Doorstep banking services has given a boost to phygital services. The service is delivered through 100 centers identified by IBA as part of EASE reforms agenda of 12 public sector banks:

Atul Kumar Goel indicates that it is encouraging to have more than 200,000 registered customers in the first 3 months of launch

Public sector banks have come together to launch Doorstep banking services after Finance Minister Nirmala Sitharaman inaugurated the novel initiative recently. UCO Bank is the anchor bank for implementation of these services, envisaged under the ‘EASE’, or Enhanced Access and Service Excellence, agenda of the Government of India for customer convenience. Bank of India is the front runner among all other PSU banks in this project. Atul Kumar Goel, MD & CEO, UCO Bank, D S Shekhawat, General Manager, General Operation Department, Bank of India and K. Kalyani, General Manager, Canara Bank, describes the actual delivery of these services to the end-users:

Mehul Dani: Which are the special services being offered under doorstep banking, which otherwise have not been provided earlier? 200,000 customers in 3 months

Atul Kumar Goel: Doorstep banking service is a facility being offered by public sector banks in India in accordance with the guidelines of the Reserve Bank of India. All the public sector banks have jointly come together under the PSB Alliance-Doorstep Banking Services to offer doorstep banking services to all types of individual customers regardless of their age or any other qualifying standards. Services are being rendered through doorstep banking agents engaged for this purpose. Banks are providing 10 non-financial services along with financial services, submission of life certificate etc

Doorstep banking is unique in a way that it covers almost all regularly used services ranging from DD/ PO collection, gift card collection, TD receipt collection, 15 G/ 15 H submission, tax challan submission, new chequebook request submission, etc. Some more services, based on customer feedback, are in the process of being added to the bouquet of services.

D S Shekhawat reveals that doorstep banking services will continue even after the pandemic ends

D S Shekhawat: Bank of India is at present rendering all non-financial services under doorstep banking. Cash withdrawal under financial services has started from 16 October 2020 and the digital life certificate facility has started from 1 November 2020.

K Kalyani: Banks are providing a number of services, including cash withdrawal (through AePS as well as card +PIN). Cash deposit is under process and should go live very shortly. The minimum and maximum per transaction limit is fixed as Rs1000 and Rs10,000 respectively for cash withdrawal and cash deposit.

What are the multiple inter-operable channels for customers? Which electronic, digital devices are deployed under doorstep banking?

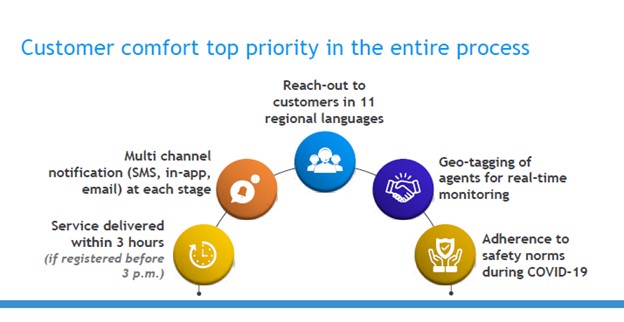

Atul Kumar Goel: Doorstep Banking services are designed and developed to be an omni-channel platform for customer of all public sector banks. Customers of any of the 12 public sector banks can avail the service through any of the channels -. mobile app, web portal or call center. In true sense, the services are channel agnostic and interoperable as it gives freedom to the customers to use any of the medium available – be it smart phone (app), laptop/ desktop (web portal), or base phone/ form factor phones (call center). For the purpose of financial service, micro-ATM based real time interoperable services using Aadhaar enabled payment system / debit card, are being provided to the customers.

D S Shekhawat: Bank of India has taken many innovative steps to popularize doorstep banking services, which includes SMS and e-mail to all eligible customers, Facebook posts, Twitter handler and activated field functionaries who provide details through video conference and interaction with senior citizen and Divyang persons. Apart from these, we are displaying banners in our branches and distribute pamphlets in the vicinity of branch premises.

D S Shekhawat: Bank of India has taken many innovative steps to popularize doorstep banking services, which includes SMS and e-mail to all eligible customers, Facebook posts, Twitter handler and activated field functionaries who provide details through video conference and interaction with senior citizen and Divyang persons. Apart from these, we are displaying banners in our branches and distribute pamphlets in the vicinity of branch premises.

Customers can avail doorstep banking services by registering themselves through the mobile app available on Google Play Store or web portal. The registration is done using OTP on registered mobile phones of the customers. The facility is available to fully KYC compliant savings account holders (with or without term deposit) with the bank.

K. Kalyani believes that the concept of doorstep banking services in the coming days will change the way banking transactions are done

Kalyani: Doorstep banking services are implemented through universal touch points as part of EASE reforms agenda for public sector banks. Customers can place service requests through web portal, mobile app or by calling toll free numbers.

How many states and union territories are covered at present and how many will be completed by the end of the current FY?

Atul Kumar Goel: Doorstep banking services are being offered by all the public sector banks in 100 centers across 28 states are UTs. Based on a study of demand, it may be scaled up to other parts in due course, after approval of the stakeholders.

D S Shekhawat: Bank of India has set up a war room at its HO, manned by a dedicated team of officers and identified nodal officers at national banking group (NBGs), zonal office and specified branches. We are extending these services to all our customers in select 100 major centers across the country covering 1252 branches in 23 states and 4 UTs. These services are being rendered through 2 vendors – Atyati Technologies (having presence in 60 centers with our 928 branches) and Integra Micro Systems (having presence in 40 centers with our 324 branches).

: Initially 100 centres have been identified by IBA to provide doorstep banking services. We will be providing the services in 60 and 40 specified centres respectively by the agents deployed by the 2 selected vendors. The 100 identified centres cover all the states and UTs except 5 north-eastern states and 4 union territories.

: Initially 100 centres have been identified by IBA to provide doorstep banking services. We will be providing the services in 60 and 40 specified centres respectively by the agents deployed by the 2 selected vendors. The 100 identified centres cover all the states and UTs except 5 north-eastern states and 4 union territories.

If the customer is illiterate or semi-literate, how his or her comfort is ensured in the entire process?

Atul Kumar Goel: There are no qualifiers (or discriminators) except the customer being an individual having valid account in any of the public sector banks. However, services being alternate delivery channel in the basic principle of design, need to be authenticated for delivery. For this purpose, one-time password is being sent to the registered mobile number of the customer. He is expected to have at least that much awareness about using OTP based validation.

For the purpose of semi-illiterate customers, call centers are the best solution wherein call center executives guide the customer to book the services. However, even in this process OTP has to be entered by the customer over IVR menu. Role of any manual intervention is overruled in this scenario.

D S Shekhawat: Illiterate or semi-literate customers can avail doorstep banking services using call center facility on 18001037188 or 18001213721.

Kalyani: If any customer is illiterate or semi-literate, he/she can call toll free numbers to book the service.

Will doorstep banking continue even after the pandemic ends and normalcy returns?

Atul Kumar Goel: Yes, Doorstep banking services have been a source of great relief for all our customers since its launch on 9 September 2020. However, these are not exclusively meant to be used during the pandemic and will continue even during normal times. Consumers in India are naturally turning towards home delivery choice owing to busy lifestyle. If we take a quick survey of a sample size of 5000 customers who have booked services, approximately 55% are below the age group of 40, which highlights its demand among young millennials.

D S Shekhawat: Yes, as the services are targeted to provide facility especially to senior citizens and differently abled persons, it will continue even after the pandemic ends.

Kalyani: Doorstep banking service is a joint venture of all public sector banks, intended to help their customers to complete their major banking transactions at their doorsteps. The services will continue even after the pandemic ends. Further, IBA is considering inclusion of more services like submission of family pension application forms, applying for nomination etc. through this mode in future.

How many customers are estimated to avail of this facility and what is likely to be the fee income that the banks will gain under this initiative?

Atul Kumar Goel: Well, the service, being one of the unique offerings for the customers of public sector banks, is still in its novice phase. It’s a behavioural change for our customers, who are fond of face-to-face interaction. Still, it is encouraging to have more than 200,000 registered customers in the first 3 months of launch.

D S Shekhawat: All the customers in 100 major centers across the country in doorstep banking services enabled branches are estimated to avail facility. It is not revenue generation model or profit oriented services rendered by the banks. These services are intended to provide ease and comfort to the customers, especially for senior citizen and differently abled persons during times of hardship. Uniformly Rs75 plus GST per service is charged for both financial /non-financial services to customers, out of which Rs63 plus GST goes to the vendor for deploying resources and meeting travelling expenses.

Kalyani: This facility can be availed by all the customers residing in the 100 centers identified by IBA. Banks are providing doorstep banking services at nominal charge as a service to customers. The concept of doorstep banking in the coming days will change the way of doing banking transactions by the customers. IBA is planning to include more banking services under this umbrella service. This facility will be a boon to pensioners, senior citizens, persons with physical disability, especially in this pandemic situation.