The banking industry is undergoing massive digital disruption with mobile apps and e-payments becoming the norm. India had 1.2 billion mobile subscribers in 2021, of which around 750 million were smartphone users. India to have 1 billion smartphone users by 2026, says a Deloitte report. For most people, mobile is becoming the preferred option, whether it is food ordering, ticketing, entertainment, payments, or funds transfer.

On the other hand, this phenomenal trend has also resulted in an increased risk of mobile cyber threats and financial fraud. India ranks fourth in an FBI report on global cybercrime victims after US, UK, and Canada. India reported 2,08,456 incidents in 2018; 3,94,499 in 2019; 11,58,208 cases in 2020; 14,02,809 in 2021; and 2,12,485 incidents in the first two months of 2022. The above figures show an increase of over six times in three years between 2018 and 2021 and more sharply during the pandemic. According to various research reports, about half of mobile banking apps are vulnerable to fraud/data thefts.

Given the multiplicity of threats, any BFSI player would prefer a solution that has a wide range of protections for its mobile apps as compared to multiple solutions with narrow coverage. Here is a list of 10 important features a CISO would desire from a mobile security solution:

- Runtime Integrity Check & Self Protection Capabilities

- Protection from Reverse Engineering & App Tampering

- Zero Trust Device & SIM Binding

- Device Policy Enforcement

- Protection against unsecured Wi-Fi

- Protection against MiTM attack

- Anti Malware Controls

- Regulatory compliance

- Security cloud to be available in India

- Realtime Dashboard for Bank Administrator

AppProtectt, by Protectt.ai, is a one-stop solution that provides all these features. Protectt.ai is a mobile threat defense (MTD) cyber-security company building the next-generation Mobile App, Device & Transaction security solution driven by Deep Tech.

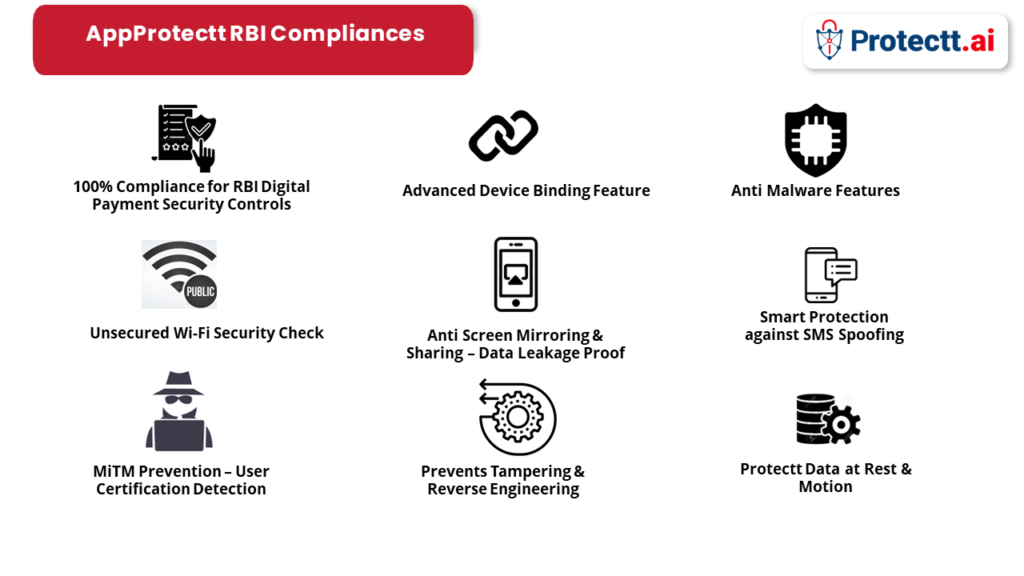

In its Master Circular on the subject, RBI has listed security & controls required to be ensured by the regulated entities in their mobile apps. AppProtectt is a RASP (Runtime Mobile Application Self Protection) based solution and is equipped with all these controls, from antimalware capabilities to device binding to detection of remote control apps or unsecured wi-fi connections and more. The security solution thus helps Banks to be in compliance with RBI guidelines.

In its Master Circular on the subject, RBI has listed security & controls required to be ensured by the regulated entities in their mobile apps. AppProtectt is a RASP (Runtime Mobile Application Self Protection) based solution and is equipped with all these controls, from antimalware capabilities to device binding to detection of remote control apps or unsecured wi-fi connections and more. The security solution thus helps Banks to be in compliance with RBI guidelines.

AppProtectt from Protectt.ai comes in the form of an easy-to-integrate SDK with comprehensive security features. Banks are provided with a real-time dashboard that allows them to gain data insights on various types of threat scenarios on their respective apps.

The Security Configuration Module helps the Bank in customization of the security responses against each threat scenario. The solution thus minimizes the total development cost for the Bank by cutting down the time & expenses towards building security features in the app or hosting a security solution. Customer gets benefited with effortless regulatory compliances and a faster Go-to-Market strategy. Annual App Security Assessment is also offered along with the solution. Thus, AppProtectt’s wide-ranging, evolving features uniquely present an all-encompassing comprehensive coverage.

Says Manish Mimani, Founder & CEO, Protectt.ai: “At Protectt.ai, our mission is to deliver best-in-class Mobile App, Device & Transaction security solutions to the industry and safeguard mobile application usage to enhance customer experience. We aim to build an Aatmanirbhar Bharat in Mobile Cyber Threat Defense area by developing self-reliance, providing Import substitution, stimulating Digital Innovation & developing talent in the Deep Tech space.”

Sunita Handa, Principal Advisor – Strategy, Protectt.ai says: “Mobile apps offer a fertile ground for the digital attackers to find and exploit vulnerabilities to breach an enterprise’s sensitive data. An effective way for a Bank would be, to make its mobile apps self-protect themselves by identifying and blocking attacks in real time. Protectt.ai’s industry-first RASP based solution for mobile apps aptly meets bankers’ need to not only secure their apps from a wide variety of banking fraud / data-leakage scenarios but also meet the related regulatory compliance.”

Apart from offering capable mobile threat defense solutions, Protectt.ai has a well-equipped Product Innovation Center where a dedicated team of cyber security experts is engaged in continuous research work and development of new solutions for ever-evolving mobile cyber threats. This makes the company unique, which instead of providing a stand-alone piecemeal resolution, aims for a holistic solution to offer complete security in the world of mobile banking. Such innovative and comprehensive solutions coming from a home-grown Mobile threat defense firm is a matter of pride for our fast-digitalizing India.

Read More