Abhishek Gupta

India Economist,Bloomberg

India’s growth is poised to pick up in the coming fiscal year, as structural reforms clear bottlenecks and a streamlined goods and services tax framework leads to increased efficiency. The government’s effort to rein in the budget deficit will remain a headwind. Slowing inflation though, will allow the central bank to cut interest rates — reducing high real borrowing costs that are crimping investment.

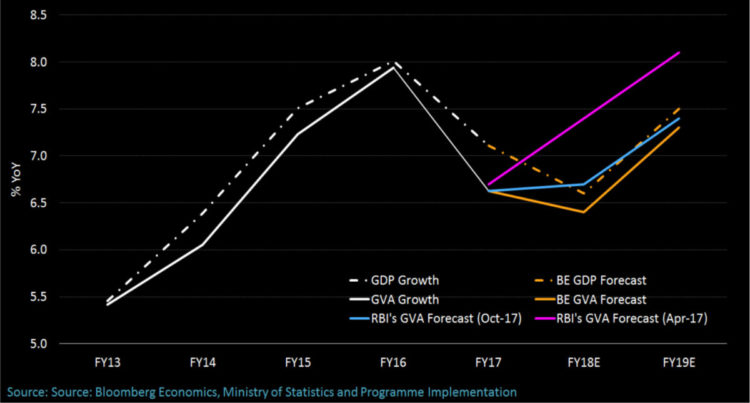

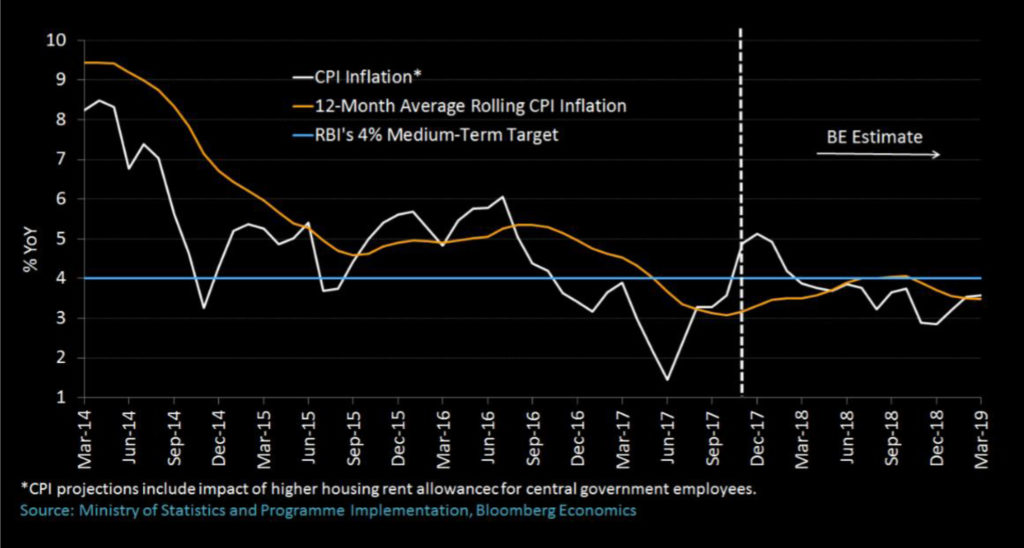

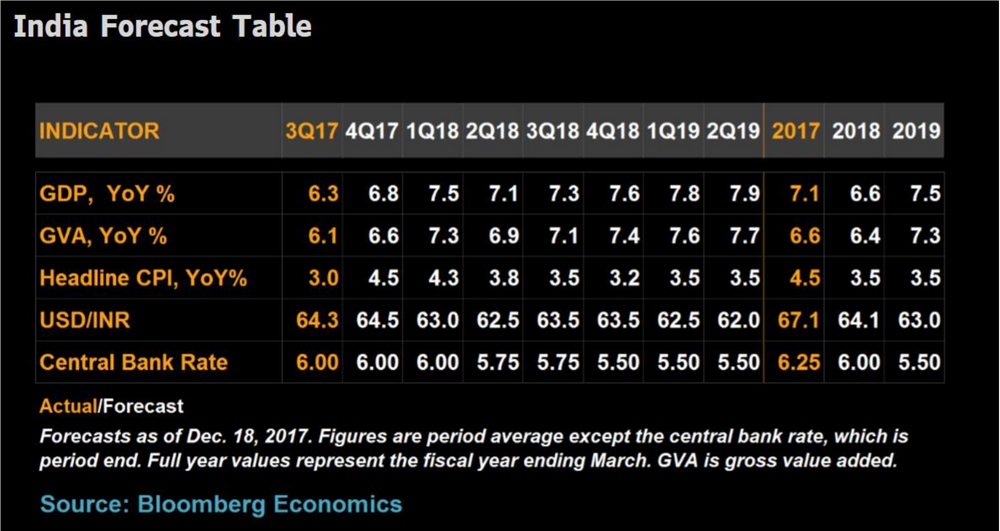

Bloomberg Economics (BE) forecasts growth in gross value added – the Reserve Bank of India’s preferred gauge – to rise to 7.3% in the year through March 2019, up from 6.4% this fiscal year. A wide output gap and prospect for vegetable prices to cool mean inflation will slow to 3.5% in 1Q 2019 from 4.3% in 1Q 2018. Inflation anchored below the RBI’s 4% medium-term target will clear the way for it to cut rates by 50 bps next year, in BE’s view.

Growth Outlook Hinges on RBI Cutting Rates

BE’s outlook is based on the RBI abandoning a hawkish policy stance that has impeded a recovery in growth following shocks from demonetization and the introduction of the GST. Elevated real borrowing costs are restraining consumer spending and investment, curbing tax revenue that could go toward narrowing the budget deficit. The pressure on corporate balance sheets is also a factor behind non-performing loans plaguing the banking system — another drag on growth.

The RBI’s projections suggest it sees little letup in consumer price pressures. It expects inflation to come in at 4.7% in 1Q 2018, and slow only marginally to 4.5% by 1Q 2019 – a full percentage point above BE’s forecast. The RBI is concerned fiscal slippage and higher food prices will have a more lasting impact on inflation. BE is more sanguine on those points. What’s more, the central bank appears to be underestimating the disinflationary forces being unleashed by a barrage of structural reforms by the Modi administration. Rising potential growth means the output gap will remain wide in the year ahead.

A slowdown in inflation is likely to surprise the RBI — opening up room for rate cuts. The next window for easing policy may be in June 2018, when inflation is likely to have slowed to under the 4% medium-term target. BE expects the RBI to reduce the policy repo rate to 5.5% by 4Q 2018 from 6.0% now. Given changes in monetary policy take time to filter through the economy, growth could pick up just in time for India’s 2019 elections — allowing Prime Minister Narendra Modi to again campaign on a platform of growth and jobs.

Inflation to Drop Back Below RBI’s 4% Medium-Term Target

A number of risks could change the economic outlook. A failure of the central bank to alter course and cut rates would increase downside risks to growth. The GST jolted the economy. Over time though, greater efficiency of the nationwide tax framework are a positive. The key will be to simplify the tax structure to reduce compliance burdens — and a delay in that effort would mean a more-sustained drag on growth. A rise in global crude oil prices to more than $65 per barrel would also spell higher inflation (if the government doesn’t respond by cutting taxes on domestic fuels) and lower growth (by worsening the current-account deficit).

India Forecast Table

(Updates to reflect the latest inflation data.)

– Abhishek Gupta is India Economist, Bloomberg