Indian jewelry demand of 101.6t in Q3, 2019 was almost a third lower yoy due to weaker consumer sentiment. Jewelry demand suffered as consumer confidence fell further over concerns around the slowing economy, according to ‘Gold Demand Trends Q3 2019’ report, released by World gold Council.

Several indicators – such as lower sales volumes reported by large fast-moving consumer goods (FMCG) companies and domestic car/two-wheeler sales – pointed towards a slowdown in both urban and rural demand. Weak sentiment due to a liquidity crunch, excessive monsoon rains in some states and the absence of any festivals, also influenced demand in the quarter. Economic slowdown dampened urban and rural consumer sentiment in India. The impact on demand was muted as it coincided with pitru-paksha, an inauspicious 16 lunar day period during which Hindus pay homage to their ancestors. The gold price breached the Rs.35,000/10g level in mid-July and continued climbing to Rs.38,795/10g by the end of August, before reaching an all-time high of Rs.39,011/10g during the first week of September. Demand was further dented by a 2.5% rise in the custom duty to 12.5%.

Wedding-related purchases provided some support during the quarter. Wedding days in the southern states of Tamil Nadu, Kerala and Karnataka supported jewelry demand during August and September. But volumes were 15-20% lower yoy due to the higher gold price. Jewelry retailers attempted to counter this by offering promotions – such as discounts on labor charges – but with limited impact.

Jewelry demand in the world fell 16% to 460.9t in Q3, its lowest level since 2010, due to the higher price. Consumers deferred purchases due to higher prices and the subdued economic sentiment. Bright spots were few and far between, with most markets seeing significant yoy declines, particularly in Asia and the Middle East. US demand, however, continued to grow in Q3, up y-o-y for the eleventh consecutive quarter. Weak consumer sentiment – due to continued geopolitical and economic uncertainty – coupled with substantially higher gold prices dented jewelry purchase in all major markets.

BAR, COIN DEMAND

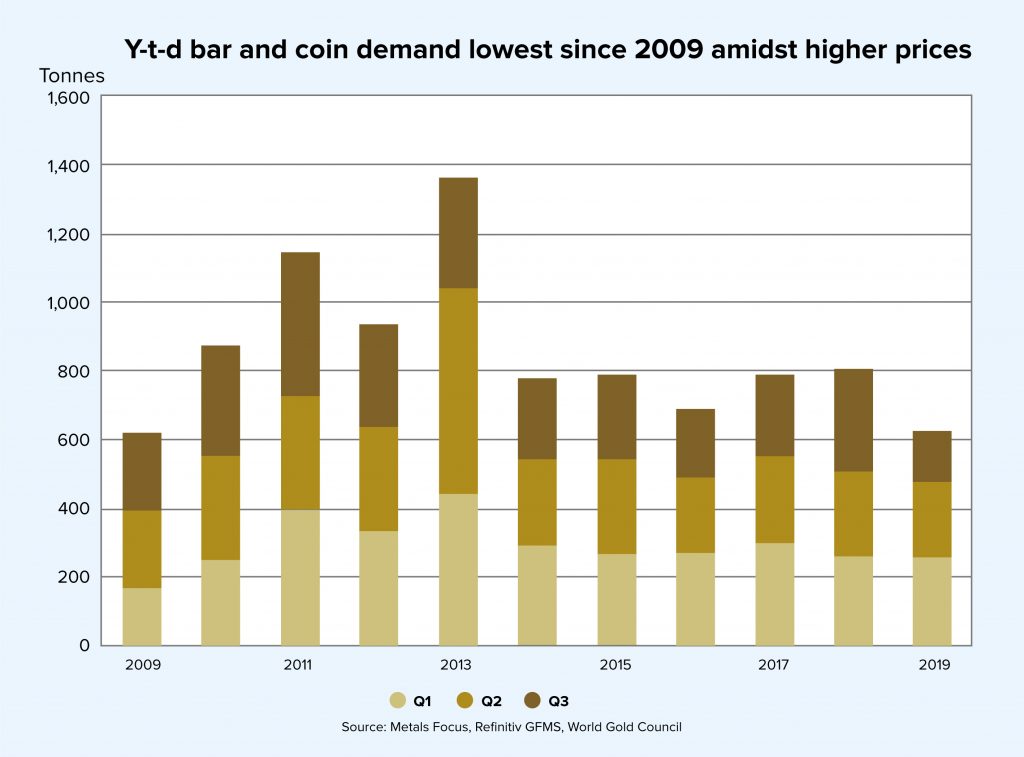

Global bar and coin demand halved yoy, dropping to 150.3t, its lowest quarterly level since Q1 2008. The y-t-d picture is similarly bleak: cumulative demand in the first 3 quarters was at its lowest level since 2009, according to the report of the World Gold Council. European bar and coin demand fell 38.9% in Q3. Y-t-d demand was 108.5t, the lowest level since 2008. A soaring gold price across multiple currencies has prompted retail investors in many markets to either wait in anticipation of a price dip or sell a portion of their holdings to realize profits. But the weakness in demand is not just price related. Households in some major gold markets, such as China and India, have had their incomes squeezed by a combination of rising inflation and slowing economic growth. Demand in the US was down 2.9t yoy, but there were signs of improvement. Turkey was unique in Q3 – it was the only market where retail investment grew yoy. Demand rose 45% to 6.7t.

Indian bar and coin demand slumped to its lowest level since Q1 2009. The already high gold price surged even higher in Q3 to reach Rs.39,011/10g which, coupled with a faltering economy, pushed retail investment down to 22.3t, a fall of 35% yoy. Despite the rapid uptick in the gold price there was limited net selling, with dealers reporting that many investors were holding on to their bars and coins in the expectation of further prices rises.

Gold demand in India faces increasingly competitive threats from other mainstream investment opportunities. Retail investors’ attention has been captured by equities.

China’s bar and coin demand fell 51% to 42.8t, its lowest level in three years, as the domestic gold price hit a multi-year high. Thailand, South East Asia’s largest gold market, experienced a rare quarter of net disinvestment in Q3 – its first in ten years.

——