The performance of regional rural banks has improved significantly during FY 2022-23 and has reached historic highs on all fronts:

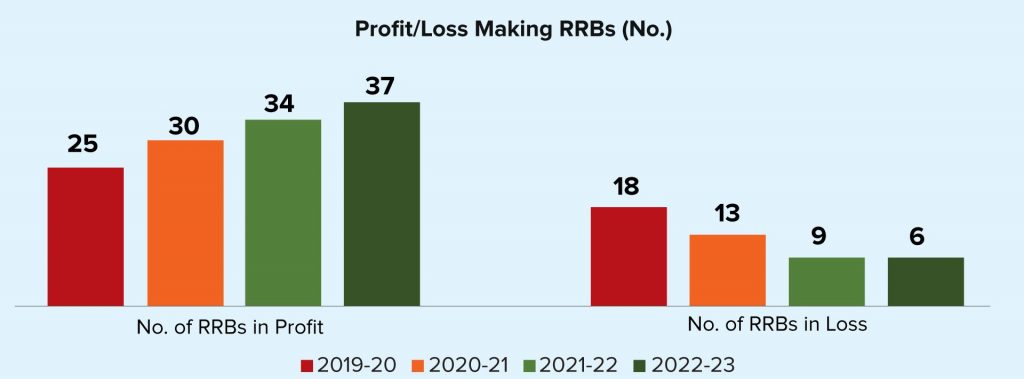

RRBs have posted the highest ever consolidated net profit of Rs49.74 billion during FY 2022-23. The number of loss-making RRBs has steadily declined from 13 in FY 2020-21 to 6 in FY 2022-23, according to NABARD’s Institutional Development Department’s latest report titled ‘Key Statistics & Financial Statements of Regional Rural Banks 31 March 2023.’

Of the 13 RRBs which were in losses in FY 2021:

- 7 RRBs have turned profitable in FY 2022-2023: Uttar Bihar Gramin Bank. Madhya Pradesh Gramin Bank, Madhyanchal Gramin Bank, Vidharbha Konkan Gramin Bank, Nagaland Rural Bank, Odisha Gramya Bank and Utkal Grameen Bank.

- 6 RRBs continue to be in perennial losses: Assam Gramin Vikash Bank (reported minor profit in FY 2022), Dakshin Bihar Gramin Bank, Ellaquai Dehati Bank, J & K Grameen Bank, Manipur Rural Bank and Paschim Banga Gramin Bank RRBs have posted their highest ever consolidated net profit of Rs49.74 bn in FY 2022-23.

- 4 RRBs have turned around in FY 2022-23 after many years of losses: Nagaland Rural Bank (8 years), Madhya Pradesh Gramin Bank (4 years), Vidharbha Konkan Gramin Bank (3 years) and Uttar Bihar Gramin Bank (3 years).

There are several reasons for losses at 6 RRBs in FY 2022-23. As the repo rate was increased by 250 bps in FY 2022-23, the market value of investment portfolio (SLR securities under AFS and HFT) of RRBs having low CD ratio depreciated. As a result, these RRBs had to provide for Mark To Market losses (MTM losses), High NPA and High Pension Liability. RRBs’ consolidated Capital to Risk Weighted Assets Ratio (CRAR) was at an all-time high of 13.43% as on 31 March 2023.

GNPA Lowest In 7 Years

The asset quality, measured by GNPA (Gross Non-Performing Assets) at 7.28%, was lowest in the previous 7 years, reveals the NABARD’s report. The asset quality position of RRBs continued to improve during FY 2022-23 and the Gross NPA (%) reduced to 7.28% as on 31 March 2023, which is the lowest in the previous 7 years. 34 of the 43 RRBs have reported reduction in absolute Gross NPA (amount) and 37 RRBs have reported reduction in percentage of GNPA. The Net NPA and PCR also improved and stood at 3.2% and 59.2%, respectively as on 31 March 2023.

Capital Infusion For Rural FI

The total recapitalization assistance to RRBs sanctioned during FY 2021-22 (Phase I: Rs81.68 bn) and FY 2022-23 (Phase II: Rs27.22 bn) was Rs108.90 bn including the proportionate share capital contribution by state governments (15%) and sponsor banks (35%). This is in comparison to the total capital infusion of Rs83.93 bn by all stakeholders from 1975 till FY 2020-21, i.e. more capital has been sanctioned for RRBs in 2 years (FY 2021-22 & FY 2022-23) than the capital infused in RRBs over a period of 45 years (1975 to 2021), notes the NABARD’s report.

- An amount of Rs81.68 bn was sanctioned to 22 RRBs during last week of March FY 2021-22 and all the 22 RRBs have received the entire amount of recapitalization assistance sanctioned during FY 2021-22 by 31 March 2023.

- An amount of Rs27.22 bn was sanctioned to 22 RRBs during last week of March FY 2022-23 and 10 RRBs have received the sponsor bank’s share amounting to Rs6.51 bn by 31 March 2023.

The latest scheme aims to rejuvenate and revitalize the RRBs with sufficient growth capital to facilitate reinventing themselves as sustainably viable and self-sufficient financial institutions and for leading the growth process and change in rural areas. The capital infusion will help RRBs in technology adoption and to efficiently cater to the financial inclusion (FI) needs of the rural populace.

The recapitalization scheme is accompanied by operational and governance reforms under the broad ambit of Sustainable Viability Plan (SVP) with a well-defined implementation mechanism aimed at credit expansion, business diversification, NPA reduction, cost rationalization, technology adoption, improvement in corporate governance, etc. The accelerated growth in NII was bolstered by the decline in NPAs of the RRBs, observes the NABARD’s report.

Improvement in CRAR

Apart from the capital support received from the stakeholders, the increase in profitability of RRBs during the last 2 FYs also contributed to the improvement in CRAR. The consolidated CRAR of RRBs, which stood at 10.2% as on 31 March 2021, has steadily increased to 13.4% as on 31 March 2023. Number of RRBs with CRAR less than 9% has declined from 16 as on 31 March 2021 (before the recapitalization process started) to 9 as on 31 March 2023. Of the 16 RRBs whose CRAR was less than 9% as on 31 March 2021, the CRAR of 8 RRBs improved beyond 9% as on 31 March 2023: (i) Bangiya Gramin Vikash Bank (ii) Kerala Gramin Bank (iii) Madhya Pradesh Gramin Bank (iv) Madhyanchal Gramin Bank (v) Odisha Gramya Bank (vi) Utkal Grameen Bank (vii) Uttar Bihar Gramin Bank (viii) Uttarakhand Gramin Bank.

Despite recapitalization assistance sanctioned in FY 2021-22, 8 RRBs continued to have CRAR < 9% as on 31 March 2023 due to losses incurred in FY 2021-22 and FY 2022-23. Of these 8 RRBs, CRAR improved in the case of 5 RRBs during FY 2022-23 Though Himachal Pradesh Gramin Bank (HPGB) has been continuously profitable, its CRAR has been declining over the past 2 years as the growth in capital funds from profits/internal accruals is not commensurate enough to maintain the CRAR over 9% in the face of greater growth in risk weighted assets. The profitability of HPGB has been declining over the previous 2 years primarily on account of provision for pension liability and provision for MTM losses.

Despite recapitalization assistance sanctioned in FY 2021-22, 8 RRBs continued to have CRAR < 9% as on 31 March 2023 due to losses incurred in FY 2021-22 and FY 2022-23. Of these 8 RRBs, CRAR improved in the case of 5 RRBs during FY 2022-23 Though Himachal Pradesh Gramin Bank (HPGB) has been continuously profitable, its CRAR has been declining over the past 2 years as the growth in capital funds from profits/internal accruals is not commensurate enough to maintain the CRAR over 9% in the face of greater growth in risk weighted assets. The profitability of HPGB has been declining over the previous 2 years primarily on account of provision for pension liability and provision for MTM losses.

Business, CD Ratio Improve

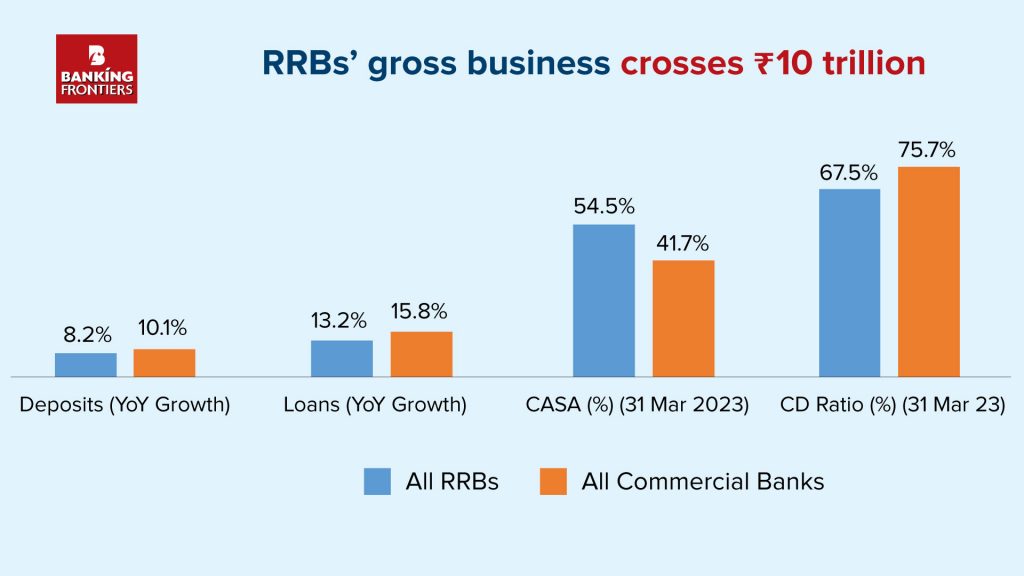

The total business size of RRBs crossed the significant milestone of Rs10 trillion during FY 2022- 23 and stood at Rs10.19 trillion as on 31 March 2023. Deposits, which constituted 78.9 % of the sources of funds, grew by 8.2% during FY2022-23 and stood at Rs6.08 trillion as on 31 March 2023. The growth rate in deposits of RRBs was lower than the 10.1% average growth rate in deposits of all Scheduled Commercial Banks during FY 2022-23. Nevertheless, low-cost CASA deposits constituted 54.5% of the total deposits and RRBs continued to have the highest share of CASA deposits amongst all categories of Scheduled Commercial Banks (public sector banks – 42.1%, private sector banks – 45%, small finance banks – 38.2%, foreign banks – 43.8%).

While the share of RRBs in the total deposits of all commercial banks was just 3.2% as on 31 March 2023, their share in the number of deposit accounts was higher at 13.7% signifying their role in catering to the banking needs of small depositors. RRBs have the highest average deposit amount per account in PMJDY accounts amongst all categories of banks (Rs4292 per account in RRBs vis-à-vis Rs4040 per account for other banks). While borrowings from NABARD grew by 9%, borrowings from other sources witnessed a growth of 177.7%, albeit from the lower base.

Due to the acceleration in the growth rate of all sources of funds, the total balance sheet grew by 9.4% and stood at Rs7.71 trillion as on 31 March 2023. The healthy growth in availability of funds translated to increased credit growth on the assets side as the net loans and advances grew by 13% during FY 2022-23.

CD ratio improved from 64.5 as on 31 March 2022 to 67.5 (highest in over 15 years) as on 31 March 2023 because of the greater growth in loans in comparison to the growth in deposits. The average CD ratio of all SCBs improved from 71.9 to 75.7 during FY 2022-23. There were 45 RRBs in FY 2019-20. Credit expansion led to increase in consolidated CD ratio to 67.50%, which was the highest in over 15 years.

The gross loans grew by 13.2% during FY 2022-23 and stood at Rs4.11 trillion as on 31 March 2023. The average growth rate in loans of all Scheduled Commercial Banks (SCBs) was 15.8% during FY 2022-23. As on 31 March 2023, while the share of RRBs in the total loan amount of all SCBs was 2.9%, the share of RRBs in the loan accounts was 8.0%.

Tech Adoption Getting Up

Keeping in view the need to promote the spread of digital banking in rural areas, RBI, has relaxed the criteria for RRBs to be eligible to provide internet banking. During FY 2022-23: (i) Number of RRBs, which have acquired mobile banking license, increased from 29 to 31. (ii) Number of RRBs, which have acquired internet banking license (transaction facility), increased from 11 to 17, of which Tripura Gramin Bank and Prathama U.P. Gramin Bank have obtained license but were yet to launch the service as on 31 March 2023. (iii) The number of RRBs, which have on-boarded to BHIM-UPI, increased from 25 to 26. (iv) The number of RRBs, which have onboarded to Account Aggregator Framework, increased from 0 to 4.

RRB Darpan Dashboard

To facilitate comprehensive monitoring of performance, a dashboard RRB (RRB Darpan) was developed during FY 2022-23. According to Shaji K V, Chairman NABARD, the pace of technology adoption has increased as more RRBs have started rolling out digital services to their customers. The dashboard presents the progress against the Viability Plan targets and helps RRBs compare their performance with the better performing RRBs in their state and national level.

Data in respect of more than 140 quantitative and qualitative metrics are collected from RRBs on a monthly basis. The dashboard presents the data submitted by the RRBs in the form of ingenious charts and reports with a facility to monitor the progress against the targets for each of the metrics under the SVPs. NABARD periodically collects financial data from the RRBs through off-site surveillance (OSS) returns.

Read more: