In tier 4 cities, cash is used as a mode of payment in 90% of e-commerce transactions, compared to 50% in tier 1 cities. Here is some interesting data on how cash in India has returned to the Rs 29 trillion level. This is more than double the low seen during the demonetization period.

CIC up at Rs 29.25 Tn

CIC up at Rs 29.25 Tn

According to the RBI’s latest weekly statistics report, released on October 29, cash in circulation (CIC) increased by Rs 91.23 billion in the week ended October 22, 2021 (compared to March 31, 2021) to Rs 29.44 trillion, indicating that cash is back in the financial system during the festive season.

CIC increased by Rs 111.15 billion in the week ending October 15, 2021, indicating a 9% year-on-year increase. Currency with the public has increased by Rs 91.46 billion to Rs 28.43 trillion as of September 24, compared to Rs 27.51 trillion at the end of March.

Index: Cash up 19% in 3 years

The CMS Cash Index shows significant increases in cash requirements in the economy with the onset of the festive season, as has been the case for the past three years, since 2018. In the last three years, the CMS Cash Index shows a 9-19% increase in cash. The CMS Cash Index reflects the ebb and flow of commerce in India, as well as the peaks of festivals and wedding seasons, pay days, recessions, and crisis events.

Unbanked rural population

Around 150 million people in the country are still unbanked, with cash being the only mode of payment. A sizable unbanked rural population uses cash. According to Anush Raghavan, President of the Currency Cycle Association, 90% of e-commerce transactions in tier 4 cities use cash as a mode of payment, compared to 50% in tier 1 cities.

Uptick in CIC now due

Cash circulation in the economy jumps as the festive season drives up demand. Anush provides an update: “Cash has been and continues to be resilient in India, given the consumption-driven nature of the economy. The demand for cash and cash transactions in India jumped this festive season, beginning with Dushera. The demand is going to intensify during Diwali.”

Historically, cash demand during the festival season has been high because a large number of merchants rely on cash payments for end-to-end transactions. “This festive season, which coincides with the salary/bonus cycle in the same week, will result in an uptick in cash in circulation,” he added.

CIC has already increased by Rs 875.80 billion till date in FY22. Despite a rise in digital payments, CIC in India is expected to reach Rs 41.53 trillion by fiscal year 2025.

CIC to GDP ratio likely to be 14%

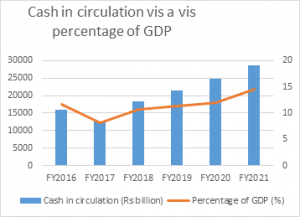

The amount of money in circulation as a percentage of GDP is also increasing. CIC increased by 14.5% of GDP to Rs 28537 billion in FY 2021, up from Rs 24728 billion (12% of GDP) the previous year. According to RBI data and Ken Research, CIC was Rs 15981 billion, or 11.6% of GDP in FY 2016.

Historically, the cash in circulation-to-GDP ratio ranged between 10% and 12% until FY20. However, following the Covid-19 pandemic and the increase in cash in the ecosystem, CIC to GDP is expected to rise to 14% by FY25.