Indian Banks performed extremely well in meeting customer expectations in areas of digital payments, omnichannel experience, staying connected and in person service. However, the areas that performed below expectations were Fairness (transparency in how fees and services are priced), Reliability and Transparency in servicing customer aspirations.

In an annual survey commissioned by FIS in December 2016, during the turmoil of India’s bank note demonetisation, this year’s Performance Against Customer Expectations (PACE) report provides a snapshot of a unique time when the banking industry was under intense stress. The response points to a dramatic and rapid, shift away from cash as payment. The scores were computed for every respondent based on how they ranked the importance of 18 key performance indicators (KPIs).

Financial institutions in India gained one point on last year’s PACE score, achieving a score of 75, but seven points below the global PACE average.

“Rapid shifting of payment modes from paper and plastic to mobile and cashless helped banks establish a stronger multiple service relationship with their customers. The PACE findings also present a clear picture on where India’s banks need to focus to remain first in the minds of their customers” said Ramaswamy Venkatachalam, Regional Managing Director, India and South Asia, FIS. “Insights from the PACE report highlight that the increase in digital access and transactions, including digital payments, is assisting in attracting and retaining customers. Opportunities exist for banks to capture more business and to help consumers become more financially healthy”.

Key Findings about Indian Consumers

- More than 60% of the respondents have used mobile devices to check their balances, view recent transactions, pay one or more bills, transfer funds between accounts or receive bank notifications.

- Nearly 18% of the respondents use their primary bank’s credit cards exclusively.

- The importance of the primary bank providing digital payment options has risen year on year across all age segments. More than 30% of common payments are done with mobile apps compared to cash, cheque or credit/debit cards.

What Gen Y in India said

- Consumers want to better connect with their banks at their convenience, at any time and from anywhere.

- The biggest pain point, according to banked Gen Y Consumer is getting time to physically visit a branch.

- Gen Y are far less satisfied with their current banking providers and are vulnerable to attrition.

India Results

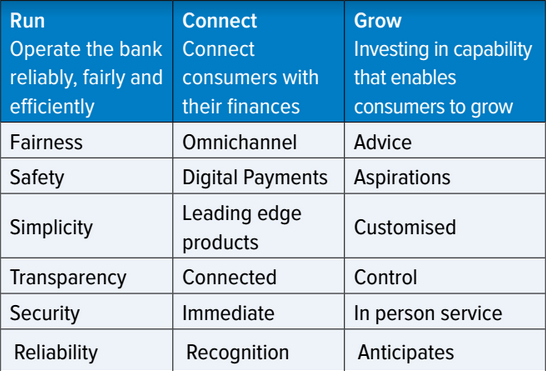

The PACE report offers invaluable insights into the view of consumers of financial services.To help financial institutions make sense of the consumers attributes, these are categorised into three groups: RUN, CONNECT and GROW.

Insights from the report:

The report provides five insights into the banking trends in India:

1. Digital is not optional: The importance of the primary banking providing digital payment options has risen year over year across all age segments. Right now, more than 30% payments are done with mobile apps (versus cash, cheque or credit/ debit cards). Mobile payments have gained the most traction among young Gen Y, with senior Gen Y catching up.

2. Gen Y members are driving digital connectivity: Mobile payments are gaining traction quickly among Gen Y members, raising the likelihood that mobile payment adoption will follow a similar path to mobile banking. Senior Gen Y have the most number of monthly interactions with their banking providers due to higher online and mobile banking activity.

3. Rapid shift to virtual payments: Compared with the global norm, India is more quickly making the shift from plastic to virtual cards. Already, mobile payments rival credit cards in popularity and virtual cards are expected to overtake plastic possibly in just a matter of years.

4.Banks must transition from Transactions to Aspirations: Opportunities abound for financial institutions to help consumers plan and save for life events and realise their financial aspirations. Across the board, when asked where they would turn for financial assistance for a key life event, India’s consumers overwhelmingly cited their primary banking provider as their first choice. However, all too often, the competition steps in and captures significant account share.

5. Addressing Customer’s pain points: Banking providers have numerous opportunities to assist consumers – especially those with important life event. Significant percentages of Gen Y members report having problems when trying to engage with their primary bank. Commonly, they have difficulty finding time to visit a bank branch and have trouble accessing investment advice or assessing whether an investment makes sense for them.

——————————

A complete copy of the PACE report for India can be downloaded from http://closethegaps.fisglobal.

Click to comment