A LexisNexis study evaluates the how higher costs of financial crime compliance landscape impacts delivering a better customer experience:

A recent study by Forrester Consulting for LexisNexis on financial services organizations streamlining internal operations and enhancing efficiency of financial crime compliance (FCC), has found that complex regulations and sanctions hinder financial institutions from delivering great customer experience. The study says the growing complexity of compliance regulations and ever-evolving criminal methodologies are a major difficulty for financial institutions and balancing the imperative of regulatory compliance with delivering an exceptional customer experience is a challenge that financial institutions must learn to navigate.

The global study, titled ‘True Cost of Financial Crime Compliance Study, 2023’, covered 1181 financial crime and compliance decision-makers in North America, Latin America, Europe, Middle East and Africa (EMEA), and Asia Pacific (APAC), aiming to assess the evolving complexities of the FCC landscape and how financial institutions are adapting.

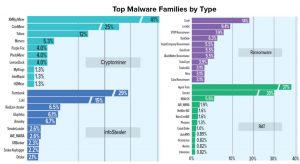

CRIMINAL USE OF TECH

The study also found that ‘criminal use of advanced technologies is soaring’ and more than half of survey respondents reported a significant increase in financial crimes involving digital payments, cryptocurrencies, and AI technologies. This trend, says the study, highlights the importance of adopting a multilayered approach that combines technology, expertise, collaboration and compliance to successfully combat new types of crime.

Stating that financial institutions are planning to transform FCC operations for efficiency and experience, the study said financial institutions are reevaluating their existing financial crime compliance processes and planning improvements to data quality, know your customer (KYC), internal compliance, anti-money laundering (AML), and transaction monitoring. “Coupled with anticipated benefits like enhanced collaboration, simplified products, and improved efficiencies, these changes are projected to transform the compliance landscape while promoting improved customer and employee experiences,” observed the study.

The study offers an insight into the worldwide financial cost of compliance, with financial institutions bearing a total cost of US$206.1 billion. “This cost,” says the study, “is comparable to more than 12% of global R&D expenditure and equates to $3.33 per month for each working-age individual on earth.”

USE OF AI, ML, DATA ANALYTICS

One key finding in the study is that while certain industries are still determining the ways in which AI and ML will bring about an influence, 71% of professionals in financial crime compliance indicate that their organizations are already enhancing data utilization through advanced analytics. Additionally, 72% confirmed that they employ analytics and AI to enhance their compliance procedures.

The study, however, cautions that similar to historic changes in ways of working, problems with data quality, data silos, outdated legacy systems and a lack of collaboration internally can create avoidable compliance activity and expenditure.

It has been established that financial institutions in EMEA and their customers continue to incur a more substantial expense for financial crime compliance compared to other regions. “The overall cost of financial crime compliance in EMEA surpasses that of the U.S./Canada by 39.8%. This difference is partly indicative of the escalating intricacy of compliance requirements,” says the study.

REGULATIONS CURB BIZ OPS

Globally, 78% of organizations and specifically 80% in EMEA indicate that the intricate network of regulations and sanctions acts as a constraint on their business operations, says the study and adds that in contrast, APAC and LATAM are comparatively more cost-effective regions, despite significant compliance expenditure. “The financial compliance expenses in APAC amount to 74.5% of those in the U.S./Canada, while LATAM’s costs are 24.7% in comparison,” it says.

The study revealed that CEOs, vice presidents and directors in financial institutions globally are not complacent, but many new initiatives add to the ongoing complexity they face in meeting financial crime compliance requirements. “However, 85% of financial institutions place enhancing customer experience at the top of their priority list. This reaffirms a commitment towards fostering trust and delivering satisfaction, even in the face of proliferating financial threats. A substantial emphasis of these efforts revolves around optimizing the efficiency and efficacy of financial crime compliance concerning payments. Globally, 74% of institutions emphasize that this is a critical or high-priority endeavor,” it says.

The study brings out what it calls a potent mix of forces propelling a surge in FCC costs over the past year. “Topping the list at 38% is the increasing burden of financial crime regulations, a testament to the ever-tightening regulatory environment. Simultaneously, the escalating demand for advanced automation, intricate data analytics and powerful tools drives cost escalation for 32% of respondents, underscoring the shifting technological landscape,” it says.

And lastly, it is the necessity for integration into digital channels and the requirements for comprehensive electronic KYC (eKYC) controls; 27% of respondents mentioned this as driving increased costs.

“These pivotal drivers highlight the complexity of the obstacles confronting today’s financial institutions and underscore the need to adopt a robust, agile strategy when navigating the labyrinth of financial crime compliance, adds the study.

Read more:

Fintechs facilitate small-ticket, unsecured lending

Ransomware detection declines, APT activity rises

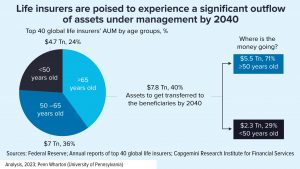

Capgemini: Life insurers facing serious wealth transfer to beneficiaries