Customers respond tremendously to lending platforms of banks:

Bankers make interesting presentations at the time of annual & quarterly results for investors and analysts, which contain treasures of information. Here is an account of how leaders at some of the leading banks analyze their own IT & digital initiatives, undertaken throughout FY 2022-23.

API Stack, UPI, Web

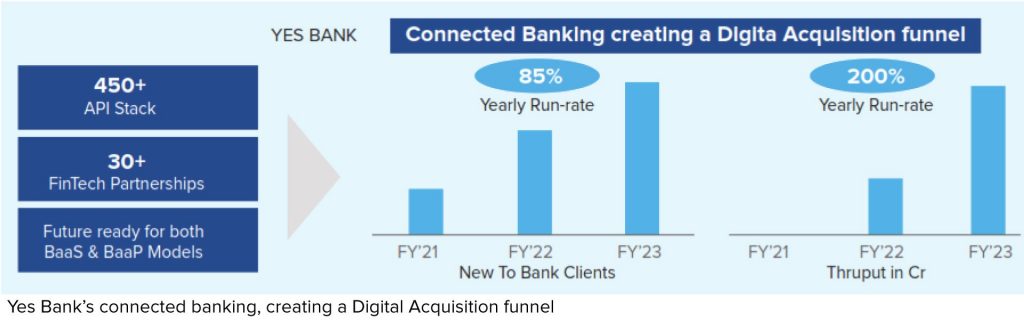

YES Bank, the 6th largest private sector universal bank, has a pan-India network of 1192 branches, 150 BCBO (business correspondent banking outlets) and 1300+ ATMs across 300+ districts of India. The bank has been leveraging advanced scorecards and analytics across underwriting and engagement. It has adopted the account aggregator ecosystem as Financial Information User (FIU) / Financial Information Provider (FIP) to capitalize on consent layer of India stack. It recorded 70% y/y growth in API banking throuput with leading market share in UPI, NEFT (Rank #1), NACH, RDA & IMPS. It registered 99.45% success rate on UPI transactions.

Prashant Kumar, MD & CEO of YES Bank, said at earnings call for Q4FY23: “We are building as new age professionally run, granular retail franchise. We are preferred banker to Digital India with best-in-class technology / API stack.”

At HDFC Bank, payment system indicates business activity continues to be robust with 15% growth in RTGS, NEFT transactions value and a 51% growth in UPI payments. Srinivasan Vaidyanathan, Chief Financial, Officer, HDFC Bank, observed at earnings call for Q4FY23: “On the website, our registered traffic during the quarter received an average of 132 million visits per month with over 106 million unique visitors over the quarter and y/y growth of around 74%.”

Partner, Solution, Tech Spend

Salesforce implementation is helping YES Bank in process improvement and customer delight. It is one of the leaders with more than 0.85 mn BCs. It has partnered with Aadhar Housing Finance, one of India’s largest affordable housing finance companies to provide convenient home finance solutions. Prashant Kumar said: “We issued the first Electronic Bank Guarantee (e-BG), in partnership with National E-Governance Services Limited (NeSL).”

Cards, Apps, Users, Value

YES Bank is the 2nd largest player in micro-ATMs. It registered steady growth in new card acquisition, leading to 20% y/y growth in customer base to reach 1.4 million. It recorded the highest ever new card acquisition of 64,000+ cards and spends of `17.15 billion in March ’23. Prashant Kumar pointed out: “The first bank in Asia Pacific to bring forth a debit card on Mastercard’s premium World Elite Platform that caters to ultra-high net worth individuals.”

YES Bank is the 2nd largest player in micro-ATMs. It registered steady growth in new card acquisition, leading to 20% y/y growth in customer base to reach 1.4 million. It recorded the highest ever new card acquisition of 64,000+ cards and spends of `17.15 billion in March ’23. Prashant Kumar pointed out: “The first bank in Asia Pacific to bring forth a debit card on Mastercard’s premium World Elite Platform that caters to ultra-high net worth individuals.”

HDFC Bank’s PayZapp 2.0, which was rebuilt from ground up, is available to public at large. The bank has 3.9 million acceptance points with a y/y growth of 30% as adoption of Vyapar app builds momentum. SmartHub Vyapar continued to add new features to the bank’s one-stop merchant solution app. As of March end, over 1.5 million small businesses are on this SmartHub platform.

HDFC Bank’s PayZapp 2.0, which was rebuilt from ground up, is available to public at large. The bank has 3.9 million acceptance points with a y/y growth of 30% as adoption of Vyapar app builds momentum. SmartHub Vyapar continued to add new features to the bank’s one-stop merchant solution app. As of March end, over 1.5 million small businesses are on this SmartHub platform.

The bank issued 1.4 million cards during the last quarter. The total cards space is now 18 million. Srinivasan updates: “We witnessed upwards of 75,000 new card additions per month during 2022-23. During the last quarter, our retail card issuing spends also showed robust growth of 31% y/y. The SmartHub Vyapar app has garnered tremendous growth with 3-fold increase in active users and more than 3-fold in merchant transactions value.”

Platforms, Digital Journeys

YES Bank’s digital lending platform has been providing seamless customer approval experience. It has self-assist digital tools – MSME App, Trade-On-Net, FX Online, etc. It provides for digital documentation, it has launched E-Sign / E-Stamp for SME banking.

The bank has revamped its UI for mobile banking and net banking for seamless user experience. 90% of its transactions take place via digital channels. Its Loan in seconds (LIS) platform and front-end automation initiatives (Yes Robot) have resulted in lower TAT along with higher productivity. Digital acquisition contribution for the bank is at 81%, leading to seamless customer onboarding experience and lower cost.

98% of YES Bank’s cash management throughput comes from digital modes transactions on its Smart Trade Platform, which saw 20% y/y growth by volume. Prashant Kumar gave further example: “YES XPRESS is industry first digital onboarding platform, extending seamless onboarding experience for availing cash management services (CMS) & smart trade products.”

‘Express Car Loans’ is an end-to-end digital lending journey platform of HDFC Bank, facilitating instant and hassle-free car loan disbursals to existing as well as new-to-bank customers. Srinivasan points out: “It has been witnessing tremendous response from customers. Express Car Loan volume now contributes 20% of our new car loan volume.”

Read more-

Digital to Educate & Differentiate