Enterprises, especially those in the financial services domain, are increasing adopting digital tools for their compliance needs:

Records management is a crucial function in digital compliance

Compliance is essentially the procedure of meeting pre-defined standards. Over a period of time, this procedure has become highly standardized ensuring that privacy and security of the data that is in use in an organization are ensured and the operations and business that it conducts are in terms of set rules and regulations. The standards that are adopted in ensuring compliance are typically designed to address the challenges of maintaining the privacy and security of the enterprise data assets.

With enterprises, especially those in the financial services domain, digitizing their processes and operations, compliance too is becoming digital in nature. Digital compliance is a way of using digital technology to ensure that an enterprise is meeting all legal and procedural obligations to relevant industry standards, laws and regulatory compliance frameworks from technology use, data handling and business functions angles.

MANDATORY & INTERNAL

The basic compliance measures that an enterprise requires to adopt to protect its sensitive data resources are one that is mandated based on the type of data that is being stored and processed, and two that which an enterprise adopts to implement measures to protect valuable information. Mandatory, or regulatory compliance is the domain of regulators. On the other hand, enterprises have to set internal standards to protect their intellectual property and valuable data assets. In many cases, these standards are designed to complement regulatory standards. The internal standards are used to control how data is used throughout the enterprise and ensure that only authorized personnel have access to sensitive information.

Enterprises that take up digital compliance have several challenges. These include the voluminous data that is constantly increasing as the operations grow, which becomes a challenge in integration and how compliance processes can be made applicable. At the same time, regulatory standards are evolving, which is a challenge for their effective implementation. Added to these is the current scenario of remote working and use of mobile devices for accessing data. There is also the question of fast-changing cybersecurity scenario with threat perceptions evolving and modifying in a quick manner.

INTEGRATION OF NEEDS

One of the key aspects of digital compliance is the integration of the requirements in an enterprise’s processes and procedures. There are several aspects to this onerous task:

- Real-time data monitoring. This is a crucial aspect in identifying and addressing potential non-compliance with regulatory or internal standards.

- Automation of repetitive manual processes where sensitive data is used. The question here is how to eliminate the possibility of human error.

- Instilling a high sense of security among employees, especially new recruits. It is important that they have the required tools for compliance.

In the compliance domain, digitization is the capability to handle repetitive tasks, eliminating the need for human intervention. Here, there are processes like workflow automation, audit trail, data analytics and ERP. The end result is an organized data source in terms of legal and compliance processes. In addition, there can be valuable insights that can be generated by correlating information across transactions, personal interactions and electronic communications.

ADHERENCE TO LAWS

What enterprises normally face in the complex and ever-changing regulatory landscape is the challenge of effectively managing compliances to ensure adherence to laws, regulations and industry standards. While digital tools have helped managing compliances to become more efficient and streamlined, there are also tangible benefits

For example, digital tools for compliance management enable enterprises to automate processes, streamline workflows and centralize compliance information. This results in improved efficiency. When notifications, reminders and reporting processes are automated, manual errors are reduced and timely compliance is achieved.

Compare this to a scenario where compliance relies on manual processes, making them cumbersome and more prone to errors, delays and oversight.

REALTIME INFORMATION

One crucial factor in digital compliance is the possibility of real-time monitoring and tracking. Enterprises can access real-time information regarding compliance requirements, deadlines and policy changes. They provide dashboards, alerts, and notifications that keep stakeholders updated and enable proactive actions. This also helps in timely identification of gaps and prompt remediation

Using digital tools, enterprises can easily create and maintain centralized repositories for documents, policies and procedures. These tools today have gained features like version control, audit trails and secure storage and they also facilitate streamlining of document retrieval

As enterprises have opted for cloud technology in a massive manner, cloud compliance is one crucial aspect of general compliance, specifically referring to adherence to regulations governing data stored in the cloud. Enterprises that have migrated to the cloud have regulations that govern data storage, security and privacy.

Digital tools offer efficiency, real-time monitoring, easier documentation process, scalability and improved collaboration in compliance management. Enterprises can today navigate the complex regulatory landscape with greater confidence, ensuring adherence to laws and regulations while optimizing operational efficiency.

IDEAL TOOLS

Newer tools in digital banking compliance

So, what are the ideal tools that help an enterprise, especially one in the financial services domain, to ensure their digital compliance processes?

First is integrated solutions Document Management Systems (DMS) and Legal Billing software. Then, there is Email Filing and Management systems that help in maintaining a thorough, searchable record of communications. Third is Records Management Systems. Still another important tool is information security tools to secure the stored information.

In addition, compliance managers today use technologies like AI, RPA and data analytics to protect the information and technology assets.

CRITICAL AREAS

As the financial services domain expands and diversifies, and the incidences of financial misconduct proliferate, compliance requirements and regulations too have become detailed and comprehensive. The major areas today are:

- Anti-Money Laundering (AML) provisions to safeguard financial systems from being used for money laundering and the funding of terrorist activities.

- Know Your Customer (KYC) regulations to verify the identity and risk profiles of customers and to monitor the identify and prevent potential risks.

- Data Privacy which mandates that enterprises strictly follow all state data privacy regulations ensuring methods in collecting, storing, sorting, processing and transferring personal data.

- Consumer protection as all financial firms are obligated to follow regulations that safeguard consumer rights and ensure complete transparency.

- Record-keeping where accurate and comprehensive records are created and stored, so they are able to demonstrate their adherence to government rules and industry standards.

DIGITAL COMPLIANCE TOOLS

Some of the tools and technologies that financial services institutions today use for compliance are:

- Compliance Management Software that helps the organizations centralize their compliance activities. They can track regulatory requirements, manage policies and procedures and monitor compliance controls from one dashboard.

- Regulatory Reporting Software, which prepares and submits regulatory reports automatically and seamlessly. These tools are accurate, reduce manual errors and save time in complying with reporting obligations.

- Risk Assessment Tools, which can identify and evaluate compliance risks within an organization.

- Data Analytics Platforms for use by compliance officials to detect anomalies, patterns and trends to indicate potential compliance issues.

- Communications Management Platforms, which automatically create records of all communication across platforms and devices.

While these tools are now standard, what is happening is the financial services domain is evolving at a fast pace. Take for example, the large-scale adoption of emerging technologies like blockchain, ML, Metaverse and RPA. Nevertheless, these technologies would provide scope for enhancing compliance processes and addressing evolving challenges.

To sum up, while businesses in general – financial services included – become more digitized, there will be challenges in safeguarding data privacy and security even as data collection and processing, adapting to rapidly changing regulations in the digital landscape and navigating a wide range of compliance requirements across different jurisdictions become routine.

Read more:

High cost of financial crime compliance affects quality CX

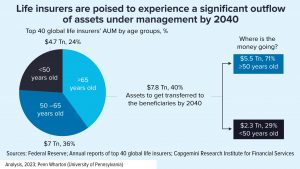

Capgemini: Life insurers facing serious wealth transfer to beneficiaries