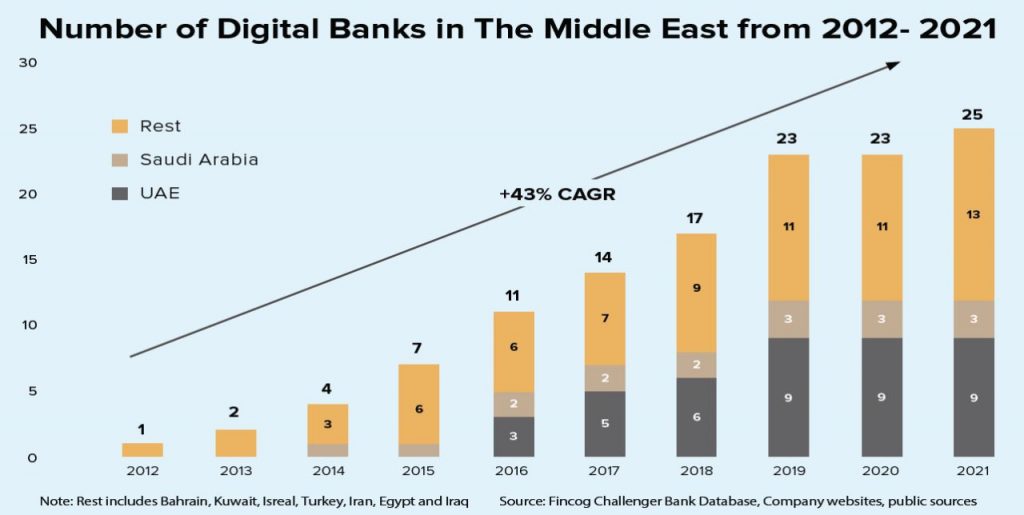

A recent report on the growth of fintechs – specifically digital or neobanks – in the Middle East region predicts traditional banks are bound to face tough competition:

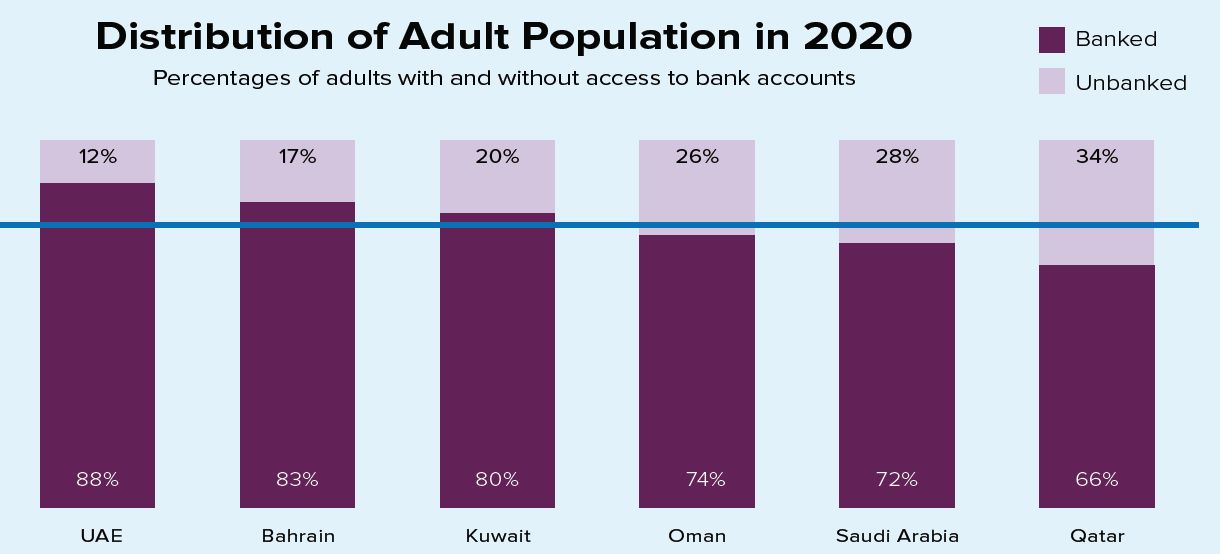

One of the major reasons for the demand for fintech solutions – read digital or neobanks – in the MENA region is the low financial inclusion rate and a high internet penetration, says a report titled ‘Digital Banking in the Middle East 2022’, prepared by banking technology firm BPC Banking Technologies and fintech consultancy group Fincog. The report discusses in detail the digital banking market of the Middle East and the characteristics of successful newcomers that stand out in between the current competitive landscape and provides an overview of players across the region.

READY CUSTOMERS

The report says several segments of the market lack access to the banking system or tend to be largely excluded from it for different reasons, the main being that most women do not have access to financial services due to cultural considerations, and a significant part of micro, small, and medium-sized enterprises are less served because banks find it more profitable to deal with larger companies. “The Middle East is one of the top-scoring regions for its level of internet penetration, with strong and sustained growth over the past decades. This has been a key enabling factor to place customers in a position to easily adopt mobile payment options as well as other innovative financial services propositions delivered online,” stresses the report.

The report highlights that most countries in the region have promoted regulatory initiatives such as innovation labs and sandboxes aimed at showing their open support for digital banking initiatives and for providing a more flexible regulatory environment to catalyse fintech advancement and growth. While incumbents have been slowly advancing their propositions, the report says, fintechs are still better suited to address the unmet needs and problems that confront unbanked and underserved individuals as well as smaller-sized businesses. Fintechs can also leverage innovatively automated and AI-based processes to deliver faster and better suited services that more closely or efficiently fit customers’ needs, it adds.

The report maintains that MENA countries have been building strong foundations for the future development of the (digital) banking industry by creating a supportive and competitive environment and thus are well-positioned to benefit from the growth potential that lies in this sizable, multifaceted and largely unbanked or underserved market.

3 MAIN CATEGORIES

It says there are 3 main categories of actors that are present in the region – incumbent banks, neobanks and non-financial institutions. As far are incumbent banks are concerned, it says the thriving startup environment and innovation culture in the region could potentially become a serious threat to them as they have slowly started to formulate and execute their digital strategy. However, in spite of the burden of their legacy infrastructure and bureaucratic processes, these institutions are launching digital greenfield banks on their own to stay relevant in this evolving market context. It cites the instances of 3 initiatives in this regard – Liv. by Emirates NBD bank, which is a digital-only lifestyle bank built for millennials and one of the fastest growing challenger banks in the UAE, Ila Bank, which is a mobile-only and cloud-first digital bank launched by Bank ABC, an international bank headquartered in Bahrain, offering a broad set of services including a current account with flexible funding options, credit cards, savings and many additional feature and STC Pay, which is the wholly-owned fintech subsidiary of STC Group and MENA’s largest digital wallet and which is helping the Kingdom of Saudi Arabia to move towards a cashless society by enabling financial transactions for it’s more than 7.8 million users.

It says there are 3 main categories of actors that are present in the region – incumbent banks, neobanks and non-financial institutions. As far are incumbent banks are concerned, it says the thriving startup environment and innovation culture in the region could potentially become a serious threat to them as they have slowly started to formulate and execute their digital strategy. However, in spite of the burden of their legacy infrastructure and bureaucratic processes, these institutions are launching digital greenfield banks on their own to stay relevant in this evolving market context. It cites the instances of 3 initiatives in this regard – Liv. by Emirates NBD bank, which is a digital-only lifestyle bank built for millennials and one of the fastest growing challenger banks in the UAE, Ila Bank, which is a mobile-only and cloud-first digital bank launched by Bank ABC, an international bank headquartered in Bahrain, offering a broad set of services including a current account with flexible funding options, credit cards, savings and many additional feature and STC Pay, which is the wholly-owned fintech subsidiary of STC Group and MENA’s largest digital wallet and which is helping the Kingdom of Saudi Arabia to move towards a cashless society by enabling financial transactions for it’s more than 7.8 million users.

As regards neobanks are concerned, these are facilitated by their agile and flexible nature, and are well-positioned to fit the needs and capture the unbanked and underserved part of the population.

Non-financial institutions are also part of the financial services ecosystem, like payment companies, investment firms.

LOW FINANCIAL INCLUSION

The report maintains that the low financial inclusion rates have necessitated innovative fintech solutions and digital banking propositions across MENA. The unbanked and underserved consumers are pushed to look for alternatives to traditional banks that do not meet their needs. This is compounded by a situation where financial services are affected by insufficient funds, there is often lack of the necessary documentation, high cost of services and remoteness from financial locations.

The report points out to a McKinsey study of the region which found that 58% of consumers in the Middle East prefer digital payment methods, with just 10% preferring cash. The number of consumer digital payments transactions in the UAE grew at an annual rate of more than 9% between 2014 and 2019, which is almost twice as fast as Europe’s average annual growth of 4-5% in the same period.

The report says besides consumer attitude, a key element that will be determinant for the successful uptake of these innovative fintechs and digital banking propositions is a delighting customer experience.

CUSTOMER EXPERIENCE KEY

The report stresses that banks need to rethink their processes in order to better adapt them for the digital evolution. “In this exercise, they should go beyond the direct scope of financial products and aim to deliver outstanding customer experiences. It should then be evident that all levels of the organization must be involved and committed to achieving the successful launch of innovative digital financial services. This spans all the way from timely and consistent work from the delivery teams to the C-level that should provide a clear vision as well as adequate sponsorship and funding,” the report recommends.

The report lists the major trends in the Middle East fintech ecosystem that would enable it to reach a higher potential as: regulatory harmonization; the integration of digital financial innovation into traditional banking strategies; and the emergence of new entrants in the market, which could not only challenge incumbent banks, but also build relationships and partner with them.

The report maintains that digital banking is well seen by governments across the Middle East and individual states are looking forward to harvesting the benefits from its increasing adoption. And the governments and regulators are generally proactive and supportive of digital banking initiatives in the region with a number of initiatives such as innovation labs and regulatory sandboxes to catalyze fintech advancements, it adds.

GOVERNMENT INITIATIVES

The report points out at several initiatives that have been initiated by banks in the region to be ready to embrace open banking – like Saudi Central Bank, which released an open banking policy in January 2021 with the country’s open banking framework set to go live in 2022; and the large majority of banks in UAE that are expected to adopt open banking by the beginning of 2022.

It adds that the regional focus on open banking will be a key determinant of financial innovation as players in the Middle Eastern market act on digitizing payment systems and operations to keep pace with shifting consumer demands and expectations. The covid pandemic has in fact accelerated existing evolutionary trends and determined a number of changes in consumer behaviors – which are likely in some cases to be permanent – affecting the way people conduct their daily lives, it adds.

TALENT REQUIREMENT

The report predicts that as competition for talents in the space digitization is already intense globally, and as the region is aggravated by a limited resource pool, it is unlikely that a ‘garage-like’ environment similar to that of the early Silicon Valley will develop in the foreseeable future in the region. “Therefore it is essential for all market participants to create an enabling and nurturing environment as well as put in place effective talent acquisition and retention strategies, also embedding digital across different initiatives in their organization, such as culture, design, brand, and marketing,” it says.

The report also points out that new entrants in the digital banking sector have been attracted by the rising demand for digital banking solutions across the Middle East, driven predominately by customer expectations for digital services and easier reach to the underserved segments of the market through online channels. “On their end, incumbent traditional banks in the region have started to launch independent entities to experiment in this space and pave the way to align their long-term strategy toward digital banking.

Thanks to some characteristic digital capabilities, new entrants have been able to secure a competitive advantage over incumbent traditional banks and meet customer expectations while keeping costs low and achieving high operational efficiencies,” says the report.

The report also advocates that by the nature of neobanks, which operate fully online without a physical location, it is paramount for this kind of new entrants in the market to compensate for the distant relationship with their (prospect) customers by focusing on 2 elements – simplicity and security.

The report also pointed out to a survey among banking customers who have not purchased any digital banking products that almost 1 in 2 respondents blamed product complexity, as they would need a person to explain it to them. Other reasons were lack of availability or awareness of digital solutions and security concerns, each cited by about a third of the respondents.

____________________

Read more-

Decision Dilemma: Is data fact or opinion?