Varo Bank has the unique distinction of being the first and only neobank to be granted a banking charter by the US Office of the Comptroller of the Currency:

Varo Bank is a mobile-only neobank, headquartered in San Francisco, California, providing critical financial services through its Apple and Android apps. It has over 4 million customers and does not have any physical branches or offices. What sets the neobank apart from others is the fact that it has been granted a banking charter – the first neobank to obtain it – by the Office of the Comptroller of the Currency, therefore giving a competitive advantage in the US neobank space. The charter allows it to legally operate as a bank.

AMONG THE TOP 3

Varo today is one of the 3 largest neobanks in the United States, along with Chime and Simple, with the advantage over the others – the banking license and the status of a deemed full-fledged financial institution/bank. And, uniquely like other neobanks, it does not have an intermediary bank that charges it a fee for every transaction and is directly regulated, and insured by the US Federal Deposit Insurance Corporation. It has several income streams, but the primary source – almost 98% – is interchange and other fees. It also can develop its own banking platform and products, a facility that is not available to other neobanks, which have licensed banks as partners.

Varo was co-founded by Colin Walsh and Kolya Klymenko, both having sound banking experience, in 2015. Its target audience was and is the young people and millennials – ‘individuals disillusioned by traditional banks and their roster of services’. Varo’s services are available only through the Varo app, which ensures that customers are serviced by a close-knot group of operators and not by branch employees.

SERVICES, FACILITIES

It offers services at a very nominal rates mainly because it has no operational overheads. Its checking and saving accounts as well as overdrafts do not have any fee. There are key technology tools, using which customers can keep track of their spending, budgeting and financial objectives. It is a partner of the Allpoint ATM Network and customers are not charged for cash withdrawals. There are no fees for maintenance, foreign transactions, or fund transfer. There is no minimum deposit required for maintaining an account. It offers one of the highest interest rates, or annual percentage yield, of 0.50%. And if a customer meets certain simple requirements like account balance above or equal to $0 for the calendar month, or receives $1000 or more in total direct deposit each qualifying period and does not exceed the daily savings balance of $5000 for the calendar month, higher rates of interest are offered.

Cash deposits are possible at Green Dot Reload@theRegister retail locations, which is a retail service offered at a fee of up to $4.95. Cheque deposits are possible through the mobile app after having a set-up in the checking account.

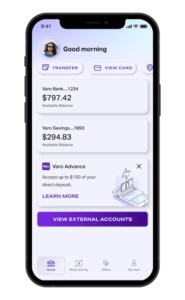

The Varo app allows a customer to link all external bank accounts, enabling them to manage their money and have a balanced view of each of their accounts under one roof. Through Varo Advance, a customer can get an instant loan of $100 and pay a flat fee for cash advances over the amount of $20 and have up to 30 days to repay it. Customers also get a Visa debit card and all deposits are FDIC-insured up to $250,000.

FUND MOP-UP

Varo has raised a total of $992.4 million in funding over 8 rounds. Its latest funding round saw $510 million being raised in Series E. It has a valuation of $2.3 billion after this round of funding.

However, there are banking analysts who believe the financial health of the neobank is not as strong as it is made out to be. They warn that regulatory filings by the neobank indicate that it had $263 million in equity and a burn rate of $84 million in Q1 2022, which will mean it could run out of money by the end of the financial year.

TECH BASE

Varo has a strong technology platform. It has built its architecture around open APIs and the cloud. It has implemented Temenos Transact as its back-end and is using Temenos Payments and Temenos Infinity services as front-ends on the cloud. It now has the capability to develop new products, including home loans and high-end credit products, using the cloud-native APIs, and launch them rapidly.

Varo is proving to be a convenient banking option for people with straightforward finances. It offers benefits for those who opt it as the primary checking and savings account. However, those who use it as a secondary account with no steady transaction and deposit activity, there could be several perks like a higher-yield savings rate and additional products and services like CDs and money market accounts that may not be available.

Read More