Side-pocketing – the word is echoing nowadays in fixed income funds as well as their investors’ ears. The IL&FS rout has made the term famous among the investors’ fraternity. The downgrade rating of the firm made many fund houses to bring down their investments in the firm to lower values and for some to even zero. Taking the echoing into account, SEBI has recently allowed the concept of side-pocketing to safeguard the interest of the investors. It would be great to see how the concept works, but before that let’s understand the term.

Side-pocketing – the word is echoing nowadays in fixed income funds as well as their investors’ ears. The IL&FS rout has made the term famous among the investors’ fraternity. The downgrade rating of the firm made many fund houses to bring down their investments in the firm to lower values and for some to even zero. Taking the echoing into account, SEBI has recently allowed the concept of side-pocketing to safeguard the interest of the investors. It would be great to see how the concept works, but before that let’s understand the term.

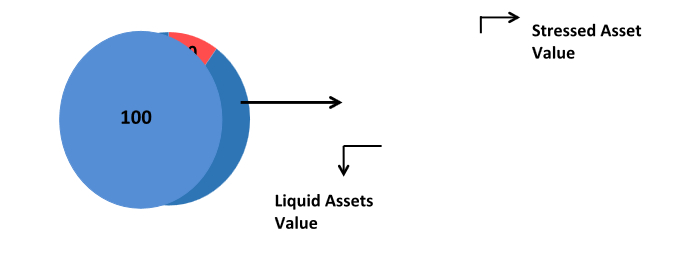

Side-pocketing is an accounting term to segregate illiquid assets from liquid ones. In simple terms, when a bond suffers from credit risk, the fund houses which have invested in that bond, segregate its value from the total NAV of the fund and keep it aside for the existing investor while the remaining portion would do as usual. When the fund realizes the money from that stressed bond, the amount then gets distributed among the investors, who had invested when the side-pocketing was done. The process enables an investor to get the complete value of his investment which could not be possible without side-pocketing. The process made the investment liquid and illiquid at the same time – liquid for the normal units which the investors can sell without having the fear to lose its investment portion on the stressed assets and illiquid, as the investor is deprived to sell the downgraded asset portion.

Examples: If a fund’s NAV is 100 and one bond has some credit issues the fund house segregates the portion of that stressed assets valuing 10 from its total value. Now, 90 will be treated as usual but the rest 10 will be taken aside.

How does it affect the fund houses?

- It is easy to monitor the stressed part. Taking the stressed assets in another pool would make it easy to monitor them. Segregating the illiquid asset from the liquid ones would help the fund houses to concentrate on their different investments with right approach resulting in better performance of the fund.

- Putting aside the non-performing illiquid asset from the good investments will help fund houses not to contaminate their funds’ returns and show poor performance. Side-pocketing provides stability to good quality investments as it prevents the illiquid assets to chew out the return from the performing assets.

- The biggest challenge in side-pocketing is to evaluate the stressed asset value in the current NAV as the value of the illiquid asset is a theoretical matter. It is possible that one method works in one situation but not in others. It would be hard to come up with the exact NAV of the stressed as well as the liquid assets. The hardened work would certainly increase the complexities for the fund houses.

- It may encourage aggressive bets. Side-pocketing is allowed to safeguard investors, but if the fund manager takes it to cover a fund’s high return, but low-value investments, it could be a disaster. The fund manager could be encouraged by risky bets and when the risk materialises, he may hive off the downgraded low-quality asset by side-pocketing.

How does it help investors?

- The side-pocketing concept has come into effect to ‘un-able’ the new entrant investor to get undue advantage from the earlier investor’s investments. Side pocketing enables the investor to sell his liquid investment as it is not required to stay invested in the funds till the stressed asset’s value materializes. If there would be any realization from the segregated illiquid assets, the amount would eventually be paid to the investors, even if he sells the liquid asset investment. Side- pocketing has made the investment liquid even if the downgrading happens to the invested bonds.

- Side-pocketing process puts the illiquid asset value aside of the fund, which after the realization would be reimbursed to the original unit holders. Earlier, investors, at the time of any delinquency, would be eager to sell their investment as they want to sell their portion at higher NAVs. But now, when the illiquid asset portion kept aside for those investors realization only, the eagerness and anxiety to make the exit out of the fund would come down and would result in a long and relaxed investment.

- Side-pocketing has made the evaluation of the investment realization hard. While the liquid asset investment is easy to evaluate on the basis of NAV, the value of the illiquid assets would be hard to calculate. The value can be known only after the realization happen for the bonds and the investor would be scratching his head to value till the asset realization happens.

- Side-pocketing unintentionally resulted in the restriction as the investors would be denied to sell their stressed asset part. The process thus kills the advantage ‘Liquidity’ from the fixed income investment. When the illiquid portion is segregated from the liquid assets then the investors, who are invested at the time of the process, are eligible for the realization and nobody else, which puts the restriction on the redemption from the side-pocket until the realization of the asset.

While the effects of the term are different for different persons, SEBI ensures that effective measures would be taken to safeguard the interest of the investors. SEBI chairman Ajay Tyagi said, “Enough steps will be taken, and safeguards will be put in by SEBI to ensure that this facility is not misused.”

All things considered, allowing this concept would eventually result in the safety and smooth function of the fund where the investors would be saved from the undue panic and fund house will be prevented from getting undue advantage.

Abhinav Angirish is founder, InvestOnline.in