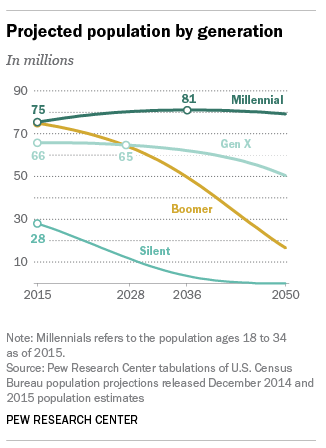

If you Google the word Millennial you will unsurprisingly discover around 133 million search results. Millennials – an indulgently demanding generation – would refuse to settle for anything less, even seldom settling down early in life, unlike their previous generations. They have truly arrived with their rising ambitions at the cost of failing business models, making them a spirited force to be reckoned with! Millennials overtook Baby Boomers in 2016 as America’s largest living generation. As is evident from the graph, the millennial generation is on a growth trajectory while the other older generations like Baby Boomers would drastically shrink in numbers in the years to come.

Globally, Ernst & Young (EY) further corroborated that Millennials would constitute 75% of the workforce by 2025. The writing is on the wall: Millennials are going to rule the world by 2025!

Whether you call them “entitled” or “skeptical”, when the world is going to be filled with Millennials, what would essentially matter is their attitude towards technology disruptions. What was untapped potential as a marketing opportunity would now drive the change they wish to see in the world. Disruptions are going to be shaped by all things Millennial. Banking is at the highest risk of disruption. We need to brace ourselves for a first-of-its-kind Millennial Banking Revolution!

Disrupt Banking – the Millennial Way

Let’s examine how banking would be radically disrupted when Millennials reign supreme. The world that we see come 2025 would be defined by what I’ve conceived as the DISRUPT model, quite literally standing for: D-Diverge, I-Individualize, S-Smarten, R-Reimagine, U-Unmake, P-Popularize, and T-Transform. Each of the “disruptive” elements in the model is meant to give a distinct flavor to the journey of Millennial Banking post 2025.

Divergent: Millennials are a divergent segment and don’t see uniformity from a single lens. They don’t care about brands: all that they’re excited about are unique experiences. Millennials would look to drive digital banking in an open banking ecosystem. Every product or service that is meant to carry the weight of a brand without an appealing experience would eventually be destroyed. The tech-savvy Millennial would look to introduce superior conversational systems for wealth advisory, branch and query assistance that will spell convenience like never before.

Notwithstanding the hype, today’s bots are a long way from providing such an experience. Research firm Forrester says, along with the nascent stage of conversational readiness found in today’s bots, banks need to first invest in foundational systems to integrate their disparate systems and re-engineer their back-end infrastructure. In the current state, banks cannot engage with customers of unique tastes with their conversational interfaces. Millennials would want to diverge from that reality.

Individualize: Millennials have unbridled energy, staying true to their vision of reinventing the way banking services would be delivered to consumers. Artificial Intelligence (AI) would come into the mainstream with intuitive self-service portals for new product discovery — targeting users based on individual preferences would be the foundation of the “Segment-of-One Marketing” that personalizes the experience for each unique customer.

Millennials suffer from password overload and would drive biometrics and other advanced identity recognition software for security and convenience. The Power of Individuality would be realized with one device that is connected across the real and virtual worlds, integrated across the IoT ecosystem for an immersive “phygital” experience. Millennials would want to keep the conversation going with their customers of unique tastes through evolved unified personas across all channels.

Smarten: Vernon Turner, Senior VP of Enterprise Systems at IDC, says by 2025 approximately 80 billion devices would be connected to the internet. Millennials want to make sense of the world around them. Alyson Clarke and Gina Fleming from Forrester have also reported that more than two-thirds of Millennials like to do their own research before making financial decisions. 6 Amplified social connectivity should pave the way for trust as a key factor to enable transactions. More than half of the Millennials share the love of in-person relationships in financial management. 7 I’ve spoken about the role of conversational systems earlier. However, this is only to augment the in-person experience, not to entirely replace it.

Canadian Bank Tangerine has already brought value with an alternative approach to branch banking: a “Café” with self-service kiosks, a children’s play area, and a coffee bar along with “Café Associates” for face-to-face discussions on finance for Millennials to manage their accounts. Millennials would seek to smarten the overall banking experience to facilitate the overall financial well-being of their customers.

Reimagine: We’ve conceptualized the 3A model to reimagine the nexus between technology and banking as we know it to create trusted relationships with Millennials. It’s the model of Authenticity, Accuracy and Agility. Authenticity is the integrity of the technology of the day to suit the needs of consumers. It’s what gives a persona to technology to conduct itself with the right amount of human-centricity to build contextualized engagement into consumer’s lives. Accuracy builds relevant and trustworthy information across all touchpoints. Agility drives decision-making in a way that allows an unparalleled synergy between business and interaction models.

While Augmented Reality (AR) and Virtual Reality (VR) continue to make great strides in experiential banking, the Millennial is on the constant look-out for Mixed Reality (MR) or Hybrid Reality that combines the best of both AR and VR to seamlessly navigate through the virtual and real environments. This could be the 4th wave of computing power, integrating all disruptive technologies like AI, Cloud, Wearables, Big Data and Sensors into the IoT ecosystem.

Unmake: The case of Citizens Bank shows how even with a solid digital strategy — simple design, intuitive UX, live chat — low conversion rates were still prevalent among Millennials due to a lack of timely contextualized engagement. They learnt the hard way that digital experience alone doesn’t cut it at an individual level unless moments of truth are identified and optimized. There are many such instances when business models need to be unmade as much as stereotypes about Millennials: overhyping the focus on only digital models of engagement without them having any relevance in a Millennial’s life.

I spoke about password overload that Millennials face in the “Individualize” phase. What should banks be doing to unmake such unpleasant experiences? Barclays offered voice security technology for identification based solely on voice: a “voice print” made up of over 100 characteristics shows how a pure voice interaction model can be an innovative approach to banking. While Capital One uses Amazon’s Alexa to help customers manage finances, UAE’s Mashreq Bank integrates with Apple’s Siri for voice-powered payments. Cumbersome experiences need to be unmade with disruptive technologies that are tightly integrated into the customer’s life.

Popularize: Millennials identify with unique notions of popularity that they see as rewarding. If it’s uppermost in the Millennial’s mind, absence doesn’t make the heart grow fonder. 73% of Millennials would be more excited about a new offering in financial services from Google, Amazon, Apple, PayPal or Square than their own nationwide bank. Nearly 8 out of 10 Millennials said they would switch accounts for better rewards. Millennials do not identify with popularity in the traditional sense which is why they are not attracted to incumbent banks but by the appealing nature of products and services offered by them.

Millennials would want to inspire customers just as they were inspired by Venmo’s model that challenged the status-quo. Venmo revolutionized the way money was being spent on campus creating unique experiences of leaving written commentary or an emoji after every transaction thus making it share-worthy. The world in 2025 will have many more advanced versions of Venmos that would make for shareable experiences. Unconventional branch banking experiences that push the envelope would also get popularized like Metro Bank’s “drive-thru” branches and Idea Bank’s mobile ATMs breaking down anything in the way of a cumbersome transaction.

Transform: Millennials are here to make a mark in this world. They’d want the dreams of their consumers realized at the click of a button without the hassle of navigating 50 odd irrelevant options. Millennials are an entrepreneurial force that wishes to be on top of their finances with Advanced Data Visualization and Machine Learning to transform the banking landscape. Newer transactional systems that offer both security and ease like bitcoins or blockchain would be the order of the day along with a Mixed Reality (MR) environment that I spoke about while reimagining the landscape. A transformative experience can go beyond banking to embed itself around the Millennial’s life.

When Singapore-based bank DBS launched an aquatic event, DBS Marina Regatta 2017 with high-octane thrills, it certainly knew how to go beyond banking and ride the experiential Millennial wave. They went big with the nation’s largest inflatable obstacle course, the largest interactive art dome, a 21,000 square foot “pop-up” beach, mass drone light displays, and a yoga workout session among the wide range of bay fest activities.

The DISRUPT model is indicative of the impending Millennial Banking Revolution. But are today’s banks thinking about their Millennial audiences with the attention they deserve? Do they have differentiated offerings to transform their engagements with Millennials?

How Can Banks Embrace the Millennial Banking Revolution?

While talking to Jeremy Balkin, the head of Innovation at HSBC and an award–winning author,on what gets him thinking on Millennials, he answers in his characteristic style that reflects the winds of change, “If you’re not thinking about Millennials, you’re not thinking!” Banks must go a step further and prioritize value-based engagements with Millennials.

The future would be driven by Open Banking. The Open Data Institute launched a global Open Banking Standard in 2016 to stimulate innovation and revolutionize customer engagement. When they are not in majority, we can afford to call a Millennial entitled, skeptical or demanding. When they become the only force that will DISRUPT business models, bankers would do well to ensure a smoother transition. Banking leaders should already be putting Millennials at the center of their value chains.

Banks today need a Millennial Banking Technology Framework that would enable them to:

- Prioritize disruptive technologies for experiential Millennial engagements in the open-banking ecosystem

- Manage value-added strategic partnerships within the fragmented Millennial Banking value chain of Solution Partners, Payment Providers, Service Partners, and Aggregators

Experiences are necessary for Millennials, banks are not! Banks need to realize this harsh reality along with the value the open-banking ecosystem offers — give themselves the best chance with the right springboard to make that timely jump on the Millennial Banking bandwagon. If one was living in Shakespeare’s age, one might have been tempted to say that the time for Millennial Banking action is nigh!

- Vishwas Anand is head of Content & Thought Leadership, Aspire Systems