Sharp decline in equity fintech funding witnessed in the first half of 2022:

The winds of change: Trends shaping India’s Fintech Sector’, the second edition of EY’s India fintech report, released at the recent Global Fintech Fest (GFF), provides deep dive into key trends that continue to shape the industry as it looks forward.

Fintech Landscape

India is the third largest fintech market after US and UK, with several fintech unicorns, start-ups, and funding. EY and Chiratae’s recent study shows that the next decade will record a 10X growth in the India fintech market to achieve $1 trillion in AUM and $200 billion in revenues.

According to the Tracxn database, as of July 2022, the number of fintech start-ups in India was over 7300. Some of these are recently founded players in the early days of building minimum viable products. It is supported by an overall funding volume of $30.2 billion, with 35% of the funds raised in the last 16 months. The growth factors include reliable and fast computing power of handheld devices, faster and widespread internet access, and the government’s push for a digital economy. Increased demand for inclusive financial services, customer expectations, and hyper-competitive financial services market underpins the rise and growth of fintech.

Opportunities, Challenges

The innovative spirit of fintech is anchored around the collaborative ecosystem, where banks and insurers are actively partnering with fintech companies. On the brighter side, huge opportunities for fintech outweigh the challenges. Financial inclusion remains an agenda for the government in the wake of traditional FS players’ under-penetration in rural, ageing population, unorganized, and gig segments. Better CX and specialized product expectations present opportunities for fintech companies, such as new models of neo-banking. Insurance and wealth have witnessed a promising uptick but remain highly underpenetrated. Major fintech trends that emerged globally are embedded finance, paytech, e-commerce growth, insurtech, and wealthtech.

Regulatory support and industry adoption of modern infrastructures and emerging technologies such as blockchain, e-KYC, video KYC, IoT, AI, digital signatures, and account aggregation infrastructures are creating the underlying infrastructure for the future of digital-native financial services. By 2030, India will add 140 million middle-income and 21 million high-income households, driving the demand and growth for the India fintech space. India offers massive opportunities for fintech players in the underserved Bharat segments in tier 2 & 3 towns.

Funding Trends

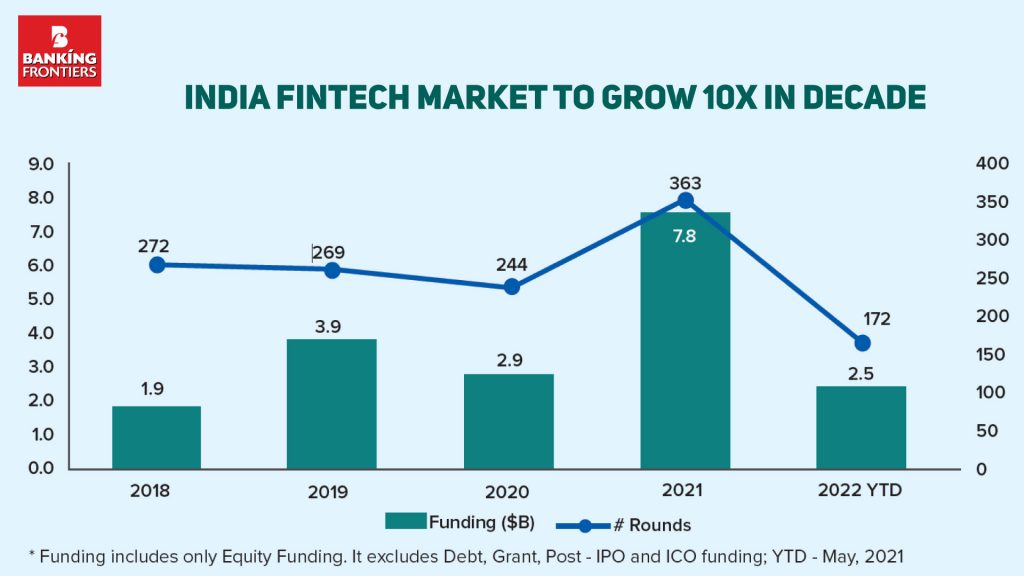

Earlier in 2020, India topped among Asia-Pacific countries in fintech investments, and then extended its lead in fintech investments, with $7.8 billion raised in 2021. The total volume of fintech funding till June 2022 has been approximately $30.2 billion, with 35% of the funds raised in the last 16 months. In 2021, fintech funding recorded a massive surge, clocking at $7.8 billion. While earlier in 2020, fintech faced a dip in funding by 26.7% to $2.9 billion.

In the first half of 2022, the market witnessed a sharp decline in equity fintech funding. As of 30 June 2022, total fintech funding raised (excluding debt, grant, post-IPO, and ICO funding, and corporate minority/majority rounds) stood at $2.47 billion. Several factors could have played a role in this decline, including macroeconomic and geopolitical factors such as the Ukraine war, increase in inflation, and uninspiring financial and public market performance of major fintech companies, creating a dent in investors’ confidence in the future exit prospects. As of June 2022, India had more than 100 unicorns, and in this prestigious pool of start-ups, almost every 4th unicorn is a fintech. But there is a lot of headroom compared to global fintech unicorns; India lags and contributes approximately 7% of the global pool of fintech unicorns.

Access to Capital

Undoubtedly, India is amongst the fastest growing fintech markets in the world, competing closely with the UK in terms of funding volume and number of start-ups. For fintech companies to grow, the availability of funding through VC and PE firms is imperative. In 2021, India bagged over $7.8 billion across 363 VC fintech deals. The overall fintech funding in 1H2022 reached $2.47 billion, led by lending of $0.5 billion, followed by payments of $0.3 billion. In addition, Wealth, InsurTech, and neobank players are rapidly evolving from the nascent stages to promising critical mass adoption that creates investment opportunities for investors.

With limited new licenses, fintech start-ups only have the partnership route to go to market, which is welcomed by banks. Government offices, especially Public Financial Management System (PFMS), are looking forward to collaborating with fintech start-ups to work on better identity verification solutions to improve the direct benefit transfer processes for effectiveness and transparency.

_______________

Read more-