It is the largest RRB in Andhra Pradesh:

The Andhra Pragathi Grameena Bank, sponsored by Syndicate Bank, came into existence on 1 June 2006 by way of merger of 3 RRBs – Rayalaseema Grameena Bank, Sree Anantha Grameena Bank and Pinakini Grameena Bank. The bank is headquartered in Kadapa and its operations span 5 contiguous districts of Ananthapuramu, Kadapa, Kurnool, Nellore and Prakasam, with a distinct socio-cultural heritage of Andhra Pradesh. Says A. Venkata Reddy, chairman: “We are now functioning with a network of 545 branches and 8 regional offices. We have added 15 branches in 2017-18. There are 322 rural, 142 semi-urban and 81 urban branches. Two mobile ATMs were introduced during 2017-18. Of the 90 onsite ATMs, 33 are in rural, 31 in semi-urban and 26 in urban branches. Nearly 44% branches (1229) of all 4 RRBs are located in Andhra Pradesh.”

Increasing Customer Base

Andhra Pragathi Grameena Bank is the largest RRB in the state in terms of branch network. It has more than 65 lakh customers. As of Q3, 2017-18 its customer base increased to 6573,178, registering 7.01% yoy growth. Various strategies are being adopted to increase the customer base of the bank. Reddy says the bank targets the young generation customers by highlighting and canvassing the services, products and latest IT initiatives. “We promote ‘one family – one bank’ concept through the ‘Palle Pragathi Sadassu’ (village development meets). We utilize every Wednesday for customer contact program by visiting one village by all the staff of the branch. This is intended to create financial literacy among the prospective clientele and awareness about the schemes of advances. We ensure presence of successful beneficiaries, who have availed loan from the bank, deposit products and other services. We organize road shows as well as door-to-door campaigns, reaching the unreached by way of handouts, posters, scrolling in electronic media, audio publicity, advertisement in local print media etc.”

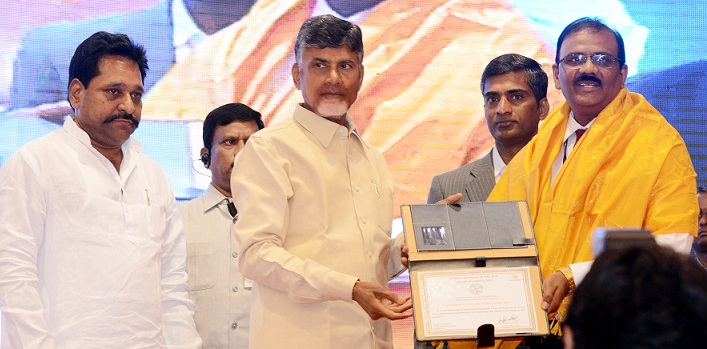

Chairman receiving award from Sri Chandra Babu Naidu, CM of AP for financing and growth in MSME sector

Reddy adds that the bank has also been preparing the branch-wise list of potential and prospective depositors and making every effort to reach out to them by personal contact, letters, etc. It has also initiated steps to recognize the valued customers by honouring them for their contributions at the customer meets. The bank has been providing doorstep banking services in villages using some 985 BCs – the highest number for an RRB.

Business in Q4 Up

As of Q3, 2017-18, the bank’s deposits grew to Rs12,321 crore, registering a sluggish yoy growth of 4.8% and advances grew to Rs11,535 crore, (up 24.25%). Total outstanding agriculture loans rose by 25% to Rs9278 crore, MSME loans shot up by 37% to Rs1018 crore and other priority sector loans amounted to Rs240 crore, with 18% yoy growth. Q3 of 2016-17 had a windfall accretion of deposits in view of demonetization and in subsequent quarters the same has seen gradual withdrawal that resulted in decline in deposits. Says Reddy: “Coupled with the seasonal withdrawals for meeting farm operations, the deposit growth is sluggish. However, we are hopeful of improvement in the last quarter in our deposits as it coincides with sale of farm produce and our thrust on deposit mobilization. The total business of the bank as on 3 March 2018 crossed Rs24,145 crore.”

The bank has shown impressive performance under advances in all the quarters, its core strength being agricultural advances and other priority sector advances. Reddy says the strategy is to cover all the farmers with bank credit in all the villages serviced by the bank and diversify the loan book for home loans, MSME and other retail sectors, which has given good results. Housing loan products were changed from age-wise to quantum-wise and special campaign was conducted with attractive rate of interest. The bank has also entered into MoUs with NGOs for promotion of JLGs.

The bank has introduced a new loan scheme called SHE (Self Help Entrepreneur) for empowering matured women SHGs by financing collateral free loan up to Rs 20 lakh for establishing manufacturing and servicing units. It has also launched special schemes like Pragathi Dhanalakshmi and Pragathi Kalpanidhi, offering better interest rates to mobilize deposits. Caller tunes for various loan products have been activated for the mobiles of all branch managers and officers. Training programs for them at various centers are organized on housing finance in coordination with National Housing Bank.

NPA & Recovery

The bank’s NPAs have declined from Rs279.05 crore as on 30 June 2017 to Rs252.86 crore as on 31 December 2017. Borrowers’ lists were provided to BCs in Telugu for their convenience. One time settlement (OTS) camps are organized in at least 2 places in each region every month with wide publicity so as to mobilize maximum number of proposals. Recovery positions of high value top 100 NPA accounts are reviewed by the chairman.

HR, Training Plans

The bank proposes to recruit 2123 people during the period ending 2020-21. “For the next 3 years, we propose to recruit 31, 38 and 45 people each year in officer scale III, 174, 213 and 260 in officer scale I, 136, 166 and 201 in officer scale I as well as 238, 291 and 330 office assistants (multipurpose),” says Reddy.

The bank has attached utmost importance for capacity building of the staff members on various subjects to improve their skills for effective discharge of duties. The bank runs its own training institutes – Andhra Pragathi Institute of Bank Management (APIBM) – at Anantapur and Kadapa. The bank is taking full advantage of the seats allocated to the RRBs by different external training institutes including sponsor bank training institute, ie, SIBM-Manipal, IDRBT-Hyderabad, BIRD-Lucknow, NIRB-Bangalore, BIRD-Mangalore, CAB-Pune etc, and nominating the officers for specialized training programs like leadership development, management development, asset liability management, labor laws, project appraisal and finance, advanced credit management, priority sector lending, etc. Special customized offsite training programs are also arranged with the help off CAB-Pune.

Reddy says 80 internal and external training programs, involving 1449 officers and 209 assistants, have been conducted from 1 April 2017 till date.””

CCTV Surveillance

A .Venkata Reddy, Chairman receiving ASSOCHAM 13th Annual Social Banking Excellence Award on 17.02.2018 from Siva Prathap Shukla, Union Minister of State for Finance.

The bank has put in place security policy to take care of all the bank’s assets, properties, manpower and also customers while transacting the business. All the branches and ATMs are under CCTV camera surveillance with 60 days back-up. Fire extinguishers, burglary alarm with SMS alerts and remote control are provided in all the branches. Strong rooms are AA class. Head office sends SMS messages alerting the branches for ensuring security measures before 2 or more consecutive holidays.

All ATMs are provided with marketing posters where bank deposit products and loan products are displayed with multi lingual screens. One officer is specially assigned to all the ATM branches for guidance in all the issues and all the branch staff are well trained periodically.

Targets, Expansion Plans

The targets of the bank for 2017-18 include taking deposits to Rs13,172 crore, advances to Rs11,376 crore, gross NPAs to Rs300 crore, CD ratio to 86.37% and CASA to Rs4903 crore. In fact, some of the parameters like advances, sub targets under agriculture and priority sector advances and CD ratio have already met the targeted level.

Reddy claims the bank would cross the net profit of Rs200 crore mark comfortably as it has posted a net profit of Rs167 crore up to December 2017. The improved performance under interest, non-interest and income on investments has enabled the bank to post better operational and net profit.

The bank is identifying the unbanked and under banked areas. As many as 15 new branches have already been opened as of Q3. Reddy adds: “Another 15 new branches are planned to be opened by the end of 2017-18. Our endeavor is to fine tune our liabilities and assets products from time to time to maintain competitive edge and customer acceptance.”