The Reserve Bank of India has kept the repo rate unchanged at 6.5% and has retained the withdrawal of accommodation stance. Following are the views of BFSI stakeholders and economists on the monetary policy meeting outcome announced on April 6:

Dinesh Khara, Chairman, SBI: The RBI’s decision to pause the rate hike, for now, was a pleasant surprise given the market talks of one more final rate hike. With uncertainty looming large, this decision was perfectly timed. Simultaneously, the bouquet of regulatory initiatives like linking UPI to credit and developing the onshore market will spur innovations in product offerings. The decision to enable tracing unclaimed deposits and strengthening grievance redressal are customer-centric. Overall, RBI’s April policy guides the market in terms of expectations alignment.

Sarvjit Singh Samra, MD & CEO, Capital Small Finance Bank: The pause in rate hike is a well-timed decision, and shall go a long way for ensuring financial stability, managing growth and inflation mix while maintaining requisite vigil.

Siddhartha Sanyal, Chief Economist and Head of Research, Bandhan Bank: The 6-0 voting in favour of a pause is stronger than our expectation. In the current EBLR regime of immediate and fuller pass through of repo rate hikes to lending rates, it is heartening to see a more balanced and nuanced approach from the MPC. The material narrowing of trade and current account deficits and range-bound INR must have offered the MPC better comfort for pursuing a more “Fed-independent” monetary policy.

Parijat Agrawal, Head, Fixed Income, Union AMC: Well-timed decision by MPC to pause on evolving global and domestic macroeconomic and geopolitical scenarios. Expecting an extended pause from MPC on the back of resilient growth and inflation trending downwards.

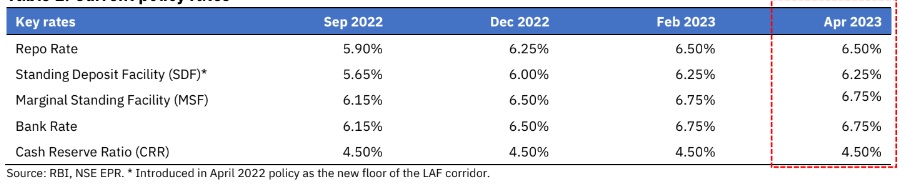

Madan Sabnavis, Chief Economist, Bank of Baroda Research: As against our expectation of a 25bps hike, MPC members unanimously decided to keep the repo rate unchanged at 6.5%. RBI has kept its options open for a rate hike in case upside risks to inflation actually play out. In case there is no severe deviation from the projected path, RBI is likely to opt for a prolonged pause. The 10-year rates will range between 7.2-7.3% in the near term. We expect pressure on liquidity to remain in deficit in the coming months on account of maturing TLTROs (Rs 73,000 crore this month) and the lack of robust FPI inflows. Further, as credit growth is still at a double-digit pace of 15% and deposit growth is at 9.6%, so in the near term as well, a gap of around 5-6% cannot be ruled out. In addition, we also expect VRR and fine-tuning operations to continue in order to manage liquidity. We have concerns owing to the stickiness of core inflation impacting purchasing power of consumers and hence hitting the domestic demand.

Murthy Nagarajan, Head, Fixed Income, Tata AMC: RBI surprised the markets by not hiking policy rates. Real rates which is the difference between expected CPI inflation and repo rates now stand at 1.3 % positive. The bar is now high for RBI to hike rates in the upcoming policy unless macroeconomic conditions change dramatically. The ten-year G-sec yield is expected to trade in the range of 7.10%- 7.30% and may move towards 7 % levels if CPI inflation moves towards 5 % targets.

Prerna Singhvi, CFA, Associate VP, Economic Policy and Research, NSE: Heightened global financial market volatility, uncertain crude oil price outlook, adverse climate conditions and lagged pass-through of input costs are likely to impart upside pressures, with downside support provided by record rabi foodgrains production and easing commodity prices. The growth outlook remains resilient; the estimate for FY24/25 is pegged at 6.5% each (SPF’s FY24 est.: 6%), aided by strong urban demand, and reviving investment activity. Muted external demand, protracted geopolitical tensions, tight financial conditions and rising market volatility pose risks to the outlook.

A modest downgrade in RBI’s inflation forecasts and relatively sanguine growth outlook, coupled with support from easing global commodity prices and a favourable base, seem to be hinting towards an extended pause. Liquidity management as a monetary policy tool is likely to take centre stage now.

Piyush Baranwal, Sr. Fund Manager, WhiteOak Capital Asset Management: Governor Das has clarified that the action should be seen as a pause, not a pivot. We believe that the bar for future rate hikes has moved higher and we may be in for a prolonged pause phase. Key risks in our view of extended pause are 1) continued negative surprise on CPI; and 2) elevated pressure on INR on account of Fed tightening, weakening of capital flows etc.

Indranil Pan, Radhika Piplani & Deepthi Mathew, Business Economics Banking, Yes Bank: The forward guidance remained hawkish as the Governor clearly mentioned that the fight against inflation is not yet over. In our view, the RBI is likely to have moved into an extended pause zone, assuming our and RBI’s model predictions on inflation are correct and there is no surprise in global financial stability risks.

Mahavir Lunawat, MD, Pantomath Capital Advisors: Pause in a rate hike by RBI without withdrawing the accommodative stance is received by the market quite well. Peaking out of Inflation, expanding domestic demand, and robust economic activity backed by strong tax collections are some of the key indicators endorsing the fundamental resilience of India. We expect increasing global footprints and overseas capital travelling to India amidst global uncertainties and continuing geopolitical challenges.

Sanjiv Bajaj, President, CII: We strongly welcome the RBI’s move to decouple from the global tightening cycle and pause interest rate hike, which is in line with what CII had been advocating for a long now. We agree with the Central Bank’s observation that the lagged impact of the past rate hikes should be allowed to percolate into the system, and not stifle demand by further rate hikes. Though the domestic demand impulses remain healthy, the headwinds from the global banking stress have gained pace, hence it was important for the Central Bank to remain cautious in its stance. This move by the RBI will help to bolster business sentiments by containing the rise in borrowing costs which have constricted the pricing power of firms.

Satish Nair, Head, Treasury and Corporate Affairs, Vastu Housing Finance: We expected a pause in the hikes. The housing sector is set on an upward growth trajectory; however, inflation needs to be watched. RBI’s continued commitment to price, financial stability, and sustained growth will result in robust macroeconomic growth.

Subhrakant Panda, President, FICCI; The pause in policy repo rate by RBI is a welcome move given the evolving macro-economic and financial markets scenario. The renewed phase of turbulence that Central Banks are grappling with globally given developments in the banking sector, geopolitics and slowdown in growth & trade flows warranted a prudent response that RBI has delivered. While the Indian economy is showing signs of resilience with growth being broad-based, the outlook globally is somewhat uncertain. RBI’s measured stance articulated today is appropriate as earlier rate hikes are still flowing through the system, and inflation is projected to trend downwards, albeit slowly; any further hike in the policy rate at this juncture would have affected growth, which must be the priority while keeping a close watch on the inflation trajectory.

Achala Jethmalani, Economist, RBL Bank: The policy appears to be a hawkish pause as the MPC turns data-dependent whilst it awaits the monetary efficacy from prior rate hikes to play out into the deposit and lending rates. With the Governor stating that today’s pause on policy rates is for this policy only, it has the elbow room to act on rates if inflation readings surprise on the upside. Basis the current growth-inflation dynamics and the global backdrop, the Repo Rate is likely to peak at 6.50-6.75% with a possibility of a final 25bps to be delivered in 1H FY24.

Prabhat Chaturvedi, CEO, Netafim Agricultural Financing Agency: The central bank is focusing to give impetus to fiscal growth while ensuring that India’s financial system is not exposed to extraordinary shocks. The unchanged repo rate will provide more elbow room to the lenders to increase the credit flow. The policymaker should evaluate the impact of cumulative 250 bps rate hikes in the last financial year, especially MSMEs with retail borrowers before revisiting its aggressive stance on inflation.

Aditi Nayar, Chief Economist, Head, Research & Outreach, ICRA: Financial stability concerns appear to have pre-empted a pause. If inflation does not fall in line with the MPC’s assessment for Q1 FY2024, another hike could be in the offing, especially if the financial stability situation stabilises.

Deepak Sood, Secretary General, ASSOCHAM: MPC has taken a prudent stance in the wake of the high level of volatility in the global financial markets and geo-political events. Even as the RBI’s MPC was reviewing the credit policy for the last few days, ASSOCHAM had made out a strong case for a halt to the rate hike cycle. The policy statement has made a correct reading of the global economy and its possible impact on India, which has done well in terms of growth, billed as the fastest among the major economies without losing sight of the inflationary risks. Even though Indian banks stand in good stead without the kind of risks faced by banks in the US or Europe, RBI has cautioned them about any unforeseen spillovers. ASSOCHAM also welcomes enabling loan accounts of the merchants with the all-pervasive UPI. India is emerging as a champion in financial technologies that would help millions of MSMEs to better manage their trade finance.

Namrata Mittal, Senior Economist, SBI Mutual Fund: Policy could provide a breather to the bond market. We are positive on duration from a yearlong perspective. Though, we would watch out for the market’s ability to absorb elevated government bond supply in the coming weeks. The lag effect of earlier actions and the cumulative monetary and liquidity tightening should enable policy rates to stay on hold incrementally.

Suman Chowdhury, Chief Analytical Officer, Acuité Ratings & Research: RBI’s pause on the interest rates has been primarily induced by the turbulence in the global banking sector brought about by the failures of a few regional banks in the US and the potential contagion risks in other parts of the world. In other words, it is a “wait and watch” policy being adopted for now not only on the global environment but also on the domestic inflation print. What has also helped in taking a pause decision, for now, is the moderation in the hawkish stance from Fed, weakness in the US dollar and the recent improvement in India’s current account position. In our opinion, the likelihood of a continued pause and a pivot to lower rates in the current year is still uncertain. The pause in the rate cycle, however, will be positive for the bond markets and government borrowings. Despite a higher issuance of G-secs in H1FY24, we don’t expect the 10 yearr G-sec yields to move appreciably above the current levels. RBI will also ensure that the liquidity in the system remains either neutral or slightly in surplus.

George Alexander Muthoot, MD, Muthoot Finance: We are glad to witness the confidence posed by the RBI in the healthy growth showcased by the Indian banking and non-banking institutions. Further, positive indicative factors like higher rabi production brightening prospects about the agriculture sector, positive rural demand, and resilience in urban demand continue to boost our confidence that it will positively impact the gold loan demand in the country. To enhance the efficiency of regulatory processes, RBI has decided to develop a secured web-based centralised portal named ‘PRAVAAH’, this will make it easier for various institutions to obtain licenses/authorizations and seek RBI approvals. This will go a long way to strengthen the financial system and reduce the cost of compliance and ease of doing business.

Sumit Chanda, Founder and CEO, JARVIS Invest: Given the backdrop of the global banking crisis, the regulator is absolutely on point in its view that any liquidity tightening at this juncture would have proven to be counterproductive. We continue to believe that Indian equity markets are poised to hit new highs. I reckon it is a good time to be invested in equities. However, prioritising asset allocation would be crucial at such a juncture for long-term wealth creation. The RBI has decided to develop a web portal to enable search across multiple banks for possible unclaimed deposits based on user inputs. The search results will be enhanced by the use of certain AI tools. This further amplifies the various use cases of AI in financial systems and powering customer experience.

Y. Viswanatha Gowd, MD & CEO of LIC Housing Finance: Keeping repo rates the same may put to rest the anxiety amongst the borrowers that emanated with the EMI increase consequent to a series of repo rate hikes. RBI’s move sends a positive signal and improves the sentiments. We expect the real estate along with other sectors to build up on this as it has come at the beginning of the new financial year. The prospective homebuyers will now be encouraged to crystallise their buying decision.

______________