Banking Frontiers organized a panel discussion in Kochi, Kerala with senior executives from banks and NBFCs. Edited excerpts:

Panelists

Sony A, CIO, Digital Head, South Indian Bank

Muraleekrishnan Nair, Global Head, Cloud Infrastructure and Security, UST Global

K N C Nair, CIO, Muthoot Group

George John (Bobby), ESAF Small Finance Bank

Subbu Subramanian, Country Manager, Dynatrace

Babu Nair, MD, Banking Frontiers (Moderator)

Babu: How has the transformation been from the legacy system to the new age digital platform?

Murali: Our journey has been from a legacy system to a cloud-based system. In my opinion, moving to the cloud should yield definite business benefits. Reduction of cost of the data centre should not be the only reason to move to the cloud as cloud space is not cheap either. Hence, good planning is required.

Babu: How has been your experience in the transformation because your bank was the first to implement a core banking system?

Sony: Not just core banking, we were the first bank to go live in UPI also which was challenging. Today it is easier to get the appropriate funds for innovation and taking banks forward. Our customer focus innovations are now appreciated by one and all. One such example is E-lock which is a single on-off switch for all digital debits. We talk to customers to get to the root of the problem. Which we are trying to solve using the ‘new and renew’ process.

KNC Nair: For the growth of the bank, customer should be offered unique products and services. We wanted to make disbursing gold loans as easy as drawing money from ATM. After exploring and experimenting we came up with a core banking solution which was developed internally and disburse the gold loan in 15 minutes.

During demonetization, we had another challenge as we deal with cash. Our in-house team came to the rescue and we could scale up the online banking. For effective seamless working, the existing infrastructure has to be re-engineered.

George: Digital transformation cannot be done overnight. Even though we are only 6 years old, certain applications are old. Instead of throwing away the whole legacy system, one can build an ecosystem around it. Or fintech partnerships can be sought.

Babu: During the transformation journey, what failures for events are actively impacting the user experiences?

Subbu: The typical problem with enterprise customers is legacy. We have to co-exist with new and old systems. There are banks which are still using obsolete technology and want more time before moving to new technology. And these banks are having silo applications which do not interact with each other. In the race of trying to be first many banks have failed. The magnitude of failure in such cases depends on the size of the bank.

Subbu: The typical problem with enterprise customers is legacy. We have to co-exist with new and old systems. There are banks which are still using obsolete technology and want more time before moving to new technology. And these banks are having silo applications which do not interact with each other. In the race of trying to be first many banks have failed. The magnitude of failure in such cases depends on the size of the bank.

Babu: How do you get the visibility of these problems where the bank gets to know the issue?

Subbu: In my observation there are 2 major underlying issues for all technological problems. One is concurrency the other is contention. Concurrency is when the application is trying to do many things together. Contention happens when all applications are reaching the same point and want an immediate response. We try to solve this by collecting the data points and put together so that it becomes meaningful. We ask for the tough problem and do a proof of concept to prove that the application or system built has flaws. The ability to observe all the data points that any application would touch gives us credibility. Once data is collected it is sorted into good and bad behaviour. So that we can fix a problem before it actually becomes a problem. And this is where AI and ML come into the picture.

Babu: How do you get good observability in multiple environments?

Murali: We have a NOC which monitors the network, including infrastructure. Another team monitors the applications. They are not connected and are in silos. To address this, we have brought in a ‘reliability operation centre’. The reliability concept is that it knows about everything about the environment and connects and makes sense of it. For example, if there is transaction failure or slowdown, the system should be able to detect and give solutions before breakdown. To achieve this, tools are available. To provide a great customer experience everything should be connected and make sense of logs, traces and matrices.

Babu: What have been the interesting performance indices that you have witnessed?

Sony: The concept of entropy for performance matrix helps us in predicting the system degradation. The build-up of problems which happen over a period, which does not create an issue in a normal scenario, is mostly the reason for the problems during a crisis. Having a performance matrix at each layer helps in triggering alerts when thresholds are crossed. Because each broken journey is a hindrance to digital adoption.

Babu: How are the parameters controlled in the gold loan business? What are the key performance indices and how do you get observability?

KNC Nair: We continuously monitor the turnaround time using built-in parameters. But at times the captured database may not reflect the reality for which regular feedbacks are taken. And at times we also collect random data and validate it with real reasons for delayed loan disbursement. At times loan repayment is not reflected in the system but with the help of AI and ML, we credit the customer’s account.

Babu: From a tech perspective what are the key performance indices?

Subbu: It benefits a lot when the goals of the journey are set in advance in stages. These goals should be reviewed regularly. The final dream would be to get into the proactive stage.

Babu: How are organizations making sense of data across the organization that is useful?

George: Data is new oil but is scattered in different stages for which we have to bring in a platform where all can be integrated together. The importance of data should be communicated to the team. All the data should be used for proactive remedies and to give a better customer experience.

Babu: Is there any interesting experience which you want to share regarding data?

Sony: Bankers have to keep in mind the penalties in case of a data breach as they attract penalties, along with harm to reputation, and a deficit in customer trust. There is an explosion of new forms of data sources including government authority, meaning data can be collected from external sources. It is a big challenge for all bankers to manage and safeguard the data.

Murali: IoT devices coming into the system are throwing data at a high level. Only if we make sense of all this data then it will be useful to all of us.

Babu: How will focused cloud mapping help in making versatile innovations safe and help in observability?

Murali: Cloud technology has very good security features controls at the enterprise level add to the security. The process which is perceived from business to IT and from there to move to the cloud and coming back in form of feedback constitutes SRE.

Babu: In a multi-cloud environment, what are the tools they must use to maintain observability?

Subbu: Before moving to the cloud, we suggest our clients categorise the applications as all applications are not meant to be on the cloud. We also give suggestions for data monetization. Also, those data which are not relevant need not be stored in expensive format. There are tools which help in identifying such data which the banks can adopt.

Babu: Some quick learning experiences which you want to share?

KNC Nair: Once a customer comes to us for a gold loan, we collect enough data. And profile the customer for further transactions without even pledging gold.

Murali: The reason for the delay in credit ratings for the Indian market is that there is no standardization of data.

Sony: Digital is not just having applications on mobile. We believe in Indulge, Nudge, Purge and Forge. There are a lot of activities where physical still plays an important role. The next level will be an omnichannel experience.

George: Whatever technology we adopt customer experience management for both internal and external customers is important. Keeping Indian geography and demography in mind before any innovation is the key to the success of the innovation.

Subbu: Not taking any risk is the biggest risk.

Audience: Where do you think the unstructured and semi-structured data should be stored?

KNC Nair: A hybrid approach having an in-house cloud approach might be the answer. But the issue with that will be it is not flexible as a public cloud. And is not very scalable.

Subbu: If there is not enough monetisation of the data, it can either be phased out or put in the lowest expensive method.

_________

Read more-

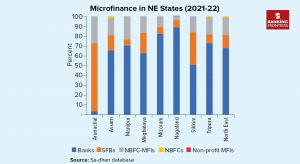

North-East: Low on banking, Average on microfinance