Banking Frontiers carried out a survey to measure popularity of apps of NBFCs and mutual fund companies. The survey was based on the statistics available on Google Playstore.

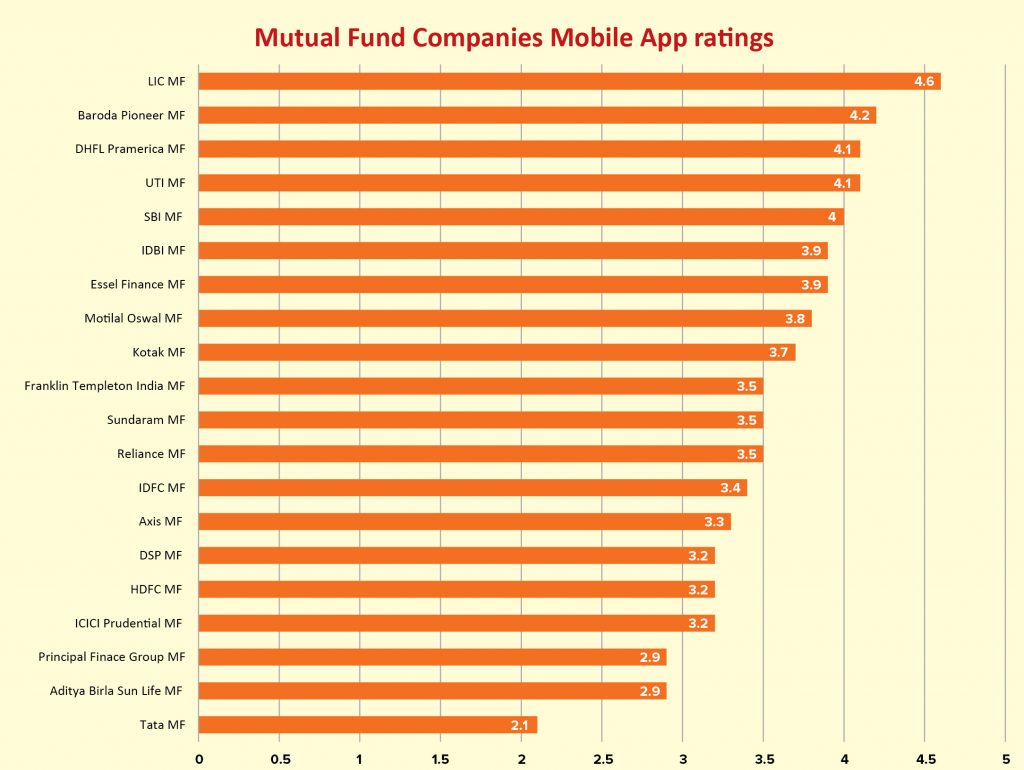

Highlights of the Mutual Fund app survey:

- The survey was based on 20 mutual fund companies in India

- LIC Mutual Fund’s app ‘LICMF Partner’ has the highest rating of 4.6

- SBI Mutual Fund’s ‘InvesTap’ has been reviewed by 12,418 customers

- 3.5 is the average rating for the mutual funds’ apps

- Around 50% of the mutual fund companies in India don’t have mobile apps

- Lack of marketing and promotion of the mutual fund apps observed in the survey

Common Positive Comments:

- User friendly

- Easy, helpful and instant

- Helps in managing portfolio

Common Negative Comments:

- Poor customer care service.

- Most customer not able to see their portfolio and investment.

- Customers face problems in login, registering, email verification, generating OTP, PAN Card updating, opening via finger-print, input date of birth during KYC and resetting of password

- Problems in design of the app

- Need to add wallet payment option like Airtel Money or Paytm

- Sensex value is not being updated regularly

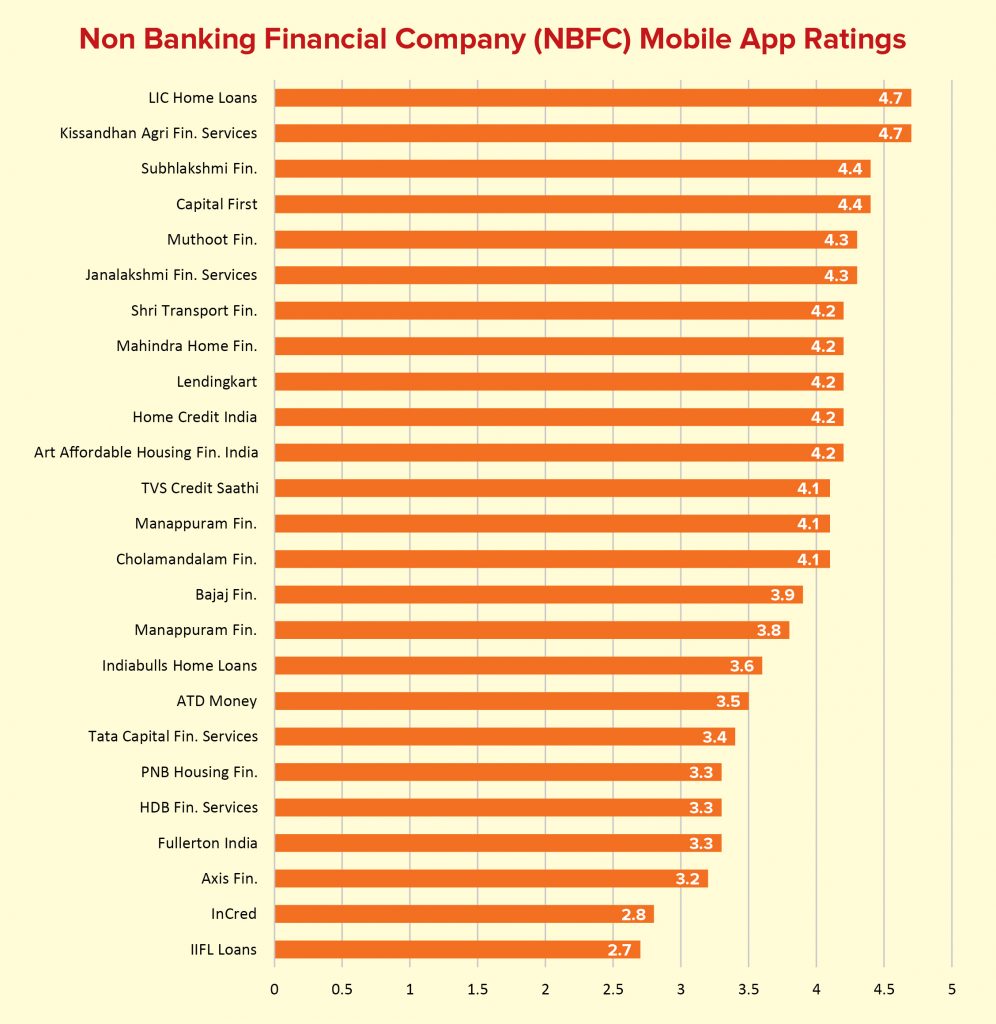

Highlights of the NBFC mobile app survey:

- The survey was based on 25 NBFCs in India.

- Bajaj Finance’s ‘Bajaj Finserv’ app has been reviewed by max- imum number of customers – 74,030

- LIC Home Loans’ Kissandhan Agri Financial Services has the highest rating 4.7

- 3.8 is the average rating for the NBFC apps in the study

- Only 40% of the leading NBFC companies in India have mobile app services for their customers

Common Positive Comments:

- Easy, useful & comfortable

- Good support from the company

- Faster loan process

Common Negative Comments:

- Bad customer service, there are no live chats for faster communication

- Login and sign-up problems

- Facing problems in updating the app

- It takes time to respond to loan applications

- No feedback about existing customer loans

Click to comment