencies, who are at the frontline and said that banks and financial institutions have risen to the occasion and have ensured normal functioning. Their efforts are praiseworthy.