As insurance penetration sees a spike post-pandemic, over 80% of the insurers prefer a physical copy of their insurance document, according to a recent survey by Bombay Master Printers Association (BMPA). However, only less than half of the purchasers received a physical copy of their insurance from the companies, increasing uncertainty around receiving claims among the buyers.

As insurance penetration sees a spike post-pandemic, over 80% of the insurers prefer a physical copy of their insurance document, according to a recent survey by Bombay Master Printers Association (BMPA). However, only less than half of the purchasers received a physical copy of their insurance from the companies, increasing uncertainty around receiving claims among the buyers.

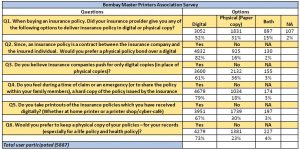

Nearly 82% of the buyers preferred a physical copy over the digital, according to the findings of the survey based on around 5900 responses spread across age groups and regions.

The policy certificate contains critical details of the insurance cover laying out the benefits, terms, and conditions, the procedure to file for a claim if needed, and the contact details of the insurer. Close to 80% of the survey participants feel that during the time of the claim or an emergency, a hard copy of the policy issued by the insurance company would be preferable.

About 56% of the respondents were in the age group of 18-40 years, 28% in the 41-60 years and 14% of the respondents were 60 years and above.

Incidentally, while several insurance companies decided to go green by either discarding the physical copies of insurance policies completely or making it optional, even before the pandemic, many insurers believe that the same insurance companies ask them for a physical copy while claiming for the policy amount. The companies not only ask for the physical copy of the insurance policy but also other necessary documents.

Over 60% of the survey respondents felt that the insurance companies push for only digital copies, instead of physical copies. 67% of the participants said that they take a printout of the policy from a cyber cafe printer, a printer shop, or home, to be on a safer side.

As per regulation 4 of IRDAI Regulations, 2016, an insurer has to issue both physical and electronic insurance certificates to policyholders. However, as an interim measure in view of the covid pandemic, IRDAI had allowed insurers to issue only electronic policy documents and exempted them from the requirement of sending insurance policies in physical form till March 31, 2022, following 2 extensions.

About 73% of the survey participants believed that it was better to have a physical copy of the document for records, especially in the case of life and health insurance.