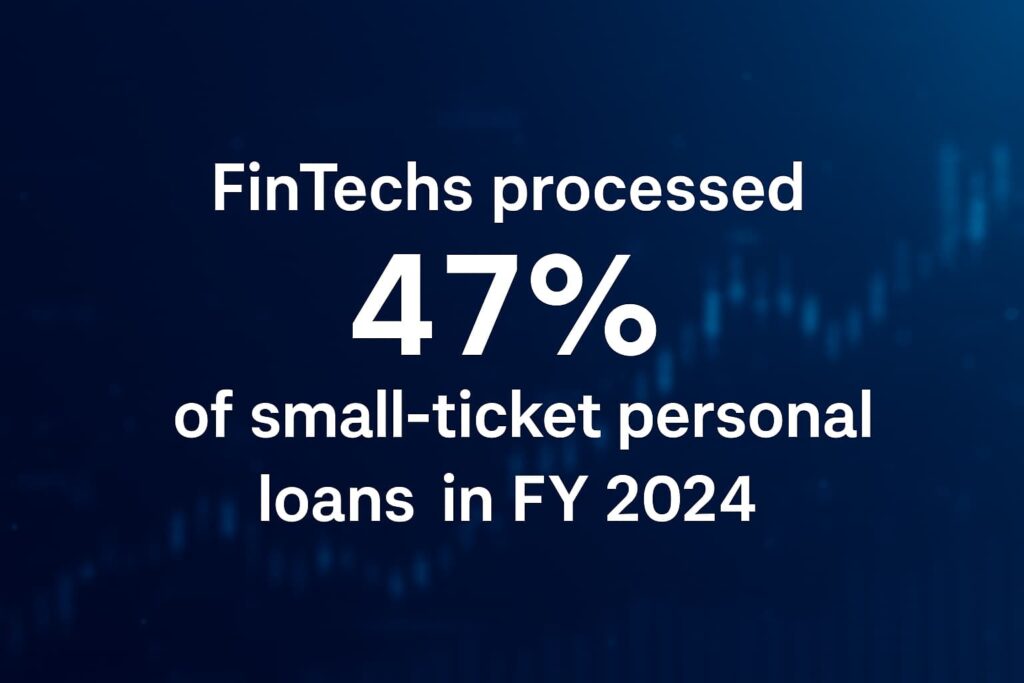

FinTechs processed approximately 47% of small-ticket personal loans of less than 1 lakh in FY 2024. FinTech players have emerged as powerful enablers, transforming how credit reaches previously unserved and underserved populations. By leveraging the power of technology, they have significantly lowered the cost and complexity of delivering financial services to the last mile, stated M Rajeshwar Rao, Deputy Governor, Reserve Bank of India, at TransUnion CIBIL’s Credit Conference in Mumbai.

This has not only improved the user experience but also addressed persistent challenges that had kept many individuals outside the formal credit system. “Importantly, we are seeing a growing collaboration between FinTechs and traditional financial institutions. This partnership is particularly impactful in credit origination and supply chain finance, where it bridges gaps created by physical infrastructure and human resource constraints in remote and rural areas,” he noted.

Speaking about improved access to credit, the Deputy Governor noted that over the years, India’s household debt as a percentage of GDP has increased and stands at 43% in 2024. This rising trend is fuelled more by an expansion in the number of borrowers rather than just through an increase in average indebtedness.

Despite some moderation observed recently, the growth in deployment of bank credit under the ‘retail/personal loan’ category witnessed a CAGR of approximately 17% over the past five years. Moreover, the composite Financial Inclusion (FI) has improved substantially from 49.9 in 2019 to 64.2 in 2024, indicating progress in the deepening of financial inclusion in the country.

Rajeshwar Rao hailed the role of Unified Lending Interface (ULI) in simplifying and democratising credit access by offering lenders regulated, seamless access to verified borrower data. The convergence of Jan Dhan Accounts, Aadhar and mobile phones, UPI and ULI represents a significant advancement in India’s digital lending infrastructure. One of ULI’s standout features is its ability to tap into alternative digital data, enabling access to credit even for those without formal financial histories.

ULI’s integration with NABARD’s e-KCC portal is expected to extend access to customers of District Central Co-operative and Regional Rural Banks, previously excluded from formal digital channels. Integration of state-level digitised data, such as land records and cooperative databases, into the ULI framework will provide novel cash flow-based lending solutions. Going forward, the potential for ULI to also harness data from e-commerce platforms and gig economy apps could open new doors for credit inclusion for small sellers, delivery workers, and freelancers, he added.