Distributed Ledger Technology is now vastly used in many banking functions and there is some sort of a threat that banks may change the way they work today:

Distributed Ledger Technology (DLT) is the new norm – a convenient way of handling data and transactions. It is essentially a database that allows multiple copies of a ledger to be accessed and shared by various organizations at the same time. There are several proven benefits that DLT brings in, the key ones being better security, more efficiency and lesser costs. DLT is the basis for innovations like cryptocurrencies while it has critical applications in areas like supply chain management.

One of the most critical aspects of DLT is its potential to enhance transparency and cut down the risk of fraud. This is because all the transactions made using DLT are recorded on a shared ledger, which can be easily traced, accessed, and verified. It also affords higher levels of security and ensures machine-to-machine communications, leading to automation in transactions.

VAST USE IN BANKING

DLT is today used worldwide in financial services sector in the area of payments, especially to speed up cross-border payments and reduce costs. Similarly, digital assets like cryptocurrencies exist because of DLT and it has applications in other asset types like commodities, currencies, securities, properties and utilities. Yet another application is that using DLT digital assets can be divided into fractions and traded, thus making investments more accessible.

DEFI, DLX

DLT is also used in creating smart contracts, which are self-executing contracts, a major breakthrough since they reduce the need for third-party intermediaries like brokers. They are also the basis for Decentralized Finance, or DeFi, in which financial transactions do not depend on any institutions like banks and users can directly interact with each other to get loans, interest or investments.

DLT also facilitated the creation of Decentralised Exchanges, or DLXs, which are online platforms allowing users to trade cryptocurrencies and other digital assets without a centralized authority, and where every user keeps access to their own wallets.

DLT has also vast applications in supply chain management. It helps organizations to track and verify the movement of goods, ensuring authenticity and preventing fraud. It enables real-time visibility into supply chain operations, reduces paperwork and minimizes inefficiencies.

Similarly, in real estate, it is now being used to simplify property transactions, reducing paperwork and enhancing security. With the implementation of smart contracts, property transfers can be automated, ensuring accurate and tamper-proof records of ownership. It can provide transparent and auditable property registries, reducing the risk of fraud and disputes and removing the need of costly intermediaries.

Experts say as DLTs develop and gain wider acceptance in several sectors beyond finance, including governments, it could create an efficient, secure and inclusive economy.

BLOCKCHAIN, TANGLE, ETC

There are today various types of DLT. The most prominent of them, Blockchain, bundles transactions into blocks and these blocks are broadcast to the nodes in the network. The technology powers cryptocurrencies. Likewise, there is Tangle, which is for use in IoT ecosystem. It is described as a ‘permission-less, fee-less, scalable distributed ledger, designed to support trustworthy data and value transfer between humans and machines’. Other DLT platforms are Corda, Ethereum and Hyperledger Fabric.

DLT can help ensure financial inclusion in a more efficient manner. Since DLT relies only on an internet connection, individuals who would be otherwise limited, may have access to a greater range of services. This extends to the use of different platforms and networks via interoperability.

According to senior bankers, DLT can make processes more efficient, speed up automation and reduce inherent risks in current processes. Back-end processes, around settlement and reconciliation, can become significantly more efficient or in several cases be eliminated entirely. It has a major role in the calculation of risk-weighted assets (RWA). A reduced RWA can have a massive impact on the business model with respect to how a bank operates today. DLT will also enable much faster workflows with transactions taking place automatically and instantaneously on the client side.

One challenge that DLT may pose is in integrating with existing legacy banking systems. Bankers feel understanding the fundamentals of DLT is key in this regard. For example, correctly identifying use cases where DLT could help. Also training people internally is crucial.

DLT will have applications in future in areas like trade finance, creation of new products etc.

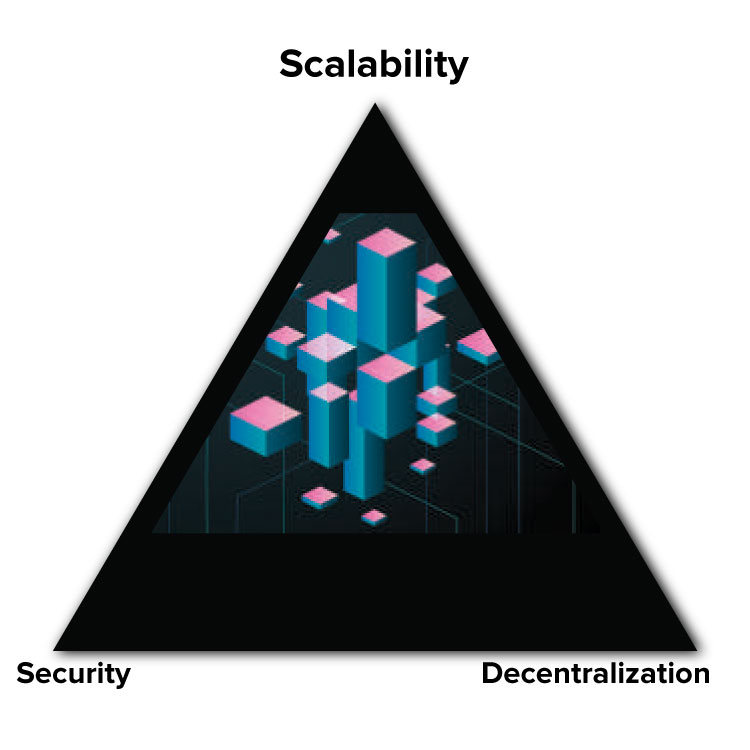

BLOCKCHAIN TRILEMMA

As DLT develops and finds more and more applications, a phenomenon has developed, which experts describe as the ‘Blockchain Trilemma’. The term, coined by Ethereum co-founder Vitalik Buterin, is about the trade-off between the 3 critical aspects of blockchain technology – security, scalability and decentralization. These 3 aspects are intertwined in such a way that enhancing one often results in the diminishing of another. Many experts believe that achieving all 3 aspects simultaneously is a very tricky task.

Security is of paramount importance in DLT and any network must be designed with strong defenses to prevent malicious entities gaining access. In DLT, this is a complex issue, especially because of the decentralized operations, with no central authority to oversee and protect the system. Security is also intertwined with the other 2 aspects – decentralization and scalability – and enhancing security potentially compromises these aspects.

Scalability is an equally critical in DLT networks as it ensures that a DLT system can handle an increasing volume of transactions and users without compromising on transaction speed or fees. Achieving high scalability is a challenge, especially when trying to maintain the other 2 aspects. For instance, the Bitcoin network can only process around 7 transactions per second, a number that is insignificant when any centralized payment systems can handle 25,000 transactions or more per second.

The third in the trilemma is decentralization, which is the defining characteristic of DLT. In the network, control is evenly distributed among all participants, eliminating the need for a central authority. This system not just enhances the transparency and fairness of the network, but makes it resistant to censorship and external manipulation. As participants in the network increase, a consensus can become difficult and time-consuming, thereby affecting

the network’s scalability. Also, a highly decentralized network could become less secure.

BALANCING ACT

Any DLT architecture, therefore, requires a fine balance between these 3 aspects. So, DLTs could be of two types – Permissionless DLTs, which are open for any entity willing to participate as a validating node (Bitcoin and Ethereum are permissionless DLTs. Since the validating nodes are unknown and cannot be trusted, they prioritize security and decentralization at the expense of scalability); and Permissioned DLT, which only allows authorized entities to join as a validating node (Enterprise DLT platforms like Hyperledger and Corda are permissioned DLTs.) Since the validating nodes are known and can be trusted, they prioritize scalability and security over decentralization.

PROGRAMMING MONEY

Any discussion on DLT will be incomplete without a reference to programming money. Programmable money is money that can be programmed to have certain in-built rules, specified in a self-executing contract that is triggered when a pre-defined condition is met. In other words, it is a ‘smart contract’.

Any discussion on DLT will be incomplete without a reference to programming money. Programmable money is money that can be programmed to have certain in-built rules, specified in a self-executing contract that is triggered when a pre-defined condition is met. In other words, it is a ‘smart contract’.

In programmable money, any third party like a bank is not required to trigger and settle a transaction. For example, Bitcoin or Ethereum use embedded financial incentives to build trust among the network of participants, eliminating the need for any centralized entity to carry out the settlement of transactions.

Today, central banks around the world are in the process of developing Central Bank Digital Currency (CBDC). This is an apt example of programmable money whose value is fixed by the fiat currency against which it is issued.

In advanced stages, programmable money may replace the escrow services provided by banks by a smart contracts that lock in the money for a sale and release it only when the required conditions are met.

Programmable money is created using cryptographic functions and DLT and essentially rely on entities that act as a validating node for the network. Many experts feel the possibilities that programmability of money offer are endless. For example, with the help of CBDCs, regulators can track economic factors in real time and adjust monetary policy accordingly. Data stored on the DLT is immutable and with the right degree of privacy, it can automate data sharing with regulators. Smart contracts on CBDCs can enable new digital models such as an automatic deduction of the taxes from a transaction.

Can programmable money be a threat to banks? Probably, yes. Cryptocurrencies like Bitcoin and even CBDCs can re-define the way consumers use financial services. Today, cross border transfers using Bitcoin are significantly faster and cheaper than the conventional payment infrastructure. Nevertheless, it is possible for banks to evolve and consider use cases that cannot be covered by such a system. For example, most CBDCs have assumed the role of a supervised intermediary that would be required to authenticate customers and to carry out KYC checks. Banks can be that supervised intermediary.

ANOTHER ROLE FOR BANKS

Again, an effective way for banks to recover lost ground as custodians of value in the new normal is by adopting technologies like DLT to enhance customer experience. For example, they can optimize their KYC processes by saving customer data on decentralized blocks. This would help banks eliminate repetitions and enable them to share information about existing and prospective customers between financial institutions in real time. They can also use DLT in improving clearance and settlement mechanisms, which can bring in big benefits for both customers and banks.

Read more: