NBFC-MFIs hold the largest share of portfolio in micro-credit with total loan outstanding of Rs688.68 bn, which is 36.8% of total micro-credit universe. As on 31 March 2019, aggregated gross loan portfolio (GLP) of NBFC-MFIs showed y/y growth of 47% in comparison to 31 March 2018 and 13% over the quarter ending 31 December 2018, according to Microfinance Institutions Network (MFIN).

In the microfinance universe, NBFC-MFIs’ share stands at 36.8%, banks contribute 32.6%, small finance banks (SFBs) have 18.5% share, whereas NBFCs’ share is 11% and non-profit MFIs account for 1.1%. As of 31 March 2019, the banks had a microfinance portfolio of Rs610.46 bn, depicting a growth of 36% over last one year while SFBs showed a growth of around 25%. The NBFCs witnessed the highest growth in portfolio of around 59% over the last year.

The entire microfinance industry has witnessed a growth of 38% over Q4 FY 17-18 with the GLP at Rs1873.86 billion as on 31 March 2019. As per ‘Micrometer’, MFIN’s publication, the total number of microfinance accounts is at 93.3 mn as on 31 March 2019, showing a growth of 21.9% over Q4 FY 17-18.

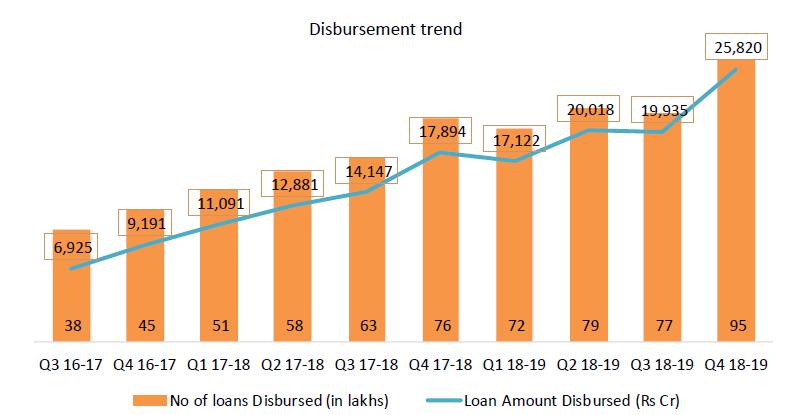

MFIN members constitute 53 NBFC-MFIs and collectively they have disbursed 32.5 mn loans during FY 18-19. Compared with financial year 17-18, there has been a y/y increase of 28% in number of loans disbursed and 44% in loan amount disbursed.