ShriMithra a B2C app has been downloaded by over 3.4 lakh customers and over 2 lakh polices have been registered through it:

Shriram Life Insurance Company is a JV between Chennai headquartered Shriram group and 103 years old South African life insurer Sanlam. Sanlam is a diversified financial services company present in 30+ countries in Africa, India, Malaysia and selected developed markets. As the MD of Shriram Life Insurance, Manoj Jain has led the company’s success in recent years. He has over 27 years of experience in financial services, with over 15 years in life insurance. He has worked with HDFC Standard Life, Tata Motor Finance and 20th Century Finance Group.

Apps: Features, Services

Ease of doing business has been at the forefront of the technology advancements made in SLIC, starting from the new business stage where the sales person visits the customer for explaining the policy needs and requirements. To make the process of new business policy sourcing easier, more transparent and faster for the customer and the salesperson, SLIC has a mobile app Astra. Manoj Jain, MD, updates: “82% of our total new business is done through the mobile App Astra. Astra also has the capability of eKYC based on facial recognition. 15 products are available on Astra, which has total over 80,000 downloads.”

There are many new features and enhancements in Astra. These include eKYC enabled proposal journey (OTP & face authentication), FR (facial recognition) management, proposal tracker, UPI auto pay, payment link on WhatsApp, ULIP proposals journey as well as combo & reverse calculator.

ShriMithra App, launched in 2018, is specifically designed as B2C app. It has more than 26 self-service options built in. Customers can instantly login to this app through mobile number and an OTP. There a number of services covered on the application. Jain elaborates: “These relate to address, mobile number, email id, PAN number updation, duplicate receipt, fund switch, policy revival, premium paid certificate, revival quote etc. Over 3.4 lakh customers have downloaded ShriMithra App. Over 2 lakh polices have been registered through it. 22% of all services requests (73% of all requests on digital mode) were on ShriMithra.”

Quick Payment, Suraksha Card

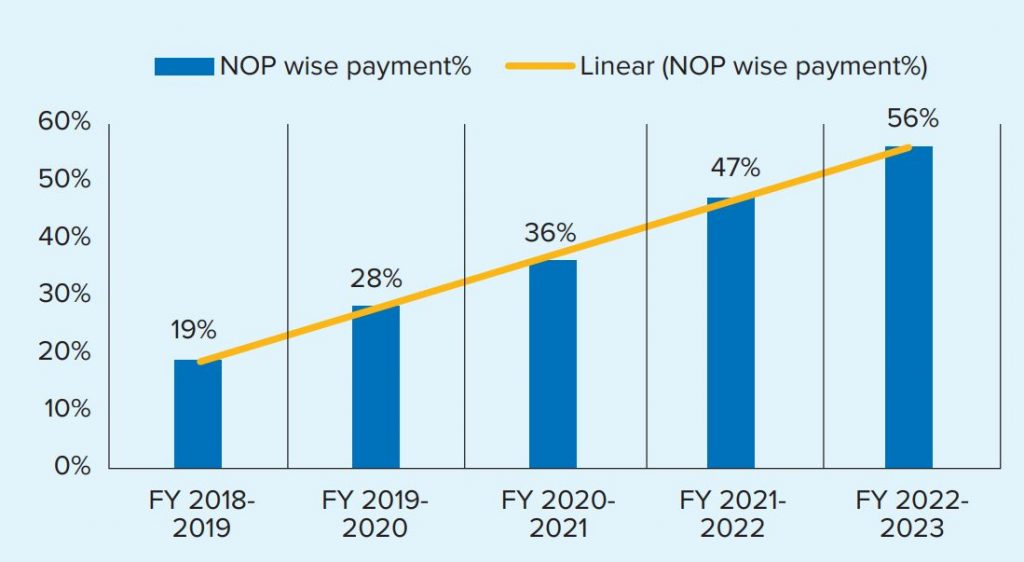

Making payments journey has evolved by time now. The tiresome process of standing in long queues for making payments has been simplified to making payments just by one click. SLIC has also seen a tremendous breakthrough in this process through flexible digital payment methods. Digital payments vis a vis to last financial year has been improving consistently. Vis-a-vis to FY 21-22, the total number of payments through digital modes have increased from 295,988 (`5.64 billion) in 2021-22 to 373,076 (`70.9 bn) in FY22-23 till Q4. NACH is one of the strong persistency enablers. Jain informs: “50,425 payments (`1.84 bn) at net banking stage is successfully tagged with NACH in FY23, which is 34% of total new business policies issued. This would be a substantial support for persistency improvement.”

Shriram Smart Suraksha Card’s punchline is ‘Suraksha apni jeb mein’.

This is a first of its kind in the life insurance industry. Smart Suraksha Card in the size of a debit or credit card is a tangible component of the life insurance industry. Jain describes: “Suraksha Card is personalized with photo, it provides ease of storage, information with quick access to digital servicing options, reinforcing the purpose of the policy. It provides instant access through QR code for policy bond and instant protection by QR code for premium payment.”

ShriA Chatbot: Self Service

ShriA Chatbot is a 24×7 service assistant on WhatsApp number +91-9015502000 and on SLIC website www.shriramlife.com. Around 20,630 customers have explored services offered through ShriA. These customers have explored 27,347 chatbot journeys between January’23 and March’23. Jain describes: “ShriA can communicate in English and Hindi. With ShriA launch, 64% of customers have used this instantaneous platform for self-services.”

Website customers can get insurance related documents such as E-policy bonds, premium paid certificates, last premium receipts, revival quotes and many more instantaneously. Also, policy related information and servicing options such as mobile number change, email id change, PAN card number change, maturity requests etc. can be instantly processed. Jain adds: “For new prospect customers as well (looking to know more about the Shriram Life products and benefits), they can choose option of ‘New to Shriram Life’ and our service assistant can help navigate them through the right plans.”

Claim Process: Whatsapp, SMS

Since the pandemic started an increasing number of customers are preferring digital serving options over visiting a branch office. The preference is strongly reflected in the numbers. Over 6.5 lakh customers have chosen WhatsApp option and 469,197 service communications have been sent through WhatsApp.

Since the pandemic started an increasing number of customers are preferring digital serving options over visiting a branch office. The preference is strongly reflected in the numbers. Over 6.5 lakh customers have chosen WhatsApp option and 469,197 service communications have been sent through WhatsApp.

During covid period, beneficiaries for sending death claim documents to help settlement the death claims have used WhatsApp extensively. Claim settlement ratio of SLIC stands at 97.5%. Last year SLIC paid 91% of the non-early claims within 12 hours of final document submission. This helps the populace from tier 2 & 3 areas that have people in lower income bracket, who are underserved regards to financial protection.

Claimants now have the provision to intimate any claim through the company enabled Whatsapp. Jain informs: “This adoption has increased the pace of settlements to the extent where the company now settles all non-early claims within 12-48 hours of satisfactory submission of documents.”

SLIC’s SMS service is multilingual. Linguistic customer outreach platform has been created in 9 regional languages. Jain adds: “We have initiated SMS communication to 8.9 million policyholders including both in-force as well as lapse base.”

Read more:

Finfluencers can have ulterior motives