Banks on e-Meets, digitalized land records and post COVID schemes:

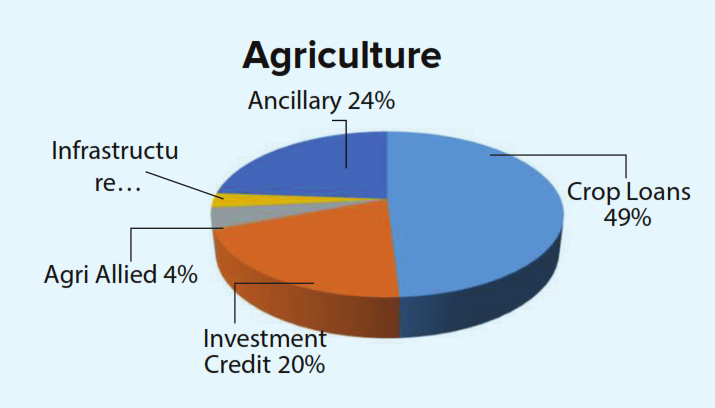

Bank of Maharashtra has provided total agriculture advances (AA) of Rs143.85 billion during the year ended 31 March 2020. A spokesperson for the bank said the total amount of AA as of 30 June 2020 has increased by Rs4.96 billion and stood at 17.30% of ANBC. The AA has shown yoy negative growth of 4.86%, which is mainly due to farm loan waiver scheme, he added. The percentage of agri infra to total agri has remained at 3%, but within that percentage of KCC/STL/other CC and percentage of KCC came down qoq by 1% each, and percentage of investment credit is unchanged at 36%, the spokesperson revealed.

MANGO, GRAPE GROWERS

The bank leads in financing growers of mango and grapes. The total outstanding credit for mango farmers in Maharashtra stood at Rs1.84 billion as of 31 March 2020 under 3773 loan accounts, which reduced slightly to Rs 1.72 billion as of 30 June 2020.” Mango farmers of Ratnagiri district lead in outstanding credit, with 2407 loan accounts, amounting to Rs1.24 billion as of 30 June 2020, followed by Sindhudurg district (Rs346.15 million) and Raigad (Rs50.46 million).

The total outstanding credit for grapes growers in the state stands at Rs7.74 billion, with 16051 loan accounts as of 30 June 2020. Nasik district leads in outstanding credit in this category with Rs5.19 billion, followed by Solapur (Rs762.48 million), Sangli (Rs497.71 million), Pune (Rs475.82 million), and Osmanabad (Rs313.19 million).

INITIATIVES, CAMPAIGNS

The bank is, however, hopeful of achieving mandatory target of 18% of ANBC on quarterly average basis for the current financial year. It is providing immediate credit assistance in the form of MKCC or term loan to all eligible borrowers benefited under MJPSKY 2019. It has designed special covid products for farmers, SHGs and agri-based industries. The bank has a focus on central sector scheme of financing facility under the Agri Infrastructure Fund of the central government. It has launched Special KCC saturation campaign for agriculture, animal husbandry and fisheries as well as agri gold loan campaign during June-July for hassle-free credit disbursement to needy farmers.

During Rabi 2020 season, the bank has evolved strategies for fund disbursement and is organizing credit camps, especially village level credit camps. Credit camps are planned for investment credit during October-November 2020 and January-February 2021. There will also be credit camps for agri gold loans. The banking is giving thrust to investment credit, big ticket size proposals under agro & food processing sector, cold storages, rural godowns, input suppliers, agri clinic, and agri business centers, and focus on financing SHGs.

SHG & JLG

The bank is lending to SHGs and JLGs on a top priority basis with the aim of uplift of women through SHGs and rural poor including landless labourers and Bhoomihin Kisans through JLGs. It has offered credit to 16,962 women SHGs under DAY-NRLM scheme during the last financial year and 4176 women SHGs during the first quarter of current financial year.

KISAN E-MEETS

The bank has introduced Covid-19 Mahabank Kisan Rahat Yojana for farmers and agro-based industries/units as well as Mahabank SHG Rahat Yojana-Covid-19. It has sent SMS to all eligible borrowers in local regional languages. The bank has also extended RBI relief package by way of moratorium of 3 months on payment of installments and deferment of interest on working capital facilities to eligible standard agriculture loans as of 29 February 2020. The bank has also entered into a MoU with the government of Maharashtra for digitization of land records and the bank branches are facilitated / enabled for digitalized verification and downloading of land records.

NPA: RISK MITIGATION

The share of the bank’s agri NPAs to total NPAs as of 31 March 2020 is nearly 30%. It is paying special attention to select zones/ branches having high NPAs (>15%) and arranging recovery camps at regular intervals. It is also allotting NPA accounts among staff, recovery agents, BCs, etc for effective recovery efforts besides implementation of OTS schemes.

TARGETS FOR 2020-21

The bank has set a target of yoy growth of 19% under agricultural advances in the current financial year. It is strengthening agri investment credit & KCC, organizing credit camps for KCC as well as investment credit, special attention on top 25 potential branches for increasing agri credit and implementation of area-based schemes (eg rice mills, cotton ginning, dal mill, cold storage, rural godown, etc). It is focusing on agri potential zones across India and agri gold loan scheme, financing SHGs for agri activities and agri exporters in select zones like Nasik, Pune, Ahmednagar, etc.