Only sustained and well-defined efforts can help create an ecosystem to use digital for financial inclusion, says a survey by Visa and Devex:

A joint study by Visa and Devex, a social enterprise and media platform for the global development community, has stressed that while infrastructure and access remain crucial to meeting digital financial inclusion goals, initiatives too need to go further to tackle the knowledge, confidence and trust needed for individuals to more effectively use the technology and services at their disposal. The study reveals in particular that building digital financial skills is essential for bringing more people into the digital economy, while issues of trust and safety must be addressed in parallel.

The report, based on an online survey of 1193 global development professionals and insights from 31 thought leaders in digital financial inclusion, examined the challenges and opportunities to achieve equitable and inclusive participation in the digital economy, particularly to create or enhance livelihood opportunities. It maintains that initiatives are stronger and more sustainable when they leverage local networks and are driven by an understanding of community contexts and on-the-ground needs. “Initiatives that bring together diverse stakeholders foster long-term sustainability and scale, but require an understanding of the role that each partner can bring to the table,” says the report.

TOP INNOVATIONS

The report lists top innovations that facilitate greater participation in the digital economy and enhance livelihood opportunities as:

- Digital and mobile payments (including contactless payments) (81%)

- E-commerce (through social media and platform ecosystems) (55%)

- E-government services (43%)

- Digital cash transfers from governments and aid organizations (42%)

- Fintechs or online banks (27%)

- Digital lending (24%)

- Cryptocurrency and digital currencies (6%)

SOPS FROM DIGITAL ECONOMY

The report says there is a huge opportunity to provide all individuals and communities with the ability to benefit from the digital economy, with 95% of respondents agreeing that digital finance has the potential to advance socio-economic inclusion and equity. “The digitization of finance creates paths to achieve broad-based financial inclusion, benefiting unbanked segments of the population and enabling entrepreneurs to exit the informal sector – provided they have the necessary skills,” says the report, and stresses on the importance of skills, capabilities and trust to help bridge the remaining divide and ensure that more people participate more meaningfully in the digital economy.

KEY FINDINGS

The report summarizes key findings of the survey:

- Look beyond infrastructure and access

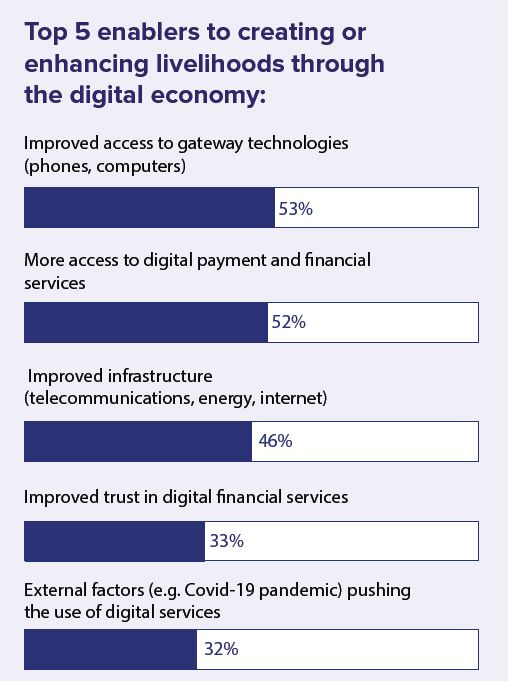

The digital divide exacerbates existing social and economic equalities, with 95% of respondents flagging the issue. The top 5 enablers in creating or enhancing livelihoods through the digital economy are: Improved access to gateway technologies; More access to digital payment and financial services; Improved infrastructure (telecommunications, energy, internet); Improved trust in digital financial services; and External factors (like the covid pandemic) pushing the use of digital services.

The respondents feel that affordability is a key component. For instance, smartphone owners use the internet for a much broader range of livelihood-enhancing activities, including financial services, but handsets and associated data remain less affordable for women than men, and for users in lower-income countries.

And a substantial section of the respondents view better access to digital payment financial services as an essential enabler. Digital financial products should also be designed to meet the needs of women, youth and low-income people, who are too often viewed as benefactors of aid rather than viable customers.

- Digital financial skills are the missing piece of the puzzle

Skills and knowledge can help level the playing field and allow more people to navigate and benefit from digital ecosystems. Seven out of 10 survey respondents believe that digital financial skills are very important in improving the livelihoods and wellbeing of their focus communities.

The most applied skills in survey respondents’ focus communities are:

- Use of digital technology (mobile phones, computers, internet) 54%

- Use of digital financial services (for personal or business use) (37%)

- Basic personal money management (saving, borrowing, lending) (36%)

- Advanced personal money management (debt, risks, investment, and insurance) (25%)

- Knowledge of and comfort with digital privacy, safeguards and redress procedures (20%)

- Digital financial skills and trust in digital financial services are intertwined

Nearly 56% of the respondents observed that gaining digital financial skills is the most effective way to build trust in digital financial services, which in turn is seen as a major enabler for participation in the digital economy. In the Philippines, for example, 39% of adults cite lack of trust as a reason for not transacting financially online – something the governments believe can be overcome by improving financial and digital literacy.

Lack of buy-in or trust from the community is also seen by survey respondents as a major barrier to implementing digital financial skills initiatives. This creates a chicken-and-egg challenge, which requires the sponsors, developers and implementers of skills initiatives to gain a nuanced understanding from the outset of what methods, tools and sources of information will have the most impact on their target community.

- Community networks are key

Leveraging community networks is vital to effective and sustainable digital financial education initiatives, as is adapting solutions to local contexts. Communities are viewed as anchors of trust, with 52% of survey respondents finding that informal or self-help networks – comprising community influencers, peers or neighbours – are the most trusted sources of information on digital financial technologies.

It is indicated that learning through peer groups and community or business networks is considered the most effective way to build digital and financial skills, according to 64% of respondents.

- Meaningful partnerships can maximize impact

When digital financial literacy initiatives are unable to reach long-term sustainability and scale, a key factor is the piecemeal approach that different actors tend to take, resulting in replication of efforts and fragmented results. Nurturing meaningful partnerships among stakeholders is vital, with two-thirds of survey respondents citing partnerships to be the most impactful step towards scaling digital financial literacy programs.

Key informants agree that a multi-faceted problem like digital financial inclusion needs a joined-up approach, with no single entity entirely responsible for leading digital financial inclusion initiatives or ensuring inclusive participation in the digital economy. Because digital financial inclusion creates benefits for multiple stakeholders, they each have an incentive to contribute to the infrastructure or skill-building needed to make that happen.

THE WAY AHEAD

The report quotes experts who believe in 3 action areas:

- Explore new roles and partnership models for the private sector

The private sector is integral to the success of digital skills initiatives, with much to gain and much to give. Financial service providers, mobile network operators, logistics companies, agribusinesses and e-commerce marketplaces have been among the first to recognize this. But as digitization expands into almost every corner of the economy, untapped sectors that have an interest in supporting skills plus bring fresh expertise and perspectives to partnerships should be identified.

- Innovate for resilience and scale

As advances in technology accelerate, tools and applications are at increased risk of becoming obsolete mid-project. Developers and implementers must therefore find ways to keep training agile, modular, and responsive so that new developments in technology offer fresh learning opportunities for existing digital financial skills initiatives, rather than threatening their relevance.

While the most impactful digital financial skills initiatives are neatly tailored to the needs, existing skills and local contexts of communities, achieving scale also requires a model that is easily repeatable. One approach that has been replicable and scalable is offering standardized but easily adapted learning resources complemented with in-person touch points.

- Design user-centric programs

To engage and motivate users, digital financial skills training must be relevant and relatable, with skills offering immediate and tangible value to their lives and livelihoods. Experts advocate for understanding the user journey for each skill needed in different use cases, as well as users’ motivation to learn.

Linking learning opportunities to specific products or services can help customize learning according to needs and make it as demand-driven and interactive as possible. Delivering training in tandem with a broader transformation in a payment system or value chain – such as when a government, employer or trading partner is shifting their benefit payments, payroll or procurement to digital – offers users opportunities to understand or apply skills that will help them shift to digital in other contexts too.

The report stresses that coordinated action on all three fronts is vital to help the world’s most marginalized and underserved communities take advantage of the digital economy and shrink a digital divide that benefits no one.

____________________

Read more-

Hybrid meetings lead to uneven playing fields