Credit growth of urban cooperative banks (UCBs) has picked up moderately. Both scheduled UCBs (SCUBs) and non-scheduled UCBs (NSUCBs), have already attained the March 31, 2023 target29 of priority sector lending of a minimum 60% of their outstanding credit. The CRAR of UCBs improved further in H1:2022-23 to reach 16.1% in September 2022. The CRAR of SUCBs improved from 14.3% to 14.9% and of NSUCBs from 16.8% to 17.1%, according to the Financial Stability Report December 2022, released by the RBI.

Credit growth of urban cooperative banks (UCBs) has picked up moderately. Both scheduled UCBs (SCUBs) and non-scheduled UCBs (NSUCBs), have already attained the March 31, 2023 target29 of priority sector lending of a minimum 60% of their outstanding credit. The CRAR of UCBs improved further in H1:2022-23 to reach 16.1% in September 2022. The CRAR of SUCBs improved from 14.3% to 14.9% and of NSUCBs from 16.8% to 17.1%, according to the Financial Stability Report December 2022, released by the RBI.

After a significant improvement in March 2022, the GNPA ratios of UCBs worsened again for both SUCBs (from 7.5% to 9.1%) in September 2022. Their NNPA ratios also deteriorated in H1:2022-23. Despite an increase in provisions, there was a decline in PCR of NSUCBs and SUCBs to 47.3% and 59.9%, respectively. The concomitant rise in CRAR and decline in PCR indicate lower provisioning relative to GNPA. Going forward, in the absence of improving profitability, additional provisioning to meet the increase in NPAs would result in a reduction of capital levels.

While net interest margin (NIM) remained steady in September 2022, profitability in terms of RoA and RoE ratios has improved continuously since March 2021.

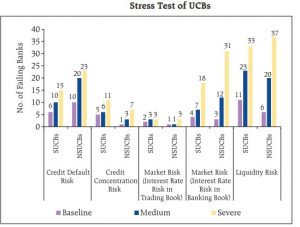

Stress tests

The results of stress tests, conducted on a select set of UCBs, show that (a) in all the 5 parameters tested, a few banks failed even in the baseline scenario; (b) the impact of credit default risk is higher than credit concentration risk in all three scenarios; (c) impact of the shock on the trading book is minimal; (d) severe stress on banking book would cause the failure of a large number of UCBs and (e) liquidity shocks impact the largest number of UCBs. Under the severe stress scenario, system level CRAR diminishes by 349 bps, 337 bps and 90 bps for credit default risk, credit concentration risk and interest rate risk in the trading book, respectively; while NII declines by around 20% under the severe stress scenario for interest rate risk in the banking book.

___________

Read more-