Milind Sathe, Head – Insurance Vertical, Birlasoft

Insurance companies have an inherent bias towards resisting any fast, comprehensive changes. Even within the business value chain, the underwriting business function moves the slowest and puts up the biggest fight against change. But with the swarm of new technologies like Internet of Things (IoT), Artificial Intelligence (AI), Machine Learning (ML) and Automation, the insurance industry will go through its most disruptive phase ever. And underwriting will go through the most substantive disruption since the advent of Actuarial/Underwriting Tables.

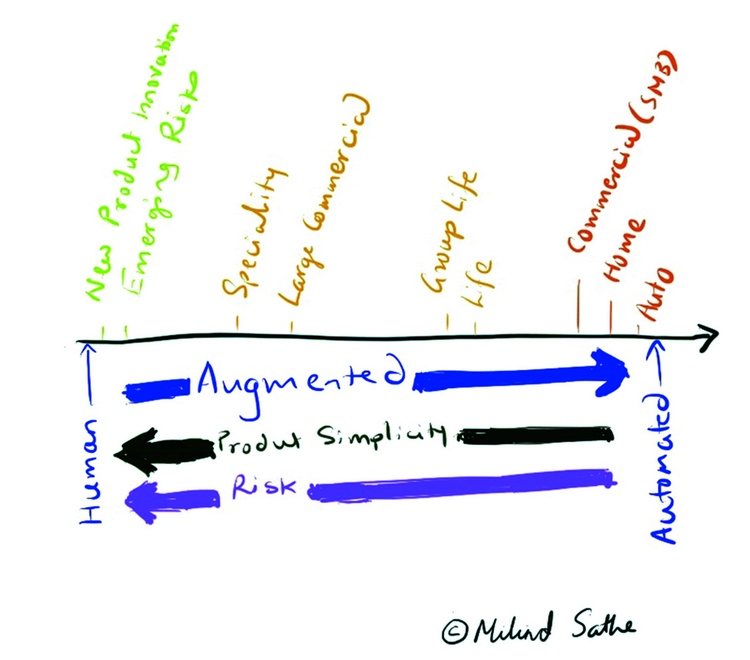

Augmented Underwriting is an evolving step from fully human underwriting to automated underwriting.

Simpler products like Auto, Home and Commercial (small & medium business) have already been mostly automated. IoT sensors (think UBI: Usage Based Insurance), data modeling (data science) and other newer inputs are making this automation more efficient.

More complex products like Specialty Insurance, Large Commercial, Life are not yet automated but the underwriting is augmented with ML and data science. The rating derived from these models are fed to an Underwriter as an input. The Underwriter makes the final determination.

The most complex Underwriting function is identifying emerging risks and new product innovation. This is true Artificial Intelligence. While we are far away from this right now, Man-Machine-Learning (MML) is emerging as a step towards AI. In MML, Man and Machine collaborate, which enhances and accelerates Human Innovation significantly. ML will sift through variety of news and data sources to identify trends and signals. The human learning and thinking then provide feedback and reinforcement to the ML component, which then refines its sources and weights to offer broader and deeper content. Using this type of MML construct, underwriters and risk experts can help carriers identify potential new markets, new customers, understand ley features and personalize products, which will ultimately lead to new product innovation.

Obviously as you get closer to automated underwriting, products become simpler (commoditized) and risk becomes lower.

Evolution of solutions

Step 1: Build Data Models to augment rating

There are tons of data providers relevant to life insurance. These sources provide Rx data, medical data, etc. Models can be built that predict smoking, heart ailments, cholesterol, etc, based on the application data and data from these sources. All applications can then go through these models that can rank the rating factors with various confidence levels. Underwriters can then look at these ranks while rating and pricing the risk.

Step 2: Build AI Systems

- Start experimenting with AI systems based on NLP and DeepQA

- Design /assemble training data sets

The loss history and policy data is not enough. To give a simple example, every customer transaction needs to be tagged with ‘good behavior’ or ‘bad behavior’ or ‘genuine’ or ‘fraud’. The algorithms then can identify trends, learn patterns and continue to refine the ‘underwriting’ skill with continuous feedback.

Some examples

John Hancock has implemented augmented underwriting for their life product. Various carriers like Metromile, Carrot, etc, are using driving data to augment underwriting decisions for auto products. American home, AIG and other carriers are experimenting with water sensors (with ability to switch off water main in case of leaks) and other home sensors to augment underwriting.

Ultimately, Insurance industry is evolving from Repair & Replace to Prevent and Protect.

—

Milind Sathe, Head – Insurance Vertical, Birlasoft

Gaurav Bhutani

August 23, 2017at6:22 pm

A neat & very concise write-up. Glad to see principles of risk based financing getting applied into Insurance.