Insurance agents provide services relating to continuance, renewal or revival of policies of insurance. The number of individual agents of life insurers as on March 31, 2022 showed a marginal decline of 0.51% over the previous year. While the private life insurers recorded a growth of 1.35%, LIC recorded a decline of 2.02%. Out of the total 2.44 million individual agents of life insurance industry, 71% are male and 29% are female, according to the ‘Annual Report 2021–22’, released by IRDAI recently.

Insurance agents provide services relating to continuance, renewal or revival of policies of insurance. The number of individual agents of life insurers as on March 31, 2022 showed a marginal decline of 0.51% over the previous year. While the private life insurers recorded a growth of 1.35%, LIC recorded a decline of 2.02%. Out of the total 2.44 million individual agents of life insurance industry, 71% are male and 29% are female, according to the ‘Annual Report 2021–22’, released by IRDAI recently.

Number of agents associated with general and health insurers recorded a growth of 5.56% and 24.83% respectively over the previous year. There are no agents associated with specialized insurers. Out of the total 0.68 million agents of general insurers, 77% are male and 23% are female. Out of the total 0.96 mn individual agents of stand-alone health insurers, 72% are male and 28% are female.

Number of agents associated with general and health insurers recorded a growth of 5.56% and 24.83% respectively over the previous year. There are no agents associated with specialized insurers. Out of the total 0.68 million agents of general insurers, 77% are male and 23% are female. Out of the total 0.96 mn individual agents of stand-alone health insurers, 72% are male and 28% are female.

Corporate Agents Growing

Corporate Agents are entities holding a valid certificate of registration issued by the Authority under IRDAI (Registration of Corporate Agents) Regulations, 2015 for solicitation and servicing of insurance business for any of the specified category of life, general or health. As on March 31, 2022, there were 602 active corporate agents, out of which there are 253 banks, 349 NBFCs / cooperative societies / limited liability partnership firms and other eligible firms.

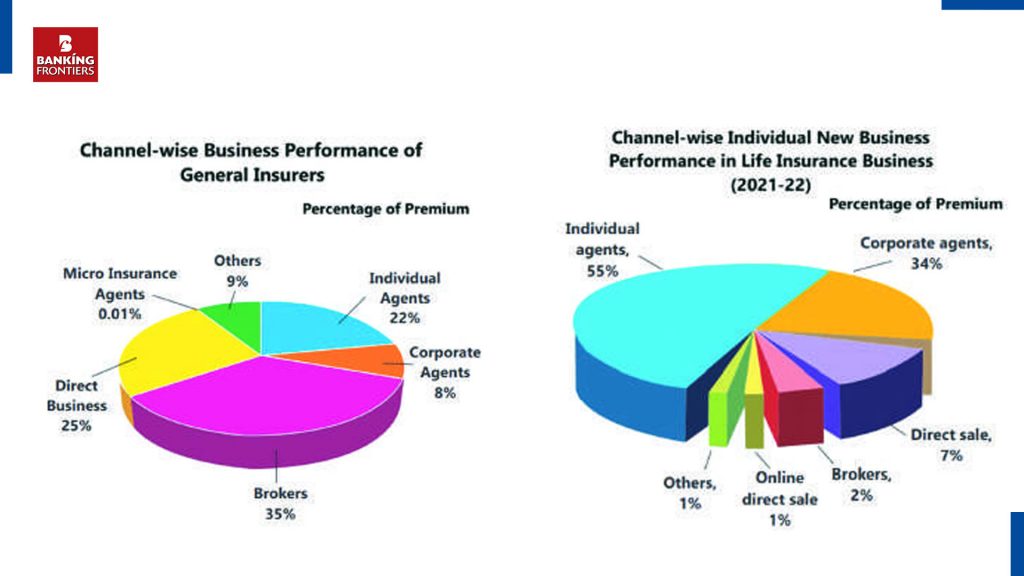

The individual agents continue to be dominant distribution channel in procuring individual new business. The new business premium procured by them is 55% for the year 2021-22 compared to 58.14% for the previous year. The corporate agents continue to lead as the second major distribution channel, and their contribution is steadily growing in procuring individual new business. During the year 2021-22, corporate agents contributed 33.9% of the new business as compared to 30.75% in the previous year.

In contrast to the trends observed in the individual agents, corporate agents continue to be dominant channel of distribution in the new business premium procurement by the private life insurers and stands at 58.23% in 2021-22, while their share is 2.72% for LIC. Micro Insurance (MI) agents, Common Service Centres (CSCs), Web Aggregators, Insurance Marketing Firm (IMF) and Point of Sales (POS) channels together contributed less than 1% to the individual new business premium in 2021-22.

Direct Selling Tops

Direct selling continued to be the dominant channel of distribution for procuring group business, with a share of 88.86% of the group new business premium during 2021-22 (against 90.86% in its previous FY). Corporate agents, in particular banks, continue to be the second dominant channel to procure group business for the private insurers. During the year 2021-22, this channel contributed to 21.47% of the total group new business premium in case of the private insurers, whereas it was 1.06% for LIC.

Amongst various channels of distribution of business for general insurers, broker channel contributed to major share in premium with 35.11%, followed by direct sale channel and individual agents with 25.42% and 22% respectively in 2021-22. The contribution of corporate agents was 8.43% of premium. All other channels together contributed to remaining 9% of premium. For public sector general insurers, individual agents (36.76%) followed by brokers (30.77%) and direct sale (30.17%) are the major channel of distribution while for private sector general insurers, brokers (41.26%) and direct sale (25.38%) are the major channel of distribution.

Individual Agents For Health

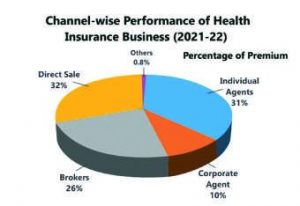

Amongst various channels for distribution of health insurance policies, individual agents contributed a major share in total health insurance premium at 32%. The share of this channel was high at 73% in individual health insurance premium. Direct sale is the second major channel for distribution of health insurance business. 100% of government business and about 30% of total health insurance premium is procured by insurers directly. Another major distribution channel is brokers, who contributed 27% of total health insurance premium. Brokers contribution is at 47% in case of group health insurance business.

_______________

[email protected]

Read more-

Truist Bank: Technology + Touch = Trust