Nedbank Group approaches digital transformation from a different perspective – maximum convenience of its customers:

South African financial services group Nedbank Group has its digital transformation essentially aligned to offer convenience to customers. The Group has gained deep insights into its customers’ behaviour, and this is the basis for its development of digital banking solutions.

The Group has developed a range of digital and mobile payment solutions forming part of its transactional banking package based on payment data insights – basically understanding the customers’ buying patterns, knowledge of the demographics and other valuable market information. An ideal example is Nedbank Enterprise, a tool that can be fully integrated into a customer enterprise’s website, so that the enterprise does not have to leave the site to another to make payments.

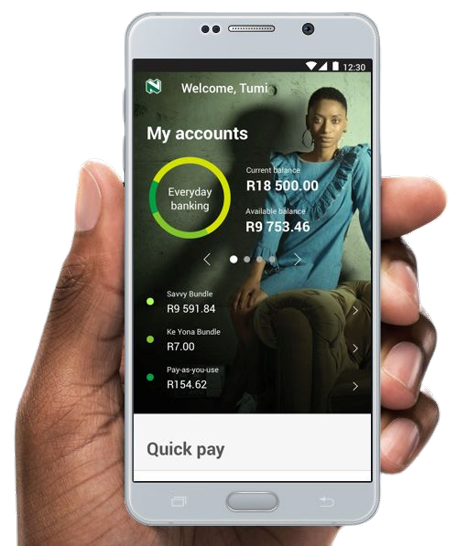

MANY USES OF NEDBANK MONEY

The Nedbank Money app is another digital initiative, which allows the customer to bank anytime, anywhere. He can use it to buy electricity, data, or airtime, chat with a live service agent about anything to help one to be bank savvy, check balance 24×7, send money in real time and open up to 10 MyPocket accounts for free. The app is actively used by 1.8 million clients.

Yet another key innovation is Avo, an all-in-one superapp to facilitate a customer’s lifestyle needs. It brings customers and businesses together, matching customers’ lifestyle needs to product and service offerings through an AI-powered app, which also ensures safe and secure payments. The platform allows users find home services, shop online for groceries (with the option of receiving one delivery from multiple retailers), buy take-aways, tech and home appliances, or search for the next family holiday, entertainment options, security solutions and more.

CENTRALIZED TECH UNIT

The Group has a transformative centralized technology unit that has responsibility for all components of the Group’s IT infrastructure and systems. The unit’s mandate is to future proof the IT ecosystem, including all systems, databases, technology infrastructure, software development, IT projects / program management and IT Strategy on behalf of the Group. At the core of the unit’s functioning is the strategy to ‘Digitize, Delight and Disrupt’ the financial services industry through rapid innovation.

AGILE PRACTICES

The Group had adopted agile practices very early in its transformation journey. It introduced DevOps practices, starting with the easier components of the technical stack, the front ends. But there were roadblocks, mainly created by the use of mainframe. However, the Group could successfully overcome the hurdles.

The Group is using Azure-based compliance technologies to increase data privacy and security. It is also using Microsoft Dynamics applications in managing customer relationships. It has also worked with Microsoft to develop a chatbot – EVA, or Electronic Virtual Assistant – that can understand the context of clients’ questions, then answer those questions, provide investment advice and prepopulate forms for investor clients.

89% OF IT UPGRADE OVER

Nedbank Group has recently announced that it will spend R1.3 billion to carry forward and complete its digitization project. On the occasion, it also reviewed its Managed Evolution technology strategy and realized it has completed 89% of its IT upgrade. It also said the transformation initiatives helped it to increase the number of digitally-active retail clients in South Africa by 10% to 2.4 million (H1 2021: 2.3 million) and by 60% since H1 2019.

The Managed Evolution technology strategy allows the Group to innovate quickly because it has modernized the infrastructure to be more agile, more modular and allows faster innovations. The Group could also cut down IT platforms from an earlier 250 to 76 now.

The Group has adopted cloud to ensure that the way financial services are delivered to clients undergoes maximum changes. Specifically, it sees agility, cost reduction, innovation and enablement of convenient, on-demand network access to a shared group of computing resources as the main benefits of cloud. It adopted a multi-vendor strategy and has partnered with global industry leaders.

UNIQUE DIGITAL ASSISTANT

In the use of AI, the Group has collaborated with Kasisto, which has created KAI, a digital platform for financial services, to power its intelligent digital assistant, Enbi. Enbi offers customers an intelligent, insightful and friction free digital banking experience by assisting them conversationally with their day-to-day banking needs and questions.

It is the endeavor of the Group to meet whatever needs its customers have. This is done by introducing dynamic, customer-centric mobile-first solutions. This means designing and creating a customer experience that distinguishes the Group from other financial institutions. And this is achieved through agile ways of work and having the ability to understand, articulate and respond to customer needs as part of design and technology decisions.

_______________

This article has been compiled based on publicly available information on the web, particularly the bank’s own website.

Read more-