Srini Peyyalamitta, Head of Banking & Financial Services at Aspire Systems

By the year 2020, Millennials (the group aged 18 to 34) will comprise half the global workforce. There is no arguing that the Millennial demographic is growing, and the economic power of this generation is greater now than in any previous era.

These young adults have come of age during a time of technological change, globalization and economic disruption, which has given them a set of behaviors and experiences that are considerably different from their baby boomer parents. They are also the first generation of digital natives, and their affinity for technology is redefining their relationships with brands in the financial sector.

However, most banks have so far fallen short of delivering the experience desired. Without deep-rooted loyalties to traditional banking institutions, millennials are flocking to the highly digitized and customized offerings of fintech companies. 73% of Millennials say they would be more excited about a new offering in financial services from the likes of Google, Amazon, Apple, PayPal, or Square than from their own traditional bank, according to the Millennial Disruption Index.

To engage Millennials and invest in this expanding customer group, here’s how banks can create a new equation hinged on the trinity of seamless connectivity, personalization and true, loyal relationships.

Engage Millennials in a dynamic way through seamless connectivity

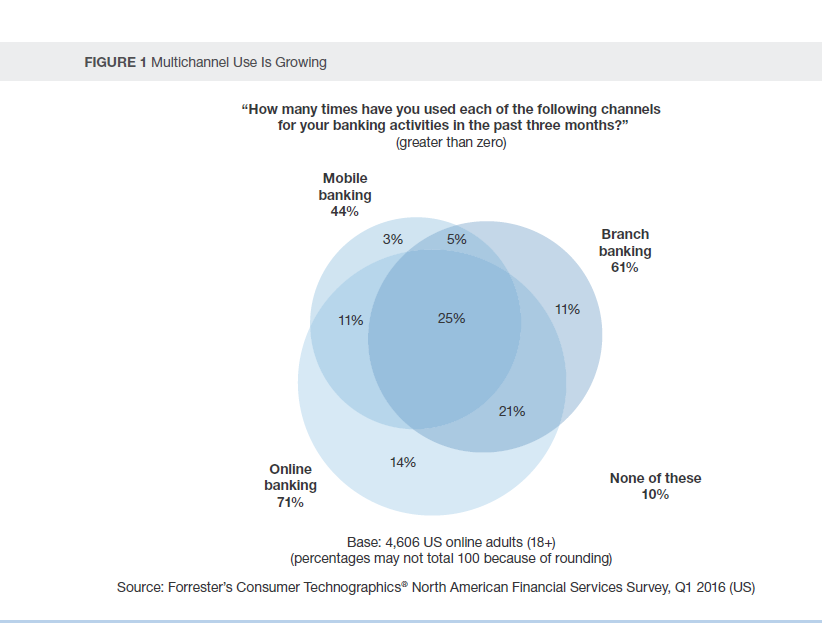

Millennials now want to access their banking services wherever, whenever and however it suits them. And as digital becomes more pervasive, the number and variety of channels are only going to increase.

Millennial customers therefore must be engaged in a dynamic fashion. To accomplish this, banks need to clearly understand customer usage habits through the optimal use of behavioral statistics and data analytics. This becomes all the more crucial, as customers may constantly flip between devices before concluding any given activity.

To enable customers to flit seamlessly between channels and pick up where they left off, it is imperative for banks to streamline their systems, synchronize different touchpoints and deliver the same structure and feel across channels.

Hit the mark with millennials through Personalization

Traditionally banks have relied on their limited set of data silos such as data residing in CRM accounts in combination with transaction history and demographics collected from their enterprise data warehouse systems.

However, to crack the code on what Millennials want, banks need to integrate these internal channels with various external sources, such as mobile application usage, clickstream data, social media etc. and apply advanced analytics to gain insights into the customer journey on a ‘segment of one’ level. For instance, by analyzing the “breadcrumbs” that these digital natives leave across the social media landscape, banks can connect with customers at various critical points in their life such as college graduation, purchase of a new house etc. and then push targeted promotions, products and services that can achieve high conversion rates. Contextual engagement that is both smart and timely is the key.

To enable a proactive and personalized customer experience, banks need to invest in predictive analytics, smart algorithms and advanced tools such as mobile application analytics, location intelligence etc. Customers near a mall, for instance, can be sent timely, value-added offers for a retail chain the bank has a tie-up with.

Similarly, “propensity to buy” models built using information fed in from multiple channels can be used to predict what customers are likely to buy next & when. Armed with such information, the frontline will be able to offer the right product at the right time with a greater degree of certainty.

Build true, loyal banking relationships

Millennials, more than any other generation seek partnerships that deliver genuine value. According to Facebook, three out of five Millennials expect their bank to be a partner.

As the industry becomes more sophisticated in handling big data, banks are changing the ways they reach out to customers and shifting their thinking about loyalty programs. Instead of mere giveaways or rewards for credit card usage, banks must look at their relationships with customers from a more holistic perspective.

Banks must also learn to play a greater role, not just at the moment of financial transactions, but before and after as well. This can be done in the form of extended value propositions such as providing end-to-end assistance to a millennial buying his new house. Banks have the potential to leverage their rich data treasure with new digital tools to manage the customer’s entire digital wallet and help them make better purchase decisions on what, where and when to buy in the future.

Final Thoughts

The banking landscape is evolving. Banks cannot win with millennials without a commitment to harnessing all of the data at their disposal. Only if they do so, will they be able to understand what makes them tick and proactively serve and delight them. If they do not, there are other fiercely disruptive competitors that are poised to give these customers just what they expect.