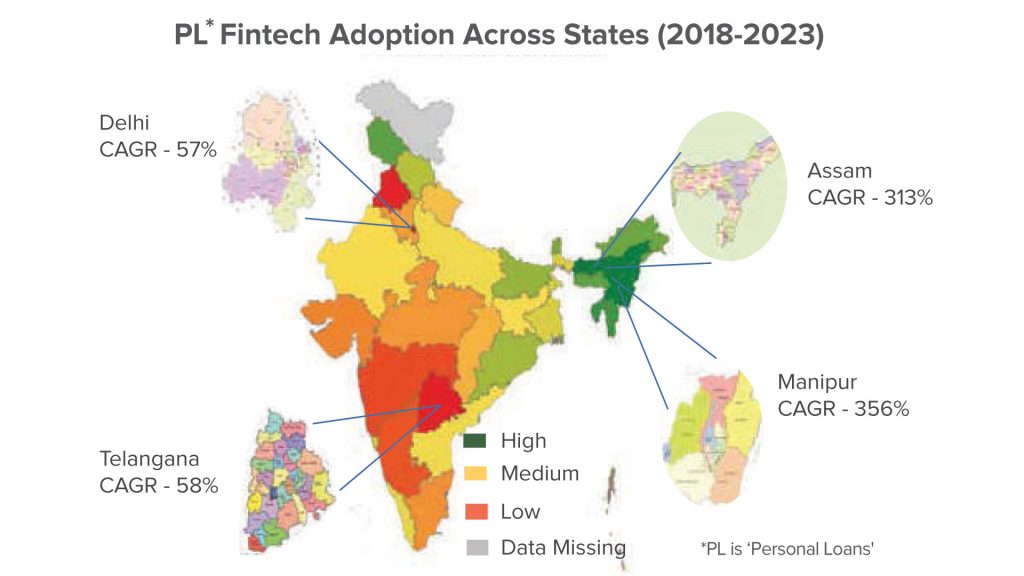

A white paper by credit information services firm Experian India highlights the growth prospects of the fintech sector in India:

A remarkable growth shown by the fintech sector in India, driven by technological innovation and digitization has facilitated a major surge in small-ticket unsecured lending, aided by digital infrastructure, Experian India. The white paper, titled ‘Building a Sustainable Fintech Portfolio: Experiences and Lessons for Future’ is upbeat about the prospects of the sector, saying: “With digitization surging ahead, the fintech industry’s influence is poised to extend into previously uncharted territories, including 2-wheeler and used car financing. Though Expected Credit Loss (ECL) for fintech may be slightly elevated, it is effectively balanced by the allure of higher interest rates. To safeguard their margins, these innovative companies are diversifying their revenue streams through strategic collaborations with lending institutions.”

The white paper highlights the crucial role of government support for digitization and the enactment of stringent data protection laws, instilling confidence in data utilization. It also says regulatory support has played a pivotal role in enhancing asset quality, further bolstering fintech’s position in the lending landscape.

MILLENNIALS’ PIVOTAL ROLE

“India’s aspirational class and tech-savvy millennials are poised to play a pivotal role in shaping the lending landscape. This demographic surge is set to be a significant driving force in the industry’s continued evolution,” predicts Experian India.

Some of the highlights of the fintech scenario as listed in the white paper are:

- 61% consumers appreciate fintech’s inclusivity via alternative data.

- 42% consumers prefer personal loans for flexibility.

- Fintech attracts more NTCs with lower personal loan interest rates, compared to the rest of the lending industry and Fintech Enabled lenders.

- Fintech has nurtured Buy Now Pay Later (BNPL) borrowers through a seamless customer experience and by offering instant approval.

The white paper also mentions that in the personal loan segment

- Fintech & fintech enabled enterprises hold a 47% market share in 2023 in less than Rs100,000 unsecured personal loan segment by count, up from 13% in 2018.

- Young professionals are showing a strong preference for personal loans.

- Many new age lenders offer instant digital loans with 15-minute disbursement.

And in the business loan segment

- Fintech & fintech enabled enterprises hold a 27% market share in 2023 in the Rs1 million and above unsecured business loan segment by count, up from 23% in 2018.

- Entrepreneurs are increasingly opting for small ticket size (Rs100,000 and above) business loans.

IMPACT OF TECHNOLOGY

The white paper also points out the transformative impact of technology on lending, ensuring both seamless customer experiences and robust underwriting practices. It says the key takeaways extend to fintech’s pivotal role in small-ticket lending, effective strategies for market expansion, valuable insights into risk management, and the imperative for diversification.

Observing that in the fintech ecosystem there is a greater emphasis on leveraging technology and analytics to create customer journey with reduced friction, the white paper says the ecosystem also ensures that underwriting due diligence standards do not get diluted.

The other key takeaways in the white paper are:

- Fintech have made significant inroads in the small ticket lending as also enabled many private lenders to ride the digital wave through partnership model such as Co-Lending and being Lending Services Provider.

- Fintech created a niche by creating ‘blue oceans’ as against focusing on available white spaces in the addressable market such as customers who are new to credit or with bureau score below 700. By offering frictionless journey and contextual selling (embedded finance) fintech even got credit averse segment to opt for credit.

- Fintech portfolio had higher delinquency but seem to price the risk as interest rates were found to be higher than industry. Hence, while there is no apparent sign of deep stress it is important to grow the portfolio cautiously given limitations of digital collection.

- Further, given limited product mix of fintech it is important for them to find new revenue streams such as being a partner in the growth of other regulated entities on asset-based products.

Read also:

Ransomware detection declines, APT activity rises

Two NBFCs with ambitious tech plans

NIA organizes its 19th Insurance Summit