Chandra Shekhar Ghosh, MD & CEO, Bandhan Bank, explains how the bank achieved growth in the midst of economic slowdown and NBFC crisis

Chandra Shekhar Ghosh,

MD & CEO, Bandhan Bank

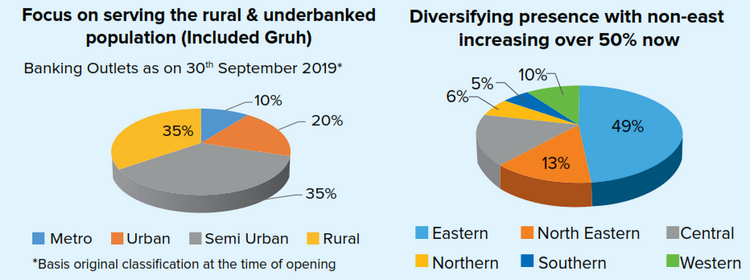

Bandhan Bank offers world class banking products and services to its urban, semi urban and rural customers alike. Though it is a bank for all, its focus remains unchanged – meeting the financial needs of the people who are overlooked by the formal banking system.

The bank started with 501 branches, 50 ATMs and 2022 door-step service centres (DSCs) on day one of its formal launch – 23 August 2015. By 31 December 2019, it registered its presence at 34 of the 36 states and union territories in India and now has 4288 banking outlets, 1009 branches, 3084 DSCs, 195 GRUH centres and 485 ATMs.

BROADENED CUSTOMER BASE

Today, the bank serves over 19 million customers. The number of customers has shot up from 13 million during Q4 2017-18 to 17 million during Q4 2018-19 and finally touching 19 million as of Q3 2019-20. According to Chandra Shekhar Ghosh, MD and CEO of the bank, one key reason in the growth in customers is the expansion in banking outlets. “From 3700 banking outlets in Q4 2017-18 to 4288 in Q3 19-20, we have expanded our footprint, and this has helped gain more traction in acquisition on the ground. We added 730,000 customers just during the third quarter of the current financial year. We have 14.56 million customers for micro banking, 4.17 million for non-micro banking and 270,000 for GRUH finance,” says Ghosh.

Another reason for the increase in customer base is the growing awareness about the bank. It has been in business as universal bank for more than 4 years and Ghosh says during this time, increasing number of people have come to know about the bank, both from deposit and advances points of view. A third factor that led to increase in the number of customers is the acquisition drives that the branches do in their catchment areas. Finally, he says, the acquisition of GRUH Finance brought in that firm’s customers into the books of the bank, thus pushing up the customer base.

Strong Growth

With the NBFC crisis and the economic slowdown impacting more and more sectors and customer segments, has the business of the bank been impacted?

Apparently not. In fact, the bank’s Q3 2019-20 net profit jumped 120.85% to Rs7.31 billion on yoy basis and loan portfolio by 88.87% to Rs654.56 billion. Says Ghosh: “We expect our business trend to continue as it has been for the last few years. With regard to the NBFC crisis, our advantage as a bank is that we have public deposits that help us get low cost funds. At the same time, we are well capitalized. While there has been a crisis among NBFCs, our numbers suggest there is no impact on our businesses. Also, the NBFC crisis has seen some improvement off late and we expect it to normalize in due course. We continue to lend to NBFCs and NBFC MFIs after due diligence of their operating model and books.”

While much has been spoken about slowdown in urban centres, Ghosh is of the view that this is not so in the rural and semi-urban India. Says he: “In our experience, there is no impact of any slowdown. Our customers are continuing with their business as usual and our books are seeing no adverse impact. In all the discussions that our staff have with customers on a daily basis, there doesn’t seem to be a slowdown in the economy at the grassroots.”

During the last quarter, the bank has made additional provision of Rs2 billion on standard advances in the microfinance portfolio after evaluating the risks observed in certain areas of a north eastern state, even though these risks have been dwindling. Says Ghosh: “The 3rd quarter has seen strong growth on advances and deposits. In fact, deposit growth has been the highest over the last 4 quarters. I am positive and confident on the business and growth going forward. The Q32019-20 has been a satisfying quarter given the challenges faced during the quarter.”